Engaging Consumers Through Streamed Audio

The audio media landscape has changed a lot over the past decade. In recent articles, I’ve explored changes in how we listen to audio and examined competition in audio streaming to contextualize consumer behavior and the major players in this space. Today, I’d like to turn to actionability – how advertisers, agencies, and publishers find and engage relevant audiences on audio streaming platforms.

Streamed audio gives us access to a massive library of music and podcasts, at our fingertips, anytime and anywhere we want to listen. These new behaviors create new opportunities to reach and engage with consumers.

I’m a planner at heart, and so I always start with the basics of communications planning: What is your source of growth? Who do you need to reach? Where in the consumer journey do you need to reach them?

Achieving Reach

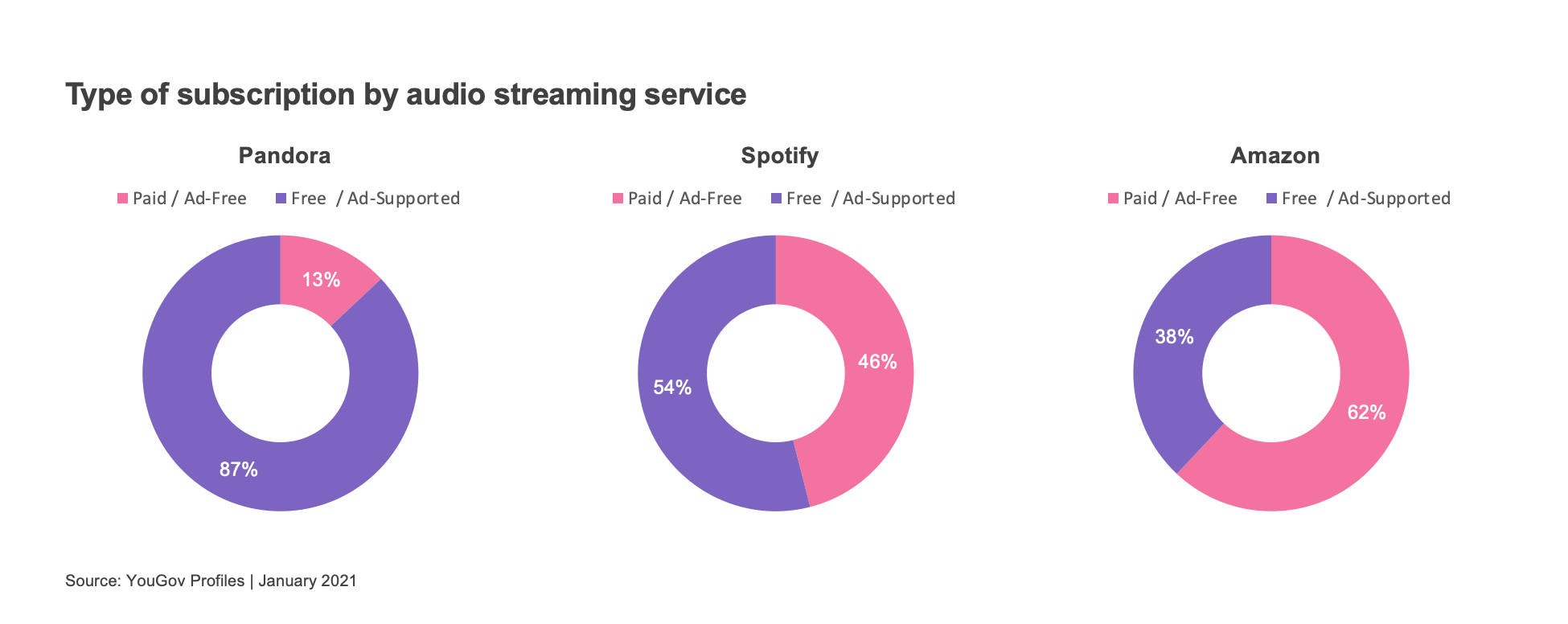

As a reminder about the major players in the space: overall usage is similar for Spotify (27%), Pandora (25%), and Amazon (24%). Pandora offers the greatest reach from a paid-media perspective, with the most ad-supported users; Spotify also offers notable reach opportunity with over half of users choosing the ad-supported version.

Finding Your Target Audience

Sometimes media planning is simply about maximizing how many people you can reach. But sometimes you need to reach specific audiences due to budgets or the relevance of your product and message. Let’s dig into who uses these platforms!

