Advertising Amid Crisis: Word of Mouth Lessons from the Auto and Financial Services Crises - Ed Keller - MediaBizBloggers

What should an advertiser do when its industry is being ravaged in the news media amid a crisis of historic proportions? Go quiet until the trouble passes, or continue to engage directly with paid messaging? The recent crisis faced by the financial and automotive industries provides two excellent cases in point, with lessons for marketers in all categories.

This week, at the Advertising Research Foundation's Annual ReThink Conference, my colleague Brad Fayjoined with Mediavest'sDavid Schiffman to address this topic. Their paper is based on more than two years of continuous research that spanned the periods before, during, and since the height of the economic crises facing the financial services and automotive industries.

The paper links word of mouth about brands in these two industries with a 360 degree perspective on the media/marketing elements that help to drive word of mouth – editorial coverage in the media, paid advertising, direct mail, point of sale activity, and so forth. The question is which of these marketing elements are most strongly associated with positive versus negative word of mouth, and intent to purchase individual brands. It also compares and contrasts changes in word of mouth for companies that "went silent" during the crisis to those that were more active in the use of paid messaging throughout the period.

The results – in short: Brands that maintained stable levels of advertising fared far better in helping to maintain positive word of mouth and brand advocacy compared to those that "went silent" by cutting back their expenditures in paid media and allowed the public conversation to be driven primarily by what they saw or read in the press.

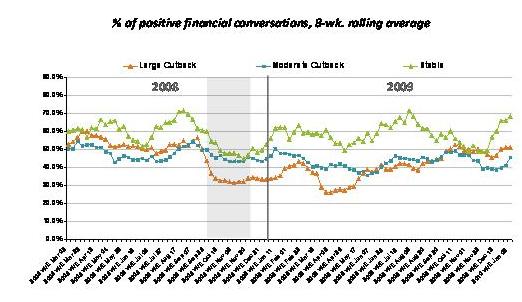

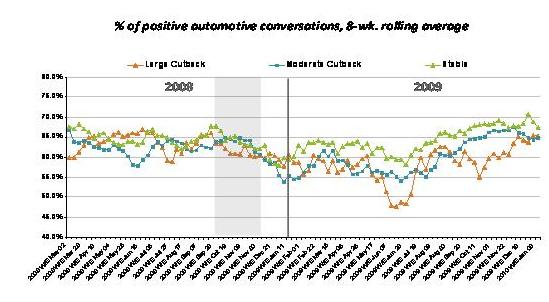

The research involved categorizing auto & financial brands into three groups – those that made large cutbacks in advertising spending (as determined by The Nielsen Company), those that made moderate cutbacks, and those that maintained relatively stable advertising. The study then examined how those choices affected the word of mouth surrounding those brands as measured by Keller Fay's ongoing word of mouth tracking system,TalkTrack®.

For the financial industry, brands that maintained stable ad spend levels were the clear winners. In early 2008, all of the companies we looked at had fairly similar WOM quality, but their fortunes separated sharply when the crisis hit towards the end of the year. In the spring and summer especially, we see that the companies that maintained higher levels of advertising were rewarded with much higher levels of positive WOM.

Source: Keller Fay Group's TalkTrack®, March 2008 – January 2010

Shaded area indicates the crisis period

The same pattern was seen for automotive brands.

While most auto brands saw dips in positive WOM levels throughout the crisis period, brands that maintained stable advertising levels benefited from higher levels of positive talk. When the auto industry took body blows as a result of failed firms and government bailouts, the brands that cut back the most on advertising also suffered the most in terms of declining levels of positive talk.

Source: Keller Fay Group's TalkTrack®, March 2008 – January 2010

Shaded area indicates the crisis period

Now, the question is which came first – the poor WOM outcome or the ad spend cutbacks? In other words, did buzz about these companies turn negative due to the underlying facts that also forced advertising to be cut, or was it the reduced advertising presence that caused the buzz to go bad?

Our word of mouth tracking research allowed us to find the answer here, because survey respondents are asked to report whether or not their branded conversations included reference to the news – and therefore the "underlying facts" – or advertising (or other forms of media/marketing).

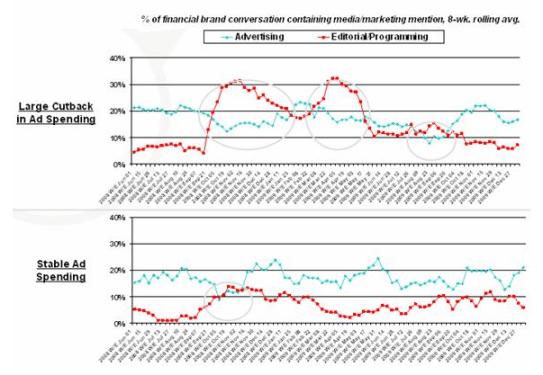

For all financial brands, the percentage of talk containing references to the news surpassed that of talk referring to advertising in October & November '08, and again in April '09. The surge in news-driven talk was much more pronounced, however, when comparing the financial brands that made the most advertising cutbacks to the firms that cut the least:

Source: Keller Fay's TalkTrack®, June 2008 – January 2010

We see that the financial brands that maintained their advertising spending levels benefited from a much higher percentage of ad-driven talk than news-driven talk.

This becomes especially important when we consider the quality of ad-driven talk vs. news-driven talk. For the financial industry specifically, news-driven talk became particularly negative, with the percentages of mixed and negative conversations far outweighing the percentages of positive conversations. For example, in the "early crisis" period of August '08 to January '09, a mere 23% of news-driven financial conversations were positive, while 45% were negative. Positive news-driven talk has since rebounded to 50%, but negative talk is at 27%.

Ad-inspired financial conversations, on the other hand, maintained their positive quality despite the crisis. Since the crisis hit, over 50% of ad-inspired conversations have remained positive, while negative and mixed have hovered around 20% each – making ad-inspired talk far more beneficial to brands than news-inspired talk. When we compare auto brands the same way, the same tendencies are apparent.

So what does this all mean? It means that companies that maintain their advertising levels during crisis times are able to offset negative press and boost positive talk, while those that cut back saw negative word of mouth dominate. And while this research looked only at the auto and financial services categories, the findings are almost certainly relevant for companies in all industries, and potentially during other types of crises. Advertising can be seen clearly to play a substantial role in driving word of mouth, especially positive, and even during major crises, ad-driven WOM retains its positive quality. Advertising messages should, of course, change to reflect the times and consumer attitudes, but silencing advertising seriously dampens the brand's ability to tell its story and leads to a sharp deterioration in public advocacy for the brand just at a time when it is most crucial. Silence, during times of crisis, is not golden.

Ed Keller, CEO of the Keller Fay Group, has been called "one of the most recognized names in word of mouth." The publication of Keller's book,The Influentials, has been called the "seminal moment in the development of word of mouth." Ed can be contacted at ekeller@kellerfay.com.

Read all Ed’s MediaBizBloggers commentaries at Ed Keller - MediaBizBloggers.

Follow our Twitter updates @MediaBizBlogger