2019-2025 Media Forecast: Who Are This Decade's Economic Winners?

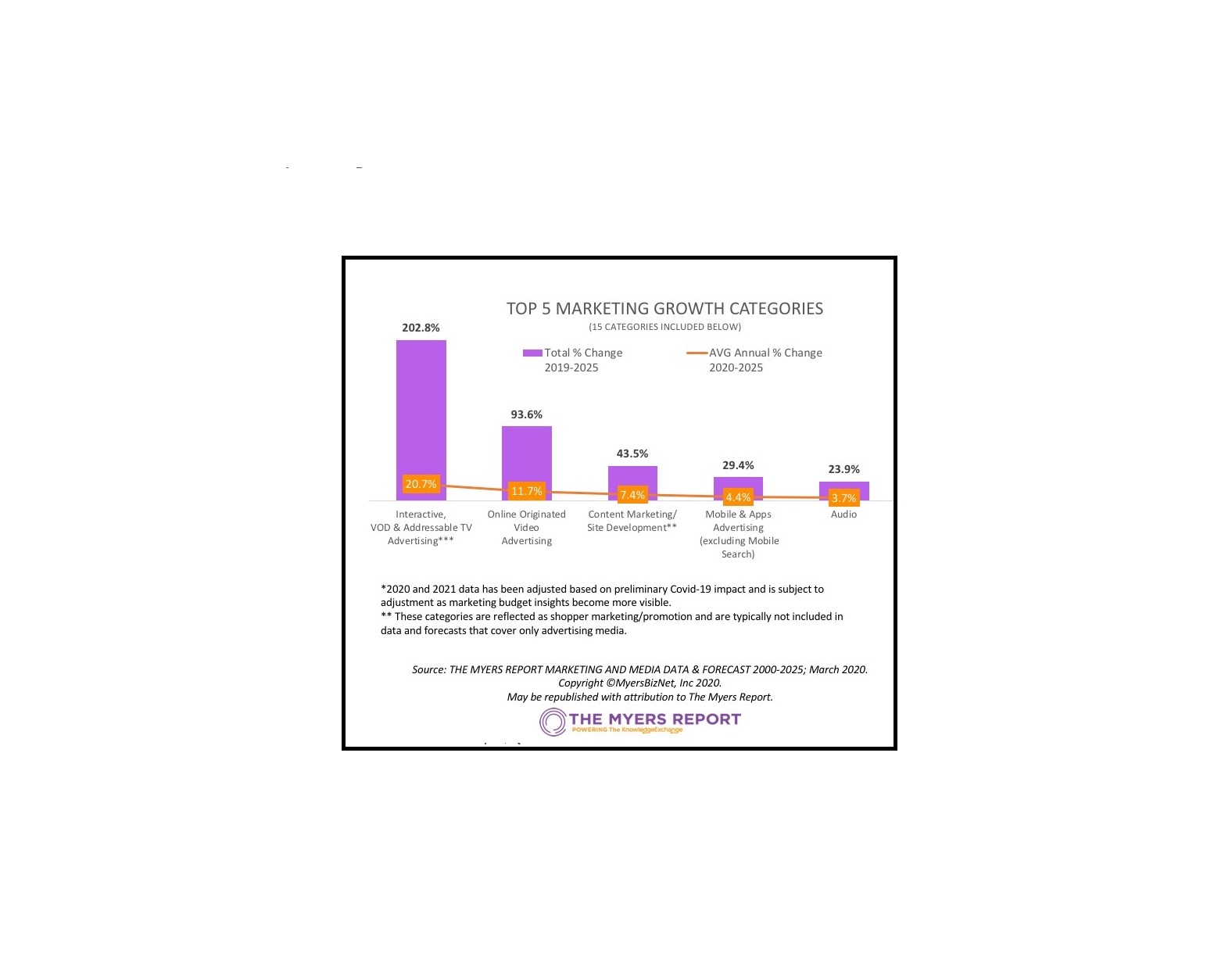

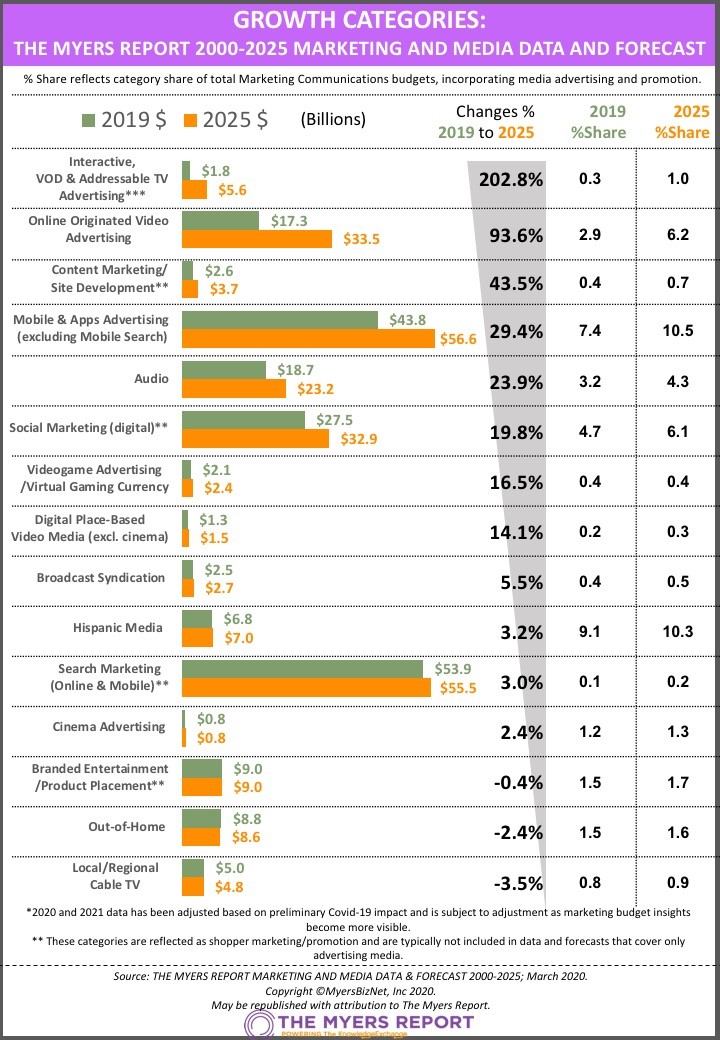

As the media and advertising community is buffeted by the negative impact of COVID-19, secular economic realities will remain a concern for legacy media categories well beyond their near-term issues. Among 28 marketing communications categories, only 12 are projected to generate growth in the first half of this decade and only three of the 12 can be categorized as legacy media: broadcast syndication, Hispanic media, and cinema advertising. (See chart below.) The Myers Report projects that the inherent advantages of place-based video and cinema will drive a reasonable recovery from coronavirus-related cancellations and that marketers will slowly but surely pay long-overdue attention to the spending power and loyalty of Hispanic/Latino consumers.

The Myers Report projects slight declines in this decade for out-of-home and local cable TV, although we believe each has the opportunity to move into the rarified air of legacy growth categories if their investments in advanced marketing partnerships and digital are successfully accellerated. The Myers Report has been publishing data from our new 2000-2025 Marketing and Media Economic Data and Forecast*, which quantifies the value and impact of digital transformation in each of the 28 communications categories. The full report will soon be available for MediaVillage member companies.