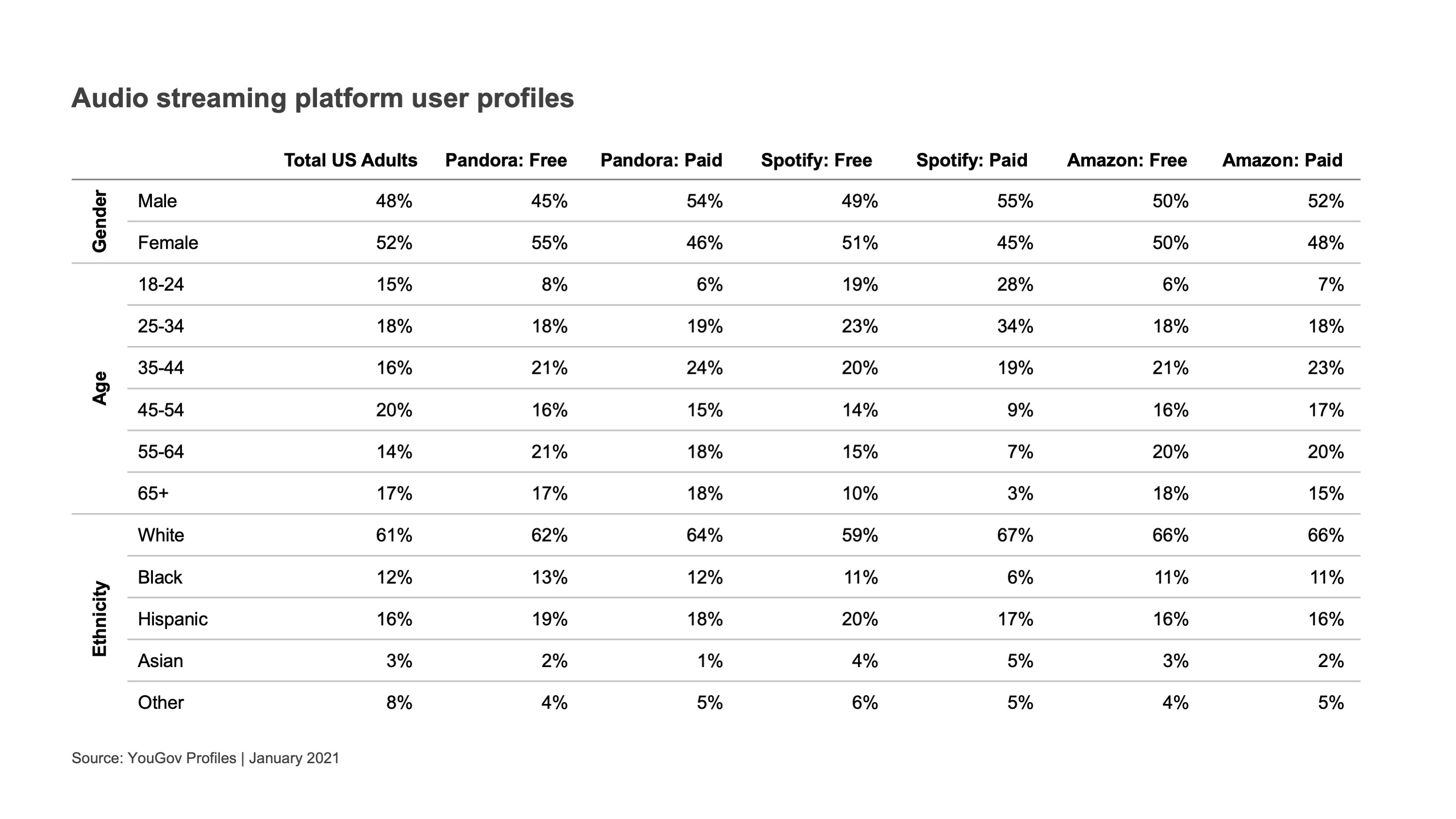

There are no dramatic gender differences across the platforms. Interestingly, men are ever-so-slightly more likely to pay for ad-free experiences.

Pandora users of both the ad-supported and ad-free versions look a lot like each other. Ethnically, they look a lot like the total US population. In terms of age, they skew somewhat towards mid-life, but only Gen Z (18-24) is notably underrepresented on the platform.

Spotify users are predominantly Gen Z and Millennials. This age-skew is even more exaggerated among paid subscribers, where 4 in 5 are under the age of 45. Ad-supported Spotify users are the most ethnically diverse while paid Spotify users are the least ethnically diverse (despite being the youngest audience).

Like Pandora listeners, Amazon Music users of both the paid and free versions look a lot like each other. They are similar in age to Pandora users, although they are slightly less ethnically diverse.

Engaging Your Audience

The importance of contextual relevance was a big theme from the panelists in a recent YouGov webinar about the media landscape. When your ad or content reaches a streamed audio listener, what device is it on and what are they listening to? These factors impact the formats and messaging of your content.

