COVID Gives the Antacid Category Heartburn

It's an understatement to say this year has been stressful. In fact, a recent YouGov survey indicates that most Americans think it was a pretty terrible year. (The good news is we expect 2021 to be better!) In light of the stresses of 2020, the latest product shortage to hit the news shouldn't come as a big surprise: antacids.

The antacid category has been impacted by many factors this year: The FDA pulling one of the leading brands, Zantac, off the shelf in the spring over concerns of the safety of ranitidine; the emotional and economic stress of the pandemic increasing the prevalence of heartburn; changes to our eating and exercise habits exacerbating heartburn (i.e., we've been indulging); and news coverage of experiments using a popular antacid, famotidine (the active ingredient in Pepcid), as treatment for COVID-19.

With the virus surging, many retailers are trying to get ahead of the panic-buying we saw in the spring with proactive limits on purchases of toilet paper, paper towels, sanitizing wipes and pain killers. We are now seeing some retailers putting limits on antacids as well, particularly Pepcid and generic famotidine.

One of the big lessons for marketers during this pandemic has been how critical it is to understand what is happening with your brand, competitors and category in real-time, so that you can pivot quickly. This is especially true for teams handling advertising, which often have more flexibility to change, and change quickly, than supply chain and distribution.

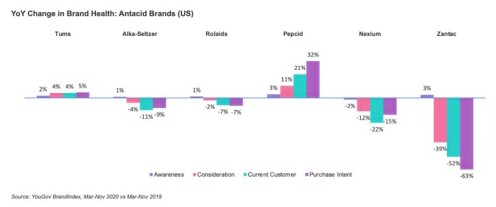

Taking a look at the category from a brand health perspective, Pepcid is the big winner, with double digit lifts in consideration (+11%), current customers (+21%) and purchase intent (+32%) for March-Nov 2020 vs the same period last year. It's likely Pepcid largely benefited from word of mouth, elevated with news coverage in the spring and summer of famotidine as a potential treatment for COVID-19 and again in October when famotidine was included in President Trump's experimental treatment cocktail at Walter Reed Medical Center.

Tums strengthened its leadership in the category, making modest gains in brand health metrics while competitors declined. The brand started 2020 with a Super Bowl campaign; however, instead of running a TV spot in the big game, Tums surrounded it with a sweepstakes and social campaign leveraging a rarely used blue dot emoji as a Tums tablet to rate their level of heartburn throughout the game (reminiscent of Frank Red Hot's chili emoji ratings the prior year). Tums continued social engagement for their #tumsworthy campaign during the summer with a National Hot Dog Day activation, which included sending micro-influencers Tums plus a heartburn-inducing meal-kit for their cookout.

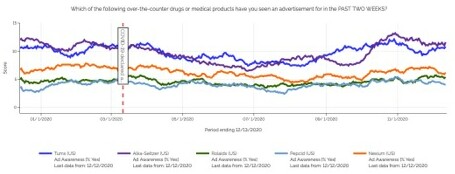

Ad awareness for Tums and its closest competitor, Alka-Seltzer, was down significantly over the summer but returned to pre-pandemic levels this fall. Consumers started noticing Tums ads slightly earlier in the fall, but Alka-Seltzer clearly made a pivot in spend or creative for Q4 and has pulled ahead of Tums in the past two months.

Balancing demand- and supply-side is even more daunting in a rapidly shifting marketplace, but marketers must collaborate to make it happen. We're leaving money on the table if we don't lean into rising demand to capitalize on the moment. We're wasting money -- and creating a bad customer experience with long-term impact -- if we generate more demand than we can meet with supply.

I look at the declines in ad awareness over the summer and wonder, were Tums and Alka-Seltzer at their max ability to manage supply to meet demand or was there a missed opportunity to gain more sales through increased ad spend? What can Alka-Seltzer, Rolaids, and Nexium do to improve advertising effectiveness, if their brand consideration and purchase intent are going down while category demand is straining supply for competitors?

The key takeaway as marketers, we must understand the performance of our brand, competitors, and category in real-time, or we'll find ourselves on the back foot when conditions change rapidly. And for those of use in charge of advertising, we need to be ready to pivot quickly (since we actually can) and we need to be connected to the rest of our organization to ensure we're not creating new problems.

It's a challenging time for marketers, but up-to-date data is available and helps a lot. We're seeing interesting impact of Covid throughout the OTC and pharmaceutical space. Contact me if you're interested in seeing this data, and more, broken out for your specific target audiences, brands, etc. I'm here to strategize and help.

Click the social buttons above or below to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.