Beyond Cost: Unveiling Key Decision-Making Factors in Media Planning and Buying

Decoding the Drivers of Media Planning and Buying Decisions: Insights from The Myers Report

In the ever-evolving world of advertising-supported media, The Myers Report's comprehensive survey involving over 4,000 media agency and advertiser respondents presents an in-depth look into the factors influencing media planning and buying decisions. This latest study delves into the diverse criteria used by professionals to measure value and identify preferred and best-in-class partners, moving beyond the basic requirement of cost efficiency.

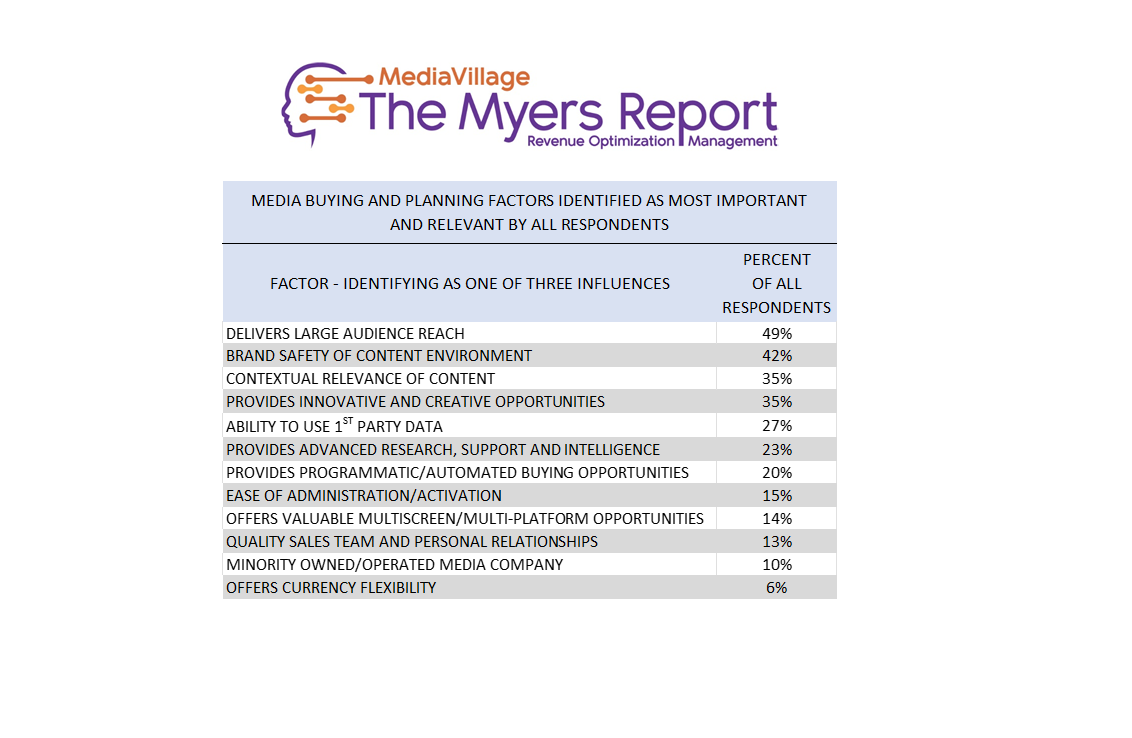

The survey reveals a complex landscape of criteria used by professionals to assess media partners. Each respondent, directly involved in media planning and buying, was asked to identify up to three factors deemed most relevant from a list of twelve. The results underscore the diversity in what is valued most in media partnerships.

A significant portion of media agency and brand professionals do not prioritize relationships with sales teams in their advertising decision-making. Furthermore, many decision-makers find their media partners' capabilities to be underperforming or inadequate. The Myers Report aims to bridge this gap, offering solutions that are aligned with the needs and expectations of modern decision-makers.

The Multifaceted Nature of Decision-Making Factors

The survey highlights a range of factors considered pivotal in the decision-making process, reflecting the nuanced and varied priorities of media professionals today.

Core Influencing Factors:

1. Large Audience Reach (49%): The paramount importance of reaching a broad audience remains a top priority.

2. Brand Safety of Content Environment (42%): Ensuring the content is safe and aligns with brand values is critical.

3. Contextual Relevance of Content (35%): The need for content to resonate with the brand's message and audience.

4. Innovative and Creative Opportunities (35%): A significant focus on creativity, with the 35% of respondents who prioritized this factor further defining their interpretation of innovation and creativity from an additional list of 12 options.

Diving Deeper into Innovation and Creativity

For those emphasizing innovative and creative opportunities, the survey provided a deeper exploration into what these terms mean in the context of media planning and buying. This additional layer of analysis, detailed in The Myers Report on Media Innovation, sheds light on the specific aspects of innovation and creativity that are most valued in the industry.

Variations by Agency and Experience

The survey also uncovered significant variations in prioritization based on agency affiliation, experience, and responsibilities. For instance:

- Respondents from one major holding company's media agency placed a higher value on the Ability to Use 1st Party Data than on Contextual Relevance.

- Conversely, another agency's respondents saw Contextual Relevance as less critical than 1st Party Data.

- One independent media agency highlighted Innovative and Creative Opportunities as their most crucial criterion, just behind Large Audience Reach.

- Meanwhile, another independent media agency's participants identified 1st Party Data as their top media planning consideration.

A Diverse Landscape of Preferences

These findings illustrate the diversity in what media professionals value most in partnerships. The emphasis on various factors such as innovative opportunities, data utilization, and brand safety reflects a dynamic industry landscape where different organizations have distinct strategic focuses.

The Myers Report: Navigating the Complexities of Media Planning and Buying

For those in the media industry, understanding these multifaceted factors is key to forging effective and forward-thinking media sales strategies. The Myers Report offers comprehensive insights into these complexities, helping professionals navigate and tactically customize their outreach and B2B marketing to achieve both strategic and tactical objectives with informed precision.

It's especially interesting how little industry-wide consensus there is around any one media planning and buying criteria other than cost efficiency, reflecting the disparity based on media category, client parameters, and responsibility. Because cost efficiency continues to dominate the media buying and selling landscape, causing widespread commoditization, other factors are inherently secondary and, therefore, not drivers of potential growth. In future surveys, The Myers Report plans to reinsert cost efficiency as a factor to explore whether the industry is shifting away from this as its dominant purpose.

To gain a deeper understanding of these factors and to stay abreast of the latest trends, we invite you to explore The Myers Report. Visit www.myersreports.com for detailed insights and a wealth of information that can guide your media decisions towards greater effectiveness and innovation.

Subscribers to The Myers Report have access to extensive detailed insights on the comparative importance of each criteria among multiple cohort groups, including the opportunity for follow-up recontact with individual respondents for strategic business development and tactical relationship-building. Request The Myers Report subscription details atinfo@mediavillage.com or contact Jack Myers directly at jack@mediavillage.org.

METHODOLOGY: In Field: 6/26/23 - 8/15/23 Total Respondents: 4202

The Myers Report Team Preparation and Readiness Assessment Study was administered online to 10,589 media & marketing professionals recruited through internal agency, trade association and media company outreach, MediaVillage subscriber lists, MediaVillage website banners and social media invitations. Respondents were incentivized to participate and complete the survey.