AMC Networks Inc. Not Quite Apocalyptic

Wall St. Speaks Out on "The Walking Dead" Ratings - Anthony DiClemente, Nomura Global Research

Following a second consecutive week of YoY ratings declines for AMC's hit show The Walking Dead (TWD), investors have become concerned about the value of the TWD asset. While we certainly do not discount the possibility that TWD ratings could enter a period of slow decline, we must point out that tough YoY sports comps the last two Sunday nights have certainly played a role in the ratings pressure we have seen; these viewers could ultimately be, at least in part, recaptured on delayed viewing. We must also point out that AMCX has already successfully expanded the TWD brand this year in its successful launch of Fear the Walking Dead. We remain of the view that TWD represents a powerful asset that continues to drive advertising and affiliate monetization. As such, while we will continue to keep an eye on time-shifted TWD ratings, we view the current sell-off in AMCX as modestly overdone.

Tough sports comps to blame? We note that this week's episode 2 of TWD faced off against both the Sunday Night Football comp (Patriots-Colts "deflate-gate" rematch), as well as the Mets-Cubs MLB playoff comparison (the #1 and #3 media markets), respectively. Taking a step back, even when including time-shifted viewing for the prior week, the Live+3 ratings for TWD's season 6 premiere episode was admittedly down 13% YoY from last year's record-setting 22.4mn viewers. This may indicate 1) modest TWD fatigue (which we acknowledge as a risk), or 2) viewership moving past the +3-day window, given the strong sports comps even in week 1. We also note that the TWD premiere was 90 minutes long (vs 60 minutes normally), which is good for monetization, but which can make audience retention a greater challenge.

What happens if TWD fatigue is truly setting in? We think it is unlikely that TWD viewership erodes at a very rapid pace given the rabid core fan base; TWD is likely to remain a top 3 show on television for the foreseeable future, in our view. As such, we believe the show remains a valuable platform to launch new shows. We look forward to the upcoming 4Q/ November premier of Into the Badlands, for which TWDwill act as a lead in. Moreover, the growing international SVOD market place remains a buoyant avenue for the company to monetize the show. Finally, we must acknowledge this year's successful 3Q launch of Fear the Walking Dead, which admittedly could be driving some zombie fatigue overall.

Though audiences slightly below, fragmentation favors the leaders . . . Even incorporating the live-ratings declines season-to-date, TWD remains the number 1 show in the coveted 18-49 demo (beating SNF in its first week). Given the scarcity value of reaching a vast, mainstream audience, we broadly contend the industry-wide viewership fragmentation benefits the audience leaders (such as TWD); the more difficult it is to reach a mass audience, the higher price advertisers will pay to do so, which could offset the impact of modest viewership declines.

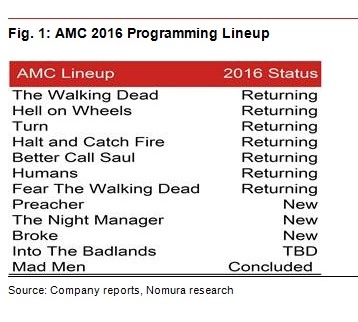

. . . as TWD ad rates are up quite a bit this year. According to AdvertisingAge, TWD now commands roughly $500k per 30-second spot, up materially versus last year. What happens if TWD ratings declines lead to a make-goods situation, or a lower CPM? Assuming a 90% incremental margin, each percentage point decline in TWD advertising would impact National AOCF by just ~ 0.2%-0.5%. Given a 2016 lineup that includes an expanded number of Better Call Saul and Fear The Walking Dead episodes (15 vs 6 in 2015) as well as new shows Preacher, The Night Manager, and Broke, we remain comfortable with our +7% YoY growth estimate for FY2016 AMC Network advertising growth, despite these TWD ratings headwinds.

Upcoming schedule, stable margins and potential buybacks remain positives. With a strong 2016 originals lineup that includes a good mix of new and returning shows, stable margins (we model flat YoY AOCF margins in 2016), and strong FCF generation that should bring the leverage ratio below 2.5x by the end of 2016, increasing the likelihood of capital returns, we believe AMCX remains an attractive asset to own. Trading at 13x 2016 EPS, 3x below the peer average, we believe the current selloff is likely somewhat overdone.

CLICK BELOW TO ACCESS RESEARCH REPORT/PRESENTATION (including important disclosures):

AMC Networks Inc. (AMCX US, Buy) - Not Quite Apocalyptic

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaVillage.com / MyersBizNet, Inc. management or associated bloggers.