Expanding Beyond A State Of Semi-Convergence

The advertising business is in what I'll describe as a state of "semi-convergence."

Industry observers have long-predicted the day television would eventually look more like digital. The growth in consumer access to premium content options, devices and countless streaming video services has only increased the need for a holistic understanding of audiences across screens.

And, in order to truly converge the premium nature of TV with the precision and performance of digital, we need to move toward a model that unifies and automates planning, activation, measurement and attribution.

So, in collaboration with Advertiser Perceptions, weset out to uncover the nuances of converged planning and buying through a series of research studies surveying TV and digital video buyers.

It's About Culture, Not Just Technology

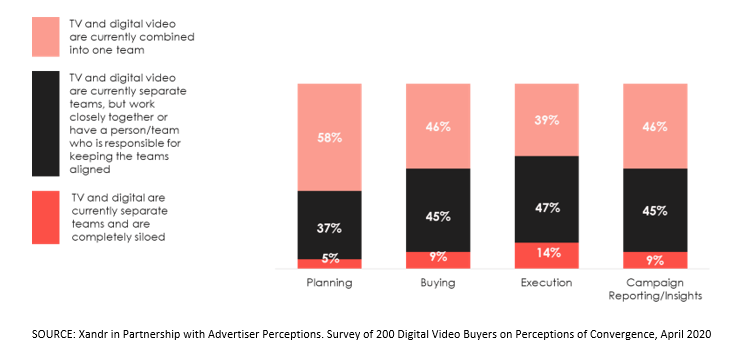

Let's begin with "how" they're buying digital video and TV. In our research process, we found most organizational structures currently support true convergence at the planning phase.

Fifty eight percent of digital video buyers surveyed said that campaign planning is conducted by a single team responsible for both television and digital video. As we move across phases, from negotiating the buy, to optimizing the campaign and then ultimately reporting the results, we see a near even-split between combined television and digital video teams, and groups that operate separately but collaboratively.

This state of "semi-convergence" speaks to both the opportunities and challenges of implementing a platform-agnostic approach across the campaign lifecycle. The identical organizational structures at the buying and campaign reporting phases indicates the need for a data-driven solution, one which can better support audience-based buying and ROI qualification.

Fifty six percent of agency respondents[1] say the buying phase would benefit the most from true television and digital convergence, while 53% percent of marketers say campaign reporting would benefit the most. This finding makes sense intuitively, since we know agencies are often a critical component of their marketer clients' activation strategy, and marketers need to prove performance and ROI to continue to drive investment.

We also conducted in-depth interviews with 10 senior agency and client leaders and discovered there was a perception that in order to operate seamlessly across digital and TV, media buyers need to learn new skills and "do double the work." Interviewees also shared that the move toward a more converged organizational structure is further complicated by a lack of standard measurement currencies.

As a result, advertisers are turning to audience-based solutions inclusive of privacy-safe identity capabilities to achieve scale, while also managing reach, frequency and exposure, and ultimately, driving campaign effectiveness.

The CTV Ecosystem Represents Opportunity, And Challenges

Advertisers are also taking advantage of the growing CTV opportunity, since CTV straddles the lines between both TV and digital media plans. Eighty two percent of video buyers we surveyed say they plan to use CTV in their campaign plans in the next year. More than half also intend to increase their spend in the channel.

While nearly 9 in 10 marketers report they'll leverage CTV in the next year, forty-five percent of marketers say they clearly understand how CTV can enable them to achieve their company's goals, compared to 50% of agency buyers, indicating there is slightly less confidence at the marketer level regarding knowledge around CTV versus at the agency level. Another key insight emerged: Despite so much optimism for future investment at the buyer level, just over a third of those surveyed consider CTV to be a must-buy and necessary to include on their media plan.

These results are partly reflective of the rapid rate of adoption of CTV by consumers (according to our April survey of 500 consumers, nearly half report watching TV programming and/or movies delivered via an Internet connection at least daily) and the advertising industry's progress to realize its value.

With no single universal identifier and growing device proliferation, the fragmentation around CTV identity does not make for seamless in-flight or post-campaign measurement at present. There is also the question of whether CTV is a TV or digital buyer's purview, or both.

The big takeaway from our research is that while convergence is happening at every stage of the advertising journey, TV and digital teams and technology need to be in alignment to fully realize the benefits of a unified digital and TV strategy.

A focus on audience and identity will help to enable buyers to reach audiences in the right place at the right moment. And investments in convergent channels like CTV will continue to drive demand for better measurement and reporting across all formats.

[1] US Marketplace Survey of 200 Digital Video buyers with fieldwork conducted from March 24 through May 4, 2020

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.com/MyersBizNet.