CFOs and B2B Marketers Are Aligned on Growth, But Not on Brand

In B2B companies, CFOs and marketers are often at odds over brand. Marketing leaders push for investment in awareness, storytelling, and reputation-building, while finance executives question the tangible return on those dollars. The reality? They are not in conflict -- and actually want the same outcome: faster, more profitable growth. The difference is perspective -- marketers frame brand as trust and consideration, while CFOs seek risk reduction, sales efficiency, and margin protection. Bridging that language gap reveals that brand is not a cost center, but a strategic driver of demand. Data from LinkedIn shows that coordinated brand and acquisition messages are six times more likely to convert than those exposed to demand media alone.

The result: Unifying brand and demand is now mission critical to elevating marketing effectiveness and efficiency. However, for many, brand-to-demand marketing remains siloed.

But why?

The Challenge of Brand-to-Demand Integration

In the 2025 Brand-to-Demand Maturity Study conducted by ANA B2B and Stein highlights key obstacles: siloed teams, outdated technology, and fragmented measurement.

Yet a shift is happening. B2B companies have moved toward balancing brand to-demand to better cultivate future demand due to the adoption of the 95-5 rule from the Ehrenberg-Bass Institute of Marketing Science which states that on average, only five percent of B2B companies are in-market for a specific product/ solution. If B2B marketers are not investing in building brand salience and mental availability among the 95 percent out-of-market buying groups, then they are not going to create future demand.

According to respondents in the ANA/Stein study, 69 percent of C-suite leaders believe brand-to-demand integration is important, but only 36 percent consider it very or highly important. Interestingly, “fully unified” organizations that report full C-suite buy-in, where the marketing budget is split approximately 50/50 between brand and demand efforts) generate better business performance.

Many executives undervalue brand building because CEOs and CFOs are under constant pressure to show quarterly growth, whereas brand building is a long-term play; it does not drive immediate revenue like promotions, discounts, or performance marketing can. Additionally, performance marketing delivers clear metrics (clicks, conversions, ROAS) versus brand equity which is harder to quantify and link directly to revenue, so it feels “squishy” to financially minded execs. Thus, there is an overemphasis on lead gen and sales enablement surfaces as B2B leaders want pipelines filled now.

Balanced programs outperform because they harness three mutually reinforcing effects:

- Brand campaigns create category fame and lower the cost of demand activation.

- Balanced budgets protect against market volatility, with brand spend fostering long-lived awareness and demand spend drives immediate pipeline and revenue goals.

- Sharper ROI models enable a unified approach creates cleaner attribution models and sharper diagnostics for ROI.

Conversely, when brand and demand run in parallel silos, business face three significant penalties:

- Slower Growth: Companies stuck at “Under-invested” and “Disconnected” maturity stages see subpar growth.

- Higher CAC: Over-reliance on demand media inflates cost per lead. Companies with strong brand-to-demand integration achieve 20 to 30 percent better funnel performance.

- Talent churn: A lack of cross-functional alignment tends to talent turnover, while integrated teams unlock better results and career growth.

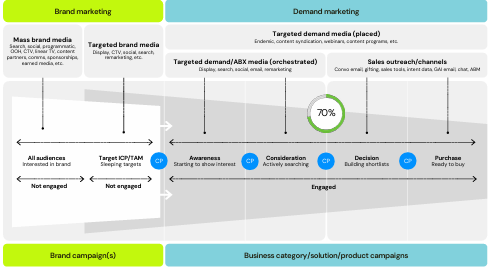

Brand-to-Demand Media Sequencing

Brand-to-demand media sequencing further outlines the most relevant channel and media combinations to consider as part of planned and always-on initiatives designed to build brand awareness and intercept buyers as they move from out-of-market to in-market demand motions.

Why the Spending Imbalance Persists

The ANA/Stein study data suggests three forces that reinforce the imbalance:

- Quarterly pressure: Demand programs defend the current number and are easier to attribute.

- Management friction: Only 36 percent of respondents say their leadership sees brand-to-demand integration as strategically important, making brand “asks” a tough sell.

- Measurement challenges: Without holistic measurement connecting investment to business outcomes making the case for reallocation is difficult.

What Leaders Do Differently

The vanguard of B2B marketers that have broken the inertia that keeps most B2B organizations stuck do so because of:

- Explicit C-suite alignment

- Brand-to-demand media balance (ranging from 40 percent brand/60 percent demand to 60 percent brand/40 percent demand)

- A unified team structure

- A performance-first mindset: Treating brand-building as a core driver of growth not just a marketing decoration.

B2B buyers do not make million-dollar decisions solely on features. They prioritize trust and risk reduction, and brand building is the most effective way to establish that trust fuels demand, lowers our acquisition costs, and accelerates revenue.

Conclusion and Next Steps

The data is clear: Integrating brand and demand is crucial for B2B growth. Leading marketers are adopting integrated models, creating cross-functional teams, and using orchestration platforms to ensure they reach buyers at every stage of their journey.

Marketers aiming to build a cohesive, long-term brand-to-demand engine can start by assessing their organization's maturity using the BDX Model. By scoring the six key pillars and identifying areas for improvement, businesses can take meaningful, 90-day actions toward building a unified, high-performance marketing strategy.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.org/MyersBizNet.