Israeli Start-ups Rake in the Cash - Levi Shapiro

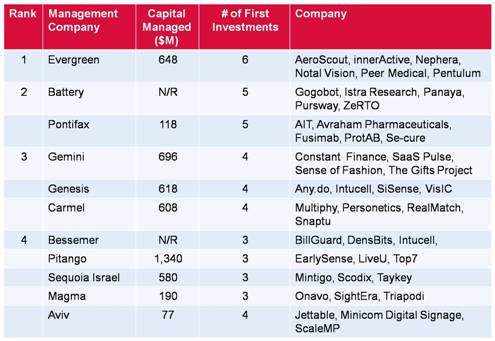

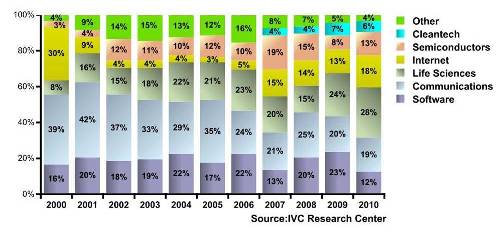

2010 was a good year for start-ups seeking money. More than $1.2 billion (13% higher than 2009) found its way to 391 Israeli start-ups (IVC). Mirroring Silicon Valley's bubble-licious valuations, first-investments averaged $1.8 million, representing 29% of all funds raised. Life sciences, communications and software continued to be the most active sectors. Among first time investments, the venture firms investing in the most companies were Evergreen, Battery, Pontifax, Gemini, Genesis, Carmel, Cedar, Bessemer, Pitango, Sequoia Israel, Magma and Aviv. Below is a description of each of those investments.

Evergreen, with $650 million under management, was the most active first time investor last year with six investments. This includes the following:

Pentalum Technologies develops wind sensing technology for control and optimization of wind turbines and wind farms. Evergreen is joined by ABB (www.ABB.com), the power automation conglomerate with operations in 100 countries and 117,000 staff.

InnerActive is a mobile advertising exchange for the 80% (Distimo) of mobile applications with an ad-based revenue model. While the market is still a tiny portion of the $26 billion spent for online ads last year in the US (IAB), it is growing faster than any other advertising medium in history. One research firm predicts US mobile ad-spend will grow by 48% this year, topping $1 billion (eMarketer). InnerActive helps developers choose from among the various mobile advertising networks for the most attractive CPM (cost per thousand), CTR (click through rate), fill-rates and other performance metrics.

Nephera: In the US, the number one cause of hospitalization for adults is congestive heart failure. Nephera is developing a device to treat patients with congestive heart failure through electrical stimulation of the bladder. The company completed preclinical trials last year and is preparing to begin human clinical trials.

AeroScout, which has been around since 1999, uses Wi-Fi-based Active RFID, sensors, RTLS and other technologies to provide complete wireless asset tracking and monitoring. Customers include Boeing, DHL, Freescale Semiconductors and more than 300 hospitals.

Notal Vision: Age-related Macular Degeneration (AMD) is the leading cause of vision loss and blindness in the western world. Since gaining FDA approval more than one year ago, Notal Vision has introduced a telemedicine based tool for doctors to access patient data via the web, allowing frequent and personalized monitoring of patients at risk of AMD.

Peer Medical develops diagnostic devices for the gastrointestinal field. The company still has not released a product but is working on tools to help physicians enhance diagnosis, reduce procedure time and minimizes complications.

Boston-based Battery Ventures, which bucked the decline in new venture funds with the closing of their $750 million, BV-9 Fund in March, established an Israel office in 2009 with four investment professionals. Last year, Battery made five first-time investments, including the following:

Gogobot: Not lacking for media attention is the start-up from former MySpace SVP, Travis Katz and Israeli Ori Zaitzman, former Chief Artchitect for Yahoo! Answers. Gogobot allows personalized travel recommendations based on suggestions from friends. If you post a travel-related query to your social graph, answers from friends and Gogobot members will be provided as a structured data list with addresses, URL's, phone numbers and reviews for each venue as well as links to partner sites Kayak, Orbitz, Priceline, Expedia and Hotels.com.

Pursway claims to quantitatively identify and measure influencers for a particular product or service through consumer transaction data. They are currently working with T-Mobile, Orange, Vodafone and others.

ZeRTO from the founder of Kashya (acquired by EMC), Zerto delivers cloud data services for dynamic IT environments, with an emphasis on virtualized mission critical applications.

Panaya: Panaya offers a Software as a Service solution that reduces cost and risk for changing ERP (Enterprise Resource Planning- ie finance, accounting, sales, service, CRM, etc) systems. The tool, which serves SAP and Oracle users, analyzes the impact of pending business process changes and dynamically informs all stakeholders.

Istra Research is a quantitative financial research firm focused on high frequency trading strategies. The company is still in stealth mode.

Pontifax is a life-sciences that is an investor in two incubators (in which research is heavily subsidized by the government) and a strategic partnership with Swiss pharma giant Roche. Some of their five first-time investments last year were for early-stage investments like the following:

Applied Immune Technologies (http://www.tcrl.co.il), formerly BioMimic Pharma, raised $4 million last year. They engage in the development of therapeutic molecules for cancer, viral, and autoimmune diseases. The company develops T-Cell Receptor-Like (TCRL) antibodies that are targeted to intracellular-derived peptides for various therapeutic and diagnostic applications. Its TCRL antibodies also have diagnostic applications in pathology; and vaccine design, validation, and monitoring, as well as in the analysis of antigen presentation in disease.