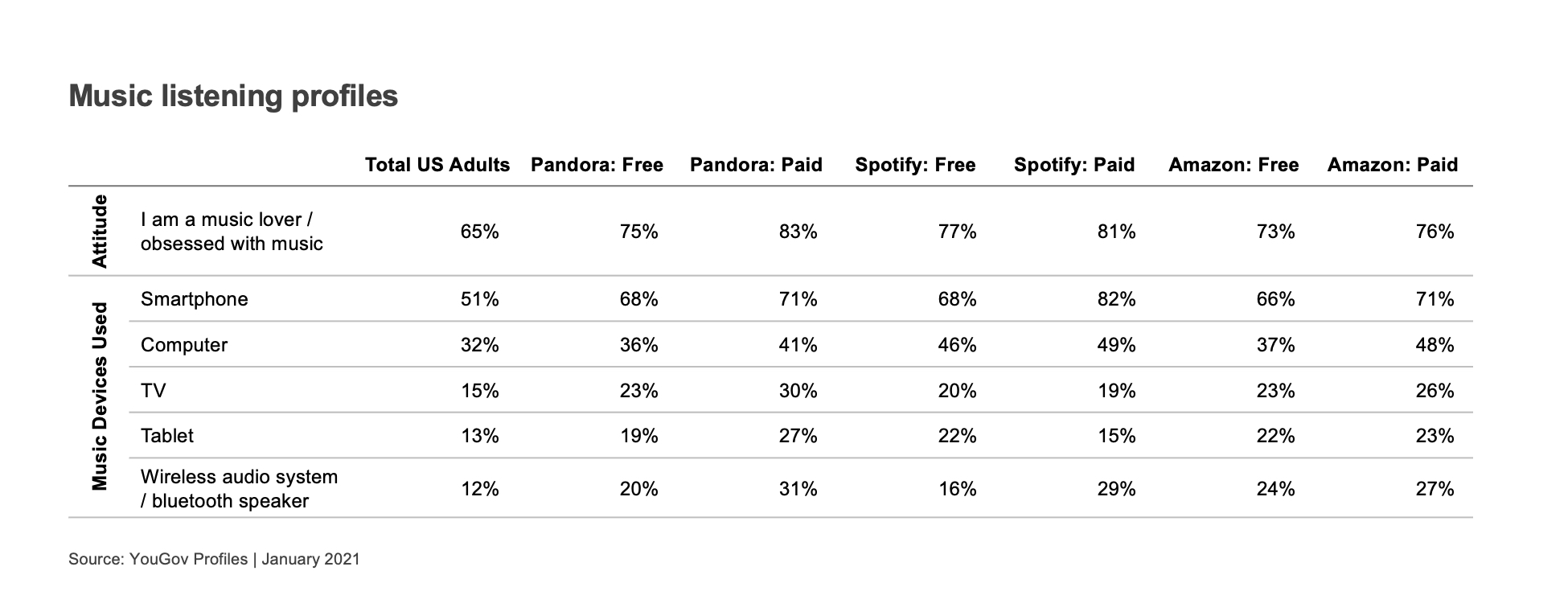

Audio streaming users are more passionate about music than the average American, and the most passionate are paid users of Pandora and Spotify.

The majority of audio streaming happens on a smartphone. Streamed audio is no longer dominated by daytime users tethered to a computer at their desk but is happening anywhere and anytime there is a smartphone. That said, listening on the computer does remain the second most common use case.

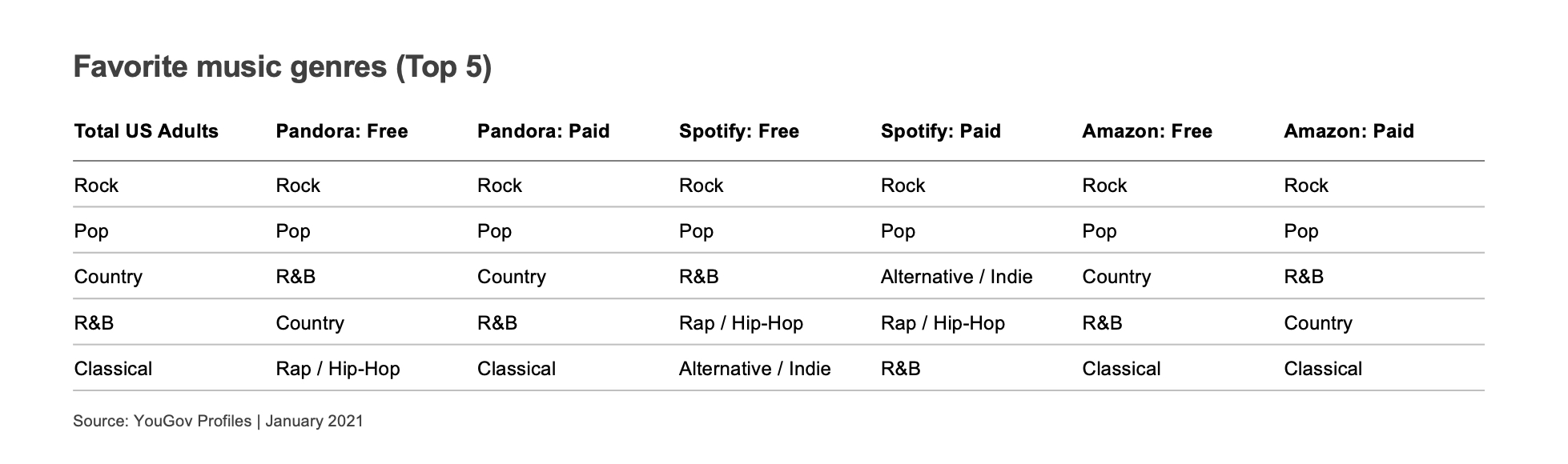

Streamed audio listeners have more diverse musical tastes than the general population. While musical tastes are not dramatically different across platforms, there are some nuances that can help guide choices in messaging, talent, etc.

I was inspired by John Cusack’s character in High Fidelity to make a Top 5 list of streaming listeners’ favorite music genres. While Rock and Pop are ubiquitous as the top genres, Spotify users stand out for Alternative/Indie and Rap/Hip-Hop making it into their Top 5 and, notably, for the absence of Country and Classical in their Top 5.

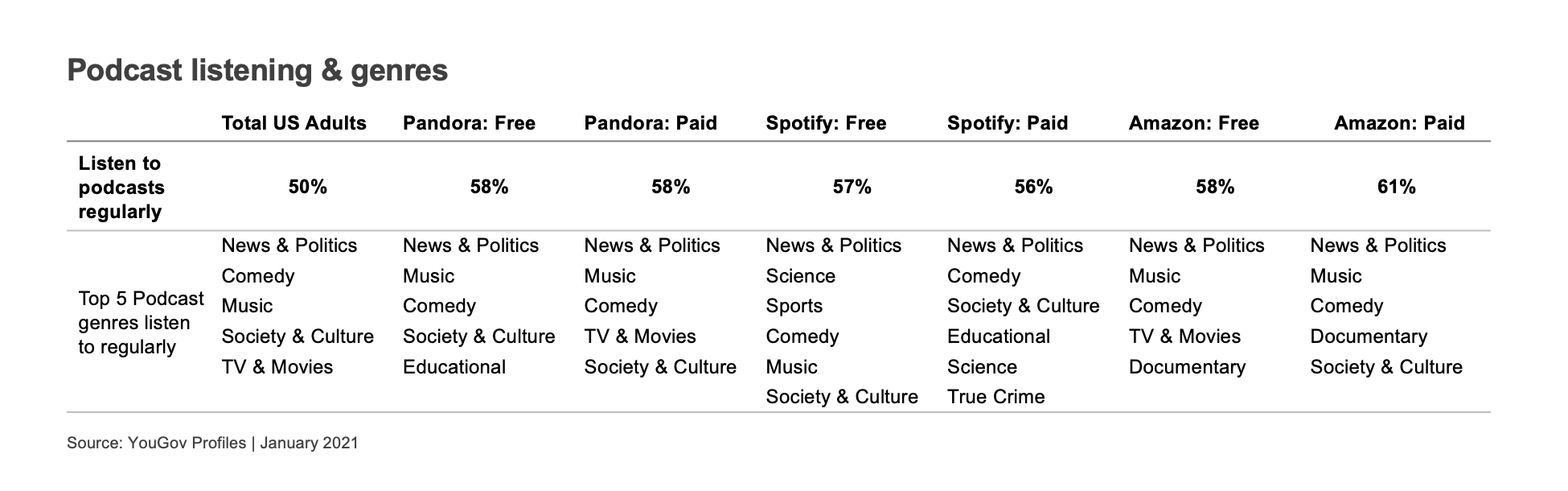

Listeners of streamed audio are slightly more likely to listen to podcasts. Paid subscribers of Pandora and Spotify listen to a greater variety of genres than their ad-supported counterparts, creating a potential opportunity reach ad-free listeners through podcast sponsorship. As with music genres, we see that the younger audience on Spotify has different tastes from their somewhat older counterparts on other platforms.

Streamed audio is changing our relationship with audio, from exponentially expanding our access to a massive library of music to expanding our minds with podcasts as our new companions during chores. The right data can help you navigate new opportunities to connect with consumers in this evolving space.

It’s a challenging time for marketers, but up-to-date data is available and helps a lot. Media fragmentation has not slowed down, and marketers must build reach & frequency with purpose. Contact me if you’re interested in seeing this data, and more, broken out for your specific target audiences, brands, etc. I’m here to strategize and help.

Photo courtesy of YouGov.

Click the social buttons above or below to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.