Leading industry growth is "'Interactive, VOD & Addressable TV'," which The Myers Report projects will grow more than 200%, from $1.8 billion in 2019 to $5.6 billion in 2025. This does not factor in the significant growth of OTT and shopper marketing at Amazon, Target's Roundel, and Walmart's Palomino, which are recognized as promotional budgets. Social marketing growth is expected to slow to an average annual rate of 3.2% and mobile advertising to 4.4% annually. The Myers Report incorporates Facebook display ads in its Banner Ad Display category and social in the Social Marketing category. YouTube and Facebook video advertising are incorporated in the Online Originated Video category

The Myers Report projects that network television spending will decline as marketers shift funding to the increasing (and more cost-efficient) supply of online originated video advertising, which is projected to increase 94%, from $17.3 billion in 2019 to $33.5 billion in 2025. Quibi's recent launch will be a litmus test of Hollywood's ability to develop high-quality digital content at scale.

Among legacy television media, national broadcast syndication is projected to generate slow growth based on the anticipated increase in local TV station demand for programming that generates a high percentage of linear viewing and content that can be inserted into expanded local news broadcasts. Our forecast of an audio renaissance is the subject of a prior Myers Report; a future report will focus on a B2B marketing rebound driven by investments in online education and thought leadership.

For regular reports and updates on the media economy, media brand equity research, and marketplace insights visit The Myers Report. The Myers Report's detailed data and forecasts will soon be available to MediaVillage member companies at www.MyersReports.com. Members may contact maryann@mediavillage.com to request password access.