Economics of AI Disruption in Advertising & Media

Artificial Intelligence is no longer theoretical in the advertising industry; it’s fully operational, embedded, and essential. In 2025, AI has evolved from a buzzword into a core component of both media agency and brand infrastructure, shaping every stage of the advertising lifecycle. From initial media planning and creative versioning to dynamic bidding, audience segmentation, fraud detection, and outcome-based attribution, AI has become the invisible architecture powering the modern media economy.

What distinguishes 2025 from previous years is the scale and strategic centrality of AI. Rather than bolting AI onto existing workflows, major holding companies Omnicom, Publicis Groupe, Dentsu, WPP, and Horizon Media are making AI the centerpiece of their operating models. These firms are investing billions into proprietary technology stacks that integrate first-party commerce data, CRM signals, loyalty program insights, and behavioral trends into centralized planning platforms. Tools like Omni (Omnicom), CoreAI (Publicis), and Dentsu’s Magpie offer predictive simulations that empower planners to dynamically model media investments across channels based on business outcomes rather than historical norms.

This shift toward AI-driven planning is having profound economic consequences. Algorithms can identify underpriced inventory, optimize cross-platform frequency, and reroute investments in real time, often without human intervention. As a result, cost-per-thousand impressions (CPMs) are being systematically compressed across commoditized channels, particularly where sellers lack the data or flexibility to defend pricing. Linear TV and basic digital display are especially vulnerable, as buyers increasingly benchmark inventory based on modeled ROI, not legacy perceptions of reach or prestige.

This evolution has also fueled a reorientation from format-centric media valuation to outcome-based metrics. In AI-powered ecosystems, a banner ad that delivers conversions may be more valuable than a TV spot that delivers undifferentiated impressions. This redefinition of media value erodes the advantage once held by publishers with high-prestige formats but weak data strategies.

Media sellers who fail to integrate AI, clean room capabilities, and first-party data analytics into their offerings face a structural disadvantage. Without the ability to forecast performance or tailor packages dynamically, they are increasingly seen as rate-card vendors, not strategic partners. Conversely, sellers who embed AI into their audience targeting, inventory management, and cross-platform delivery are positioning themselves to remain relevant in a marketplace where automation, personalization, and precision rule.

In this new economy, AI is the bridge between scale and value - the connective tissue that determines whether inventory is merely available or truly investable. The implications for 2026 and beyond are clear: media organizations that fail to adopt intelligent infrastructure will not simply fall behind. They will be priced out of the future.

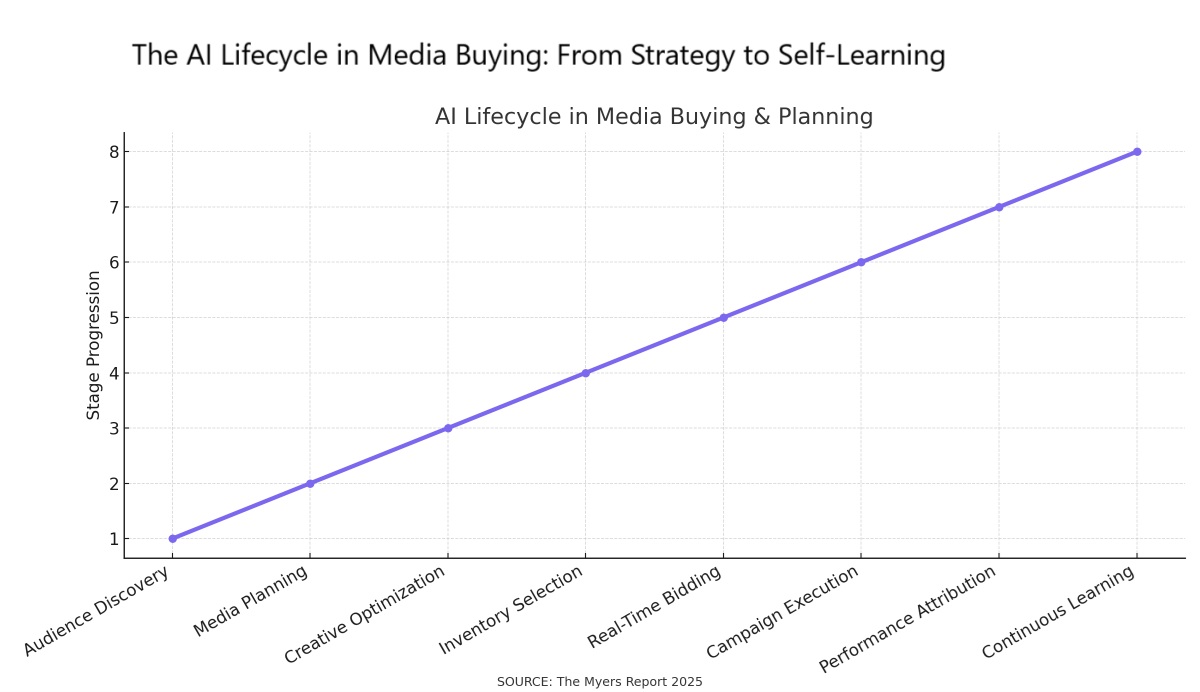

The integration of Artificial Intelligence into the media buying ecosystem is no longer theoretical; it’s systematic. In 2025, The Myers Report identifies an eight-stage lifecycle through which AI now plays an increasingly dominant role across planning, activation, and optimization. From the earliest stages of audience discovery to continuous machine learning and model refinement, AI is rapidly transforming how value is created and measured in advertising.

1. Audience Discovery

AI identifies hyper-relevant consumer segments using predictive modeling, psychographic clustering, and real-time behavior tracking—far beyond traditional demo-based targeting.

2. Media Planning

Budget allocation, reach/frequency modeling, and scenario simulation are now automated and tailored to brand KPIs using AI-enabled media planning platforms (e.g., Omnicom’s Omni, Publicis CoreAI).

3. Creative Optimization

Generative AI tools produce multiple creative variations, test copy and visuals in real time, and optimize delivery to match audience responsiveness -- reducing creative waste.

4. Inventory Selection

AI evaluates available inventory across programmatic platforms, balancing CPM efficiency with brand safety, contextual relevance, and predicted ROI.

5. Real-Time Bidding

AI engines adjust bids dynamically based on user signals, site context, and campaign goals—learning from each transaction to improve outcomes.

6. Campaign Execution

AI controls delivery pacing, channel mix, and frequency caps, ensuring consistency across fragmented media environments.

7. Performance Attribution

AI enables multi-touch and incrementality modeling, reconciling complex customer journeys across devices, platforms, and time windows.