Interactive Advertising: In Search of a Business Model - Levi Shapiro

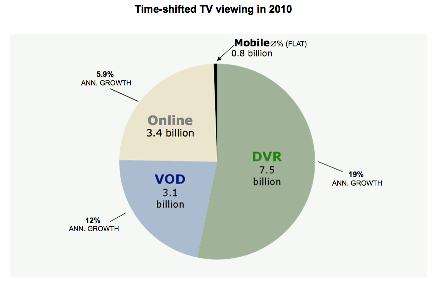

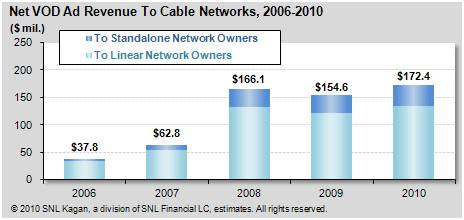

Addressable, interactive advertising on cable television should be a multi-billion dollar business. After all, cable networks earned a record $27 billion last year from traditional advertising and the 2011 upfront saw double digit revenue growth. In addition, VOD on cable, which enables dynamic ad insertion, is the fastest growing form of time-shifted viewing. According to Magna Global, 60% of US households have VOD, compared to 40.9% for DVR. In spite of these positive trends, technical and business issues are not yet resolved. Key players in the VOD value chain (cable operators, TV networks, advertisers and technology providers) share their perspectives about what lies ahead for VOD Dynamic Ad Insertion (DAI) and addressable advertising.

Addressable advertising delivers targeted messages, based on demographic and behavioral data, to individual households. For example, in the same apartment building an advertiser could deliver an ad for dog food to one household and cat food to another. The goal is to target with information about geography, socio-economic status, media usage, lifestyle habits, purchase behavior, etc.

Carl Fremont is EVP / Global Media Director at Digitas (www.digitas.com), the digital media unit of Publicis, (www.publicis.com), the world's fourth largest global advertising conglomerate. Carl presented findings last month for Stage I of an industry initiative called AAMP- the Advanced Advertising Media Project . This includes interviews with 20 senior executives from cable networks, brands, agencies and technology vendors. According to Carl, "the ecosystem recognizes the opportunity. There is an expectation for growth. In two years, VOD advertising will begin to scale. In the interim, we need to understand the linkages between VOD, the consumer and other digital media. My hypothesis is that branded entertainment will have more impact in this new medium than the traditional thirty second spot. The creative execution will need to adapt".

Diana Kerekes, VP / General Manager of Xfinity On Demand, spoke at the On Demand Summit last month: "The state of the union for VOD is extremely good. At Comcast, we launched our VOD service in 2003. Today, we have over 25,000 titles with more than 350 million views per month. 80% of these views are free".

Comcast (www.comcast.com), the nation's largest cable operator with 24 million subscribers, hopes to monetize a much larger proportion of those free views. They have invested heavily in the two major interactive advertising platforms, Canoe (Live TV) and VOD (Black Arrow).

"VOD can be a big business for cable. We are just on the cusp of DAI (Dynamic Ad Insertion), monetizing all of those views that are free for the customer. Programmers will have a valuable business model when this goes live, creating a floodgate of content coming on demand".

Two technology providers have taken the lead in offering tools like accurate subscriber and advertising data, optimized placement, ad decision services (ADS) and ad decision management (ADM).

One of these is Canoe Ventures, created three years ago by the six largest cable operators (Comcast, Time Warner, Charter, Cablevision, Cox, Bright House and focused on Live TV. Unfortunately for advertisers, Canoe does not yet deliver a truly national footprint. However, there have been a variety of successful RFI (request for information) trials for brands like USPS, GE, HP, Coca Cola, etc. The RFI is an overlay call-to-action at the bottom of the TV screen. Viewers use their remote control button to request home delivery of free product samples. The RFI overlay templates use the Enhanced TV Binary Interchange Format (EBIF) technology developed by CableLabs (http://www.cablelabs.com), the R&D consortium of the US cable TV industry. Later this year, Canoe will add additional interactive features such as polling, voting and trivia.

USPS, and their advertising agency Campbell Ewald, worked with Canoe to run a DAI campaign last Holiday Season. Managing Director Mark Bellisimo was pleased with the results. "Engagement and requests for more information exceeded our expectations and the cost per lead was competitive with other forms of media."

Arthur Orduna, CTO, of Canoe Ventures, spoke at the On Demand Summit. "We are at the cave drawing stage of VOD advertising. We think there is real money to be made for a lot of people."

"Digital now has a standard, EBIF, for interactive television. Programmers are adopting advanced SAFI and SCTE standards to capitalize on the billions of under-monetized views. Canoe offers a one-to-many value proposition, enabling a single interface and single source of campaign reporting across all participating MSO's".

Black Arrow, which is funded by the likes of Comcast, Time Warner, Intel and set top players Ciscoand Motorola is focused on VOD. Having deployed in Richmond, Pompano (FL), Jacksonville and other markets, Black Arrow PresidentNick Troiano calls 2011 "a tipping point. The focus is no longer on trials; agencies and advertisers want to know what capabilities are available. MSO's want to know how to monetize VOD".

"Television ads in prime time are very expensive. VOD can give brands a prime-time experience in a time-shifted environment. One question is whether this is a TV ad sale, a digital buy, or both".

Black Arrow recently added dynamic mid-roll ad insertion (ads in the middle of the program). Ad sales teams can now control when and where ads appear, number of "avails", enable / disable functions, etc. "Formats should be whatever the operator wants in a commercial environment. To make the market work, the sector will need marketing, packaging, positioning, and communications across the different constituencies".

While the trend of growing VOD usage is helpful, it is not enough to change entrenched industry practices. Consider the experience of TiVO (www.tivo.com), which introduced a variety of innovative ad units. Although DVR penetration will reach 40% of US households this year, the company has less than half the number of subscribers it had in 2007. Moreover, operators like Cablevision are deploying their own substitute products. There is still much work to be done before ad dollars begin flowing toward solutions like addressable advertising and dynamic ad insertion.

Levi Shapiro is a Partner at TMT Strategic Advisors, a research and strategy firm focusing on the technology, media and telecom sectors. He can be reached at levi@tmtstrat.com or via twitter: @levshapiro

Read all Levi's MediaBizBloggers commentaries at Unleavened Media.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates @MediaBizBlogger

MediaBizBloggers is an open-thought leadership blog platform for media, marketing and advertising professionals, companies and organizations. To contribute, contact Jack@mediadvisorygroup.com. The opinions expressed in MediaBizBloggers.com are not those of Media Advisory Group, its employees or other MediaBizBloggers.com contributors. Media Advisory Group accepts no responsibility for the views of MediaBizBloggers authors.