Se-cure Pharmaceuticals (se-curepharma.com) focuses research on women in menopausal age with the goal to discover and develop therapeutic solutions by means of identifying and developing biochemical compositions. These therapeutic solutions are designed for selective physiological responses with an emphasis on safety and the prevention of side effects over long-term use.

Fusimab, with only five employees, is focused on drug discovery. The company is currently in stealth mode.

Avraham Pharmaceuticals received $9 million in Series A funding last year. The company engages in Alzheimer drug discovery. Yissum and the Technion Research & Development Foundation (TRDF) exclusively licensed to Avraham the commercial rights of Ladostigil, which is the basis for the company's product. The drug has proven to be safe and well tolerated in Phase I / IIa clinical trials.

ProtAb Ltd. Raised $4 million last year. The company develops treatments for autoimmune diseases. The main product is Proximal, a monoclonal antibody to treat rheumatoid arthritis and other autoimmune diseases like diabetes. ProtAb Ltd. operates as a subsidiary of HBL Hadasit Bio Holdings Ltd. HBL is itself a unique publicly traded entity allowing the public to participate in the commercialization of promising biotech IP and R&D from the research center at Hadassah University Hospital.

Gemini Israel Funds made four investments last year. One of these was an EIR (Entrepreneur in Residence) project in the consumer finance sector that was subsequently terminated. The others were The Gifts Project, Sense of Fashion and SaaS Pulse.

The Gifts Project develops social e-commerce solutions for Internet vendors. Its first application, which was deployed on eBay during the Christmas holiday season, enables people to group-buy a present for one of their friends.

Sense of Fashion is an online marketplace for independent clothing designers. The Web site enables designers to set up their own Internet stores. The company also allows consumers to discover new clothes, communicate with like-minded people and read about fashion.

SaaS Pulse: enables managers of software as a service (SaaS) to gain real-time visibility into their business's performance. The information is meant to support critical business management decisions such as increasing sales from trials, renewing and expanding existing contracts, and optimizing the allocation of resources.

Genesis, which also operates the Junction as a resource for entrepreneurs, made four first-time investments last year- Any.Do, Intucell, SiSense and VisIC.

Any.Do: is developing technology to translate the user's natural language voice input to the mobile device into actions, using voice recognition and semantic analysis algorithms

Intucell has raised $8.5 million. The company develops auto pilot systems that continuously monitor mobile network operation and performance toward a self-optimizing network.

SiSense, which has raised $4 million, is a platform to optimize and simplify Business Intelligence (BI) tools within the enterprise. The flexible pricing model, based on service fees, makes the offering attractive to smaller companies.

VisIC: is a fables semiconductors company developing technology for electrical power conversion systems. The product is a GaN (Gallium Nitride) transistor that functions as a high voltage power switch for high voltage applications like electric vehicles, high power photovoltaic solar inverters, wind turbines and motor controls. Currently, other similar devices are limited to lower voltage applications.

Carmel Ventures is one of the larger Israeli VC funds, with $608 million under management. Carmel made four first-time investments in 2010, one of which (Snaptu) was acquired by Facebook.

Snaptu raised a total of $6 million and is rumored to have been acquired for $70 million by Facebook. The company provides a Smartphone-like experience for any feature phone. Facebook is now rolling out Snaptu's technology across 50 developing markets and further leveraging the 0.facebook.com product

Multiphy Networks is a fables semiconductor company that provides digital-signal-processing based integrated circuits for high speed networks. The start-up is developing transceiver designs to boost the transmission performance of metro and long-haul 40 and 100 Gigabit-per-second (Gbps) links.

Personetics is a platform for the automation of customer interactions in the consumer banking and financial services sector.

RealMatch has raised $4.7 million and is already powering the classifieds section of many major newspaper sites. The technology replaces keyword technology to increase relevance for better matching between job seekers and employers. The service is free and for the applicant, while employers pay a fee when they find a qualified applicant. Realmatch also powers the career channel of many newspaper sites.

Cedar has $325 million under management. Several of Cedar's investments began in their Pre-Seed program where experienced entrepreneurs are provided limited funding to develop products for targeted growth sectors. Cedar made four first-time investments in 2010- Intigua, Plankton Digital, Zizio and Scalebase

Intigua: This is a pre-seed investment in which Cedar Principal Shimon Hason serves as the CEO.

Zizio: A white-label b2b platform enabling merchants to launch, promote and manage group-sale, eCommerce campaigns. Data mining and machine learning technologies are integrated for efficient lead-gen.

Scalebase provides solutions for running scalable, relational databases in the cloud, with high availability on public and private environments. Their load balancer gives databases greater cloud elasticity for more concurrent user connections and SQL commands on all types of SQL database applications.

Bessemer is a global fund with three investment professionals covering Israel. Besides follow-ons for hot start-ups like PC optimization service Soluto or web-building kit Wix, BVP made first investments in Intucell, BillGuard and Densbits.

BillGuard, led by serial entrepreneur and founder of the Tech Aviv networking group, Yaron Samid, has raised $3 million. It is a personal finance security start-up, combining the collective vigilance of consumers with advanced transaction mining algorithms to protect consumers from unwanted and unauthorized charges on credit/debit card bills.

Densbits makes advanced controller technology for Flash memory that extends the life of NAND Flash technology.

Pitango is one of the earliest venture capital firms in Israel, with a total of $1.34 billion under management. First-time investments in 2010 included LiveU, Top7 and Early Sense.

LiveU is a portable video-over-cellular backpack that allows for high-quality transmission of video content without a satellite connection. Broadcasters and content creators can use cellular or other links simultaneously to provide a low-cost broadband channel for live video transmission.

Top7 allows Facebook users to rank any topic they feel