YouGov Data: How We Eat Now (and Where)

It’s hard to believe it’s already Thanksgiving! Many of us will be celebrating differently this year, but the feast goes on. In a YouGov survey two weeks ago, 81% of Americans said they will be celebrating Thanksgiving, but the majority said they’re celebrating only with immediate family this year.

There’s no talking about Thanksgiving without talking about food. Even with virtual family gatherings, Google searches for Thanksgiving recipes have only declined less than a third from prior years. It seems an appropriate time to look at how our eating habits have changed this year due to COVID.

Here are some changes in our eating behaviors and trends to nibble on. Bon Appetit!

We Have Conflicted Feelings About Dining Out

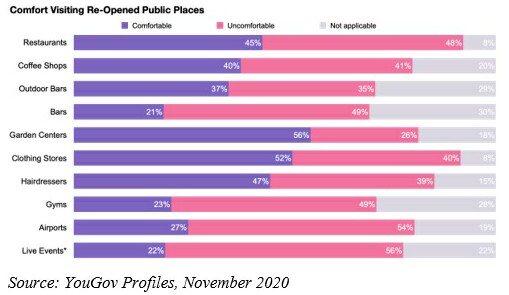

As a whole, Americans remain ambivalent about going into public spaces. Where do food and beverage service establishments sit? About half of consumers are comfortable going to a restaurant while the other half are not. This is similar to our comfort/discomfort with going to clothing stores and hairdressers. We’re more leery of bars, with only one in five saying they’re comfortable going to one (although this almost doubles for outdoor bars) -- a level of overall discomfort we also see for gyms, airports and live events like sports, music events and festivals.

If on-premise consumption is key to your brand’s business, communicating comfort and safety will be key to getting consumers back as things reopen, but it must be handled delicately -- sometimes pointing out the problem we’re solving just ends up drawing more attention to the problem.

We’re Eating More Meals at Home

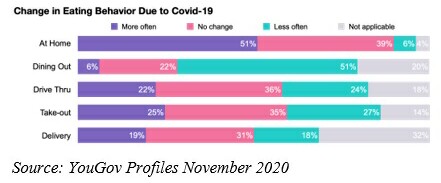

COVID has radically changed where many of us eat. Gone are the days of constant on-the-go meals and frequent dining out ... at least for now. Restrictions on restaurant dining, combined with overall skepticism about safety in public places, have created a massive shift from on-premise to at-home dining.

When it comes to other ways to get our meals -- drive thru, take-out, delivery -- it’s a bit of a tale of two households. We see equal shifting of consumers using drive thru less often (logical with fewer commuters) as well as using it more often (presumably replacing what were formerly meals eaten at a restaurant). We see similar patterns for take-out and delivery meals.

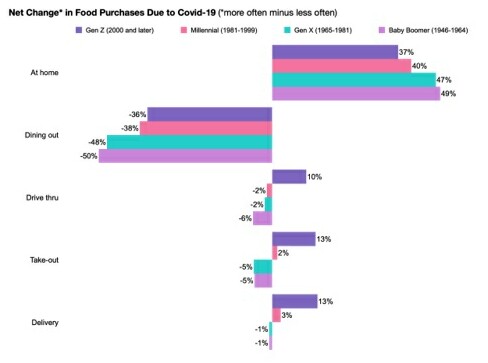

Digging in further, we see a large upswing in eating at home and a decline in dining out across all age groups, but Gen Z has increased their net usage of drive thru, take-out and delivery. For other generations, the increases and decreases more or less balance each other out.

In an interesting twist, foodies are less likely to be heading back into restaurants (71% dine out less often now vs 51% among total), but they are more likely to be making efforts to support establishments through take-out (43% get take-out more often than before vs 25% total).

Stocking Up the Pantry

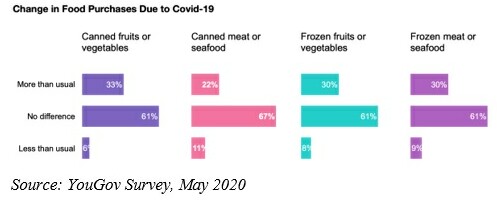

I talked last week about changes in shopping behavior, and one place we’re spending a lot more on groceries -- both in-store and online. What we’re buying at the grocery store is changing, too. All this cooking at home, when combined with a desire to limit shopping trips (and perhaps a bit of anxiety about product shortages), has increased purchases of frozen and canned foods. Three in ten consumers are purchasing frozen and canned foods more often than before.

Frozen and canned food purchases increased more among younger consumers (Gen Z and Millennials), who had a lower baseline frequency of cooking at home and using frozen and canned foods. We also see a bigger increase specifically for canned fruits and vegetables among parents of kids under 18, who are getting creative in providing healthy foods while being time-strapped between overseeing remote-learning and continuing to work their own jobs.

If we learn anything from how we eat now, it’s that at-home is the most important experience right now.

As marketers, we should be asking ourselves: How can my products enhance the at-home experience? How is my messaging speaking to my consumer’s current lifestyle as well as the one they want to return to (without rubbing salt in the wound about things they can’t responsibly have right now)? Am I offering multiple ways to shop my products? Am I learning which of my customers want things delivered vs want to get out of the house to pick something up? Am I providing ideas on how to use my products differently? Even, experiences with my kids or friends (over Zoom, at a safe distance of course)?

It’s a challenging time for many categories, but up-to-date data is available and helps a lot. Contact me if you’re interested in seeing this data, and more, broken out for your specific target audiences, brands, etc. I’m here to strategize and help. Send your request here.

Photo courtesy of Tamara Alesi.

Click the social buttons above or below to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.