China to Hollywood: Don’t Quit Your Day Job

The box office results in China for Hollywood's big budget films are in, and so is the message from Chinese movie goers.

America’s favorite pastime has produced its share of baseball philosophers whose pronouncements have livened up a variety of subject matter, albeit rarely international affairs. Count Reggie Jackson the exception. The all-star slugger’s 21-year career yielded a unique insight into the iconic American sport’s place in the world as well as 563 home runs. Not known for his modesty, Jackson put it this way: "I was reminded that when we lose and I strike out, a billion people in China don't care."

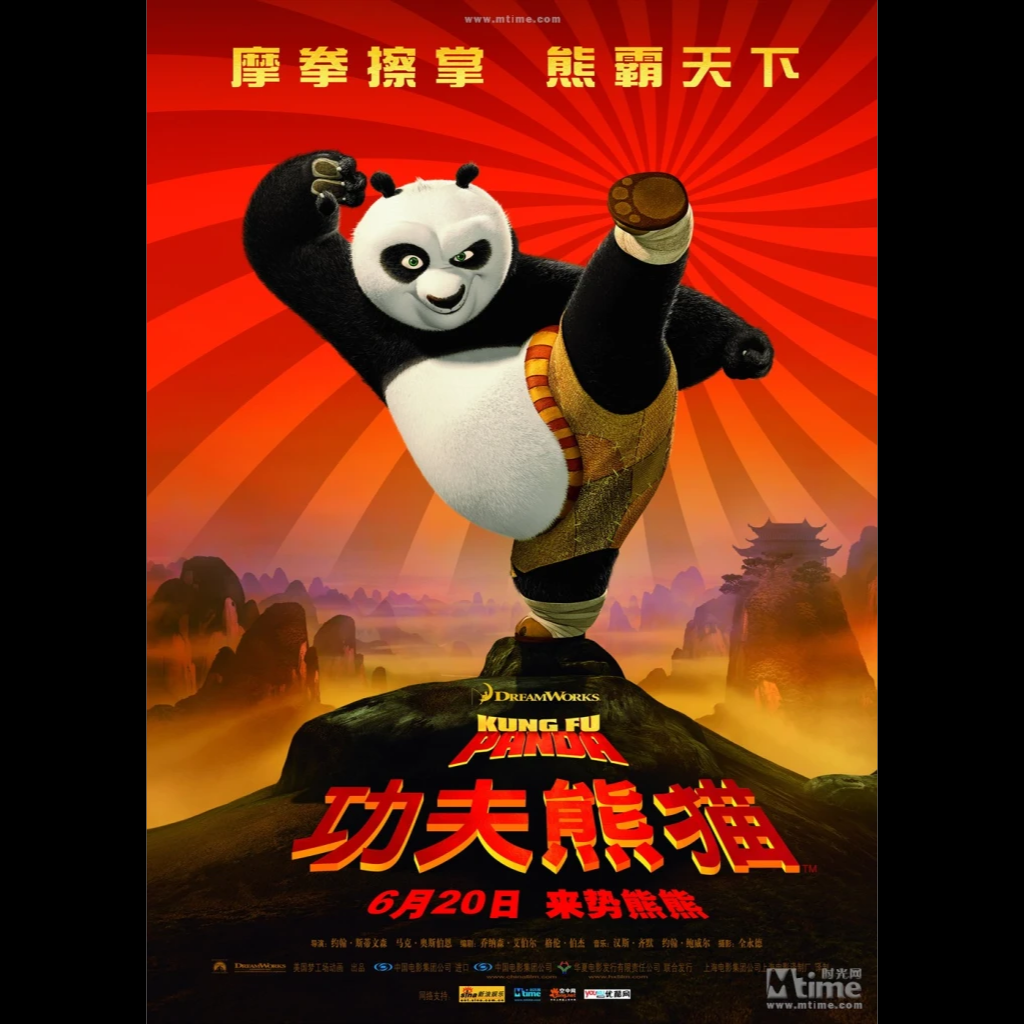

The import of the Hall of Famer’s rare self-deprecation is worth pondering, particularly if you’re on the lengthening list of CEOs who once bragged about your company’s rosy future foreordained by its investments in China. Hollywood’s movie moguls are the latest watching their touted bonanzas turn into busts. In the Middle Kingdom this year, Tinsel Town’s big budget flicks are tanking. A decade ago, as China’s multiplex’s multiplied, the movie bosses bet big on winning a major share of the burgeoning screens, self-censoring scripts and inking joint production ventures to please the country’s communist mandarins.

So far in 2023, as the Wall Street Journal reported last week, total box office sales for U.S. films in China are faltering badly. At $592 million, they represent one-third of the $1.9 billion tally for the same six-month period in 2019. To date, only one Hollywood movie has made China’s top ten. An average of three did so annually from 2014-2018. In two of those years, they accounted for five of the top ten. In 2023, from Indiana Jones to Mission Impossible receipts are anemic, as is enthusiasm among Chinese movie goers for their marquee name talent.

It isn’t because Hollywood is producing yawners. Most obviously, Chinese audiences are turning on to their own stories and stars and turning off on western narratives. Credit in part Xi Jinping. More than half of moviegoers are under 30. They’ve grown up under Xi, whose increasingly authoritarian regime has force-fed a diet of flag-waving propaganda, not to mention "guidance" to moviemakers. Their Chinese heroes and story lines -- in box-office smash epics on the Korean War, for example -- play out scripts that sell patriotic daring-do that any People’s Liberation Army recruiter would love.

The success of China’s movies isn’t just about their nationalistic narratives or local Chinese stars, directors and animators catching up with Hollywood’s best. The assumption that conforming to the regime’s censorship and collaborating with Chinese filmmakers would produce long-term access and a lucrative market share clearly reflected a misreading of Xi’s authoritarian regime. But Hollywood’s hubris also included a blind eye to a Chinese industrial policy purposed to advantage domestic competitors in every cutting-edge field.

Like the Hollywood studio big shots, the carmakers’ CEOs in the United States, Europe and Asia are learning that lesson the hard way. The headline news in the car business, of course, reflects China’s grip on the growing domestic EV market. More than 80 percent of the electric cars sold in China in 2022 were Chinese manufactured. China is expanding EV sales abroad with highly priced competitive models. It’s not only EVs. Chinese manufacturers last fall overtook western counterparts in the total number of gasoline powered cars as well as EVs sold.

Just like the tough market facing American movies, the Chinese car competition didn’t pop up yesterday. In the last eight years, Ford’s sales in China have fallen 60 percent, while Hyundai’s dropped 75 percent. Ford’s red ink totaled $572 million last year in China. With earnings from China operations down 70 percent since 2014, General Motors has lost nearly half its sales. Volkswagen -- including Porsche and Audi -- says its brands are holding their own, while Tesla has cut prices to boost slowing sales.

Nationalism, propaganda and official subsidies underwriting the domestic competition, however, aren’t the only reasons Hollywood and international car makers with a stake in China are seeing their Chinese rivals rise. Both have done deals and collaborated, including training and transferring know-how to their erstwhile partners. The relationships clearly produced profits on American bottom lines for a time. Indeed, taking a broader view, arguably they’ve been a great success -- if you’re Chinese.

The business press is correct in pointing to the big wheels driving the smaller. China’s pandemic shutdown and chaotic reopening, insipid growth, a crucial but weak real estate sector, and rising unemployment; the economy ‘s struggle and Xi Jinping’s policy problems are affecting Chinese consumers and foreign companies, movies and cars included, in turn. But none of these factors can explain away the fact that Chinese movie- and carmakers have gotten good at what they do, reshaping their customers’ perceptions, tastes and demand for domestic products in the process.

Notwithstanding quotas that limited their releases in China, a shrinking slice of their movies’ revenues, and the need to kowtow to the Communist Party’s commissars, rewriting characters and movie plots even before their scripts hit the censors’ desks, for a time Hollywood appeared willing to do anything for its share of China’s box-office take. Meanwhile, China’s moviegoers and moviemakers as well as the fare on their big screens simply changed.

In fact, when it comes to American movies Chinese audiences are sending a message. Ask Reggie Jackson. Whether a made-in-Hollywood blockbuster goes big or bombs in Boston, Birmingham or Boise, they couldn’t care less.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.org/MyersBizNet.