Flat is the New Up. 2023 Ad Spend Forecast +0.7%; Total Marketing +0.4%. Retail Media Gains 20% with National TV -4.0%

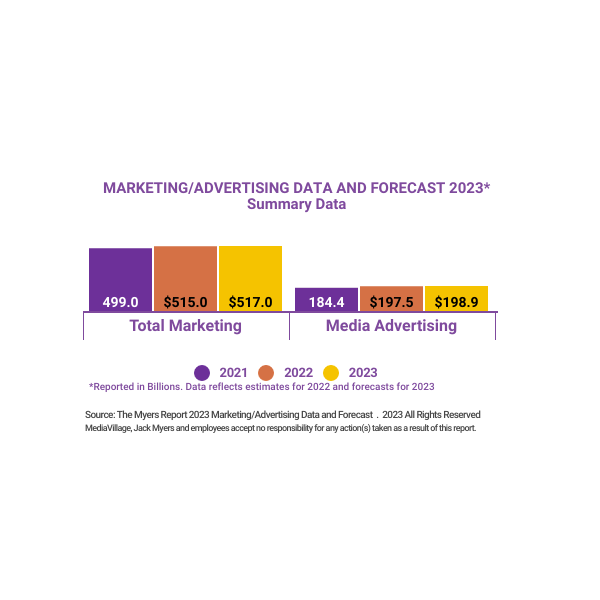

Flat is the new up for U.S. advertising investments, which are forecast to increase only 0.7% in 2023 according to The Myers Report. The 30th annual Marketing/Advertising Data and Forecast was published today and is available to MediaVillage members by downloading it below. The report covers 2021 actuals, 2022 final estimates and 2023 forecasts for forty-five above and below-the-line marketing and media categories. The Myers Report estimates a 7.1% increase in 2022 advertising spending ($197.5 billion), reflecting 6.1% growth of legacy/linear media ($89.6b) and 7.8% digital media growth ($107.9b). U.S. total marketing is forecast to grow only 0.4%; retail media gains at 20%; while national TV is forecast to be down 4.0%. Total marketing investments, including advertising, sales promotion and direct marketing, is estimated to increase 3.2% ($515b) in 2022 and to deliver only 0.4% growth in 2023 ($517.3b).

For 2023, The Myers Report forecasts 6.3% declines in legacy linear advertising investments offset by 6.5% growth in digital spend. Total marketing investments, including advertising, sales promotion, and direct marketing, are estimated to have increased 3.2% ($515 billion) in 2022 and projected to deliver only 0.4% growth in 2023 ($517 billion).

Forecasts recognize the cyclical impact of more than $12 billion invested in 2022 political advertising plus the World Cup and Beijing Olympics included in the 2022 advertising spend. However, there are secular headwinds that will continue to repress advertising investments. These include programmatic and procurement-led commoditization, data disruption, expansion of retail media networks and a 'shiny new object syndrome' in digital media investments.

The Myers Reports' long-term outlook suggests a significant upside for advertising supported media in the second half of the decade and beyond once the marketplace adjusts to the ongoing digital, data and distribution transformation and advanced technology is integrated into marketers' tool kits. We're also issuing a strong advisory to the financial community to continue to invest in advertising supported media companies that own legacy brands with valuable intellectual capital, which we compare to 'downtown central city' real estate that is the foundation of renewed urban growth. The current attitude among investors toward legacy ad supported media companies will not only kill the golden goose that continues to lay eggs but will destroy the economic marketing ecosystem that depends on it.

I've been an outspoken critic of an industry-wide failure to invest in educating marketers, the financial community and consumers on the value and importance of advertising supported media. To effectively compete in the global marketplace the advertising supported media community must invest in building positive brand equity for their own industry among marketers and investors. Most importantly, the industry must increase investments in building a diverse modern workforce by educating them about the amazing career opportunities being created in this business.

The full 2021-2023 economic data is available to MediaVillage members below and available for purchase by non-members for $295. Custom spending analyses covering 2009 to 2025 are available on request. The 2022 Myers Report compares legacy/linear investments to digital investments for most major marketing and advertising categories. The Myers Report has been forecasting economic trends for nearly four decades and was the first to reflect the flow of "below-the-line" promotional budgets to "above-the-line" advertising as marketers embraced social and search, driving advertising growth as total marketing budgets stagnated. Similarly, The Myers Report and MediaVillage have been actively covering the Retail Media Networks marketplace, which is growing at a steady 20% annual rate and is projected to generate $50 billion in 2025, much of which will be reallocated from social and linear television. Advanced television advertising, which we also cover in-depth, is projected to grow an average of 30% annually to more than $7 billion in 2025. To search all relevant data and reports relevant to the advertising economy, search at www.MeetingPrep.com.

Visit www.MyersReports.com for more information.