Fox, Disney, OTT, Upfront & More -- RBC Capital Markets

We spent the last two days in the heartland meeting Media/TIMT investors, primarily long-onlies. These were the main topics and themes:

FOXA – James's stock appears to be on the rise: Sentiment continues to improve around FOXA reflecting improving estimates, less worry about currency and good growth. Perhaps most notable is the shift in tone around CEO James Murdoch. His recent articulation of the future of media distribution, and especially digital bundles ala Hulu, has captivated investors and they now see him as a leading force for change and innovation. His relative youth and experience at Sky are cited as major assets. CBS and TWX are still considered more consensus longs by investors, so FOXA is benefitting from what is seen as a more meaningful sentiment shift. We continue to see FOXA and DISCA as our favorite long ideas. Our Technical Research has also recently highlighted FOXA and TWX on improving relative performance shifts (link).

DIS can't catch a break: We met with DIS bulls but no real bears. Bulls are frustrated that headlines remains broadly negative (e.g. competing Chinese theme parks, Alice performance) despite very strong levels of execution. Our sense is that it's going to be tough to fight the tape until more clarity on OTT packages arise, with plenty of buyers of DIS at $90 but not too many >$100.

OTT – how can I explain it? I'll take you frame by frame: Speaking of OTT, it remains the number one thematic issue for investors. But while it's a big topic of discussion, actual data points and conclusions remain scarce. Many investors agree that consumers want a 'best of cable' bundle with multiple streams, in-season stacking, content library and broad hardware compatibility. But fitting this into a $30/mo price point seems near impossible, so digital bundles could end up pricing out much closer to their current cable counterparts. This could mean they're not the game-changing panacea that has had sellside commentary so positive.

When is the Ad party over? The final, and new, topic of discussion is the Ad market and when strong scatter + political will give way to lower Ad growth from just core, and possibly tough comps. We'd say investors are getting worried about when Media starts to be valued on 2017 growth, with CBS in particular causing some concern given its above-average Ad exposure. A soft vs hard landing for Ad comps will remain important in our view, and we think investors could decide to rotate from CBS to TWX starting around Q3 if the 2017 Ad market looks to at all be at risk.

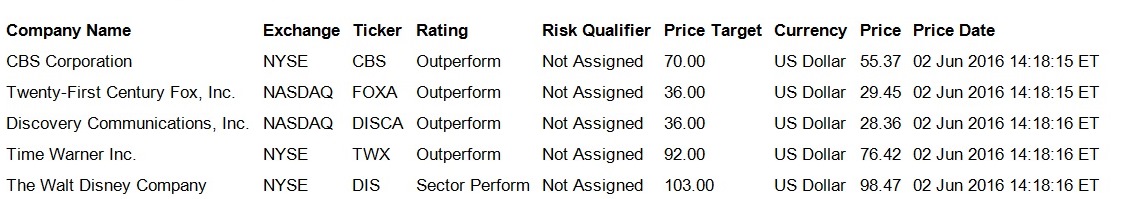

Click here for conflict of interest and other disclosures relating to CBS Corporation, Twenty-First Century Fox, Inc., Discovery Communications, Inc., Time Warner Inc., The Walt Disney Company, Steven Cahall

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaVillage.com / MyersBizNet, Inc. management or associated bloggers.