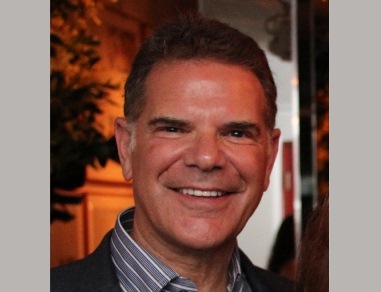

Bob Pittman: Radio's $3 Billion Man

Radio was a hidden and mostly ignored medium until Bob Pittman arrived as CEO of Clear Channel and launched iHeartRadio. Along with the progressive digital initiatives at CBS Radio and other selected radio station owners, Clear Channel is leading the radio industry to an unexpected revenue surge over the next several years. Leading agency executives appeared at the recent RadioInk Forecasting Conference to share their enthusiasm for radio and urge industry leaders to be more aggressive in presenting the benefits of their medium and validate its effectiveness. New digital prospects for the radio industry have positively shifted in the past 12-months, resulting in my revising my forecasts for radio through 2020 from expected annual declines to 1.4% annual growth. Although legacy radio advertising revenues are projected to decline more than 2% annually (even with bi-annual political spending inflation), digital revenues will more than compensate for the declines. Horizon Media CEO Bill Koenigsberg, who chaired the RadioInk event, suggested that even legacy radio revenues could grow if the industry better demonstrated its core value to advertisers. He was joined on a panel (moderated by David Verklin) by Mediabrands Global president Tim Spengler, Carat North American CEO Doug Ray and Mediavest president Brian Terkelsen.

Last year, before the launch of iHeartRadio and Pittman's evangelical clarion calls to the industry to leap into the 21st century, my forecasts anticipated 2020 digitaladvertising revenues for the radio industry of $2.7 billion, an average annual digital growth rate of 13.3%. My new view of the radio marketplace has led to a revised forecast of 2020 radio industrydigital ad revenues of an estimated $5.5 billion (up from $1 billion this year) representing average annual growth of 22%, with 34% annual growth 2013-2015. (See data charts below)

Not only does this revised forecast reflect the impact that one compelling, focused and trusted executive can have on a company and an industry, but it reflects how quickly a true commitment to digital businesses can transform a medium. Radio had seemed moribund, slow to adapt to new technologies, and locked into traditional paradigms. Radio station management, much like newspaper publishers, held-fast to a sinking ship, refusing to acknowledge that small leaks in the hull would ultimately capsize the ship.

Not only is radio now positioned to capitalize on the growth of online audio revenues, but will capture a share of online video and display ad spending, commerce opportunities, mobile revenue and an expanding gaming marketplace. Legacy radio stations' business will also be supported by a digital infrastructure, enabling sales executives to build relevant multi-platform initiatives at the local, regional and national level.

In addition to the ad revenues generated by the traditional radio industry, an additional $4.2 billion is projected to be generated in 2020 by Internet originated audio-based media including Pandora, Spotify, Yahoo, AOL and others.

| 2012 | 2013-2015 | 2016-2020 | ||

| $ | % | % | % | |

| RADIO – Total Ad Investments | $16.957 | +4.9 | 0.7* | 1.8* |

| TOTAL 2020 $ = $18.900 | ||||

| RADIO – Legacy Ad Investments | $15.952 | +3.5 | -(2.2)* | -(2.1)* |

| Total 2020 $ = $13.353 | ||||

| RADIO – Digital Ad Investments | $1.005 | +32.0 | +33.7* | +18.4* |

| Total 2020 $ = $5.547 | ||||

| RADIO – Internet Originated (U.S.) | $0.6 | +22.0 | +32.0* | +21.0* |

| Total 2020 $ = $4.200 | ||||

| Source: Jack Myers Media Business Report | *Average Annual | |||

If you are receiving this report, you are a registered subscriber to Jack Myers Media Business Report or are receiving it as part of a registered corporate subscription. As a subscriber, Jack responds personally to your e-mails, requests and comments. He is available to speak at your company events. In addition to Jack Myers Media Business Reports, your subscription underwrites MediaBizBloggers.com, Women in Media Mentoring Initiative, Jack Myers Wall St. Report, Jack Myers Video Media Report, plus our exclusive industry economic forecasts, trend forecasts and corporate performance research. Re-distribution in any form, except among approved individuals within your company, is prohibited. As a subscriber you have full access to all archives and reports at www.jackmyers.com. If you require your ID and password, contact maryann@jackmyers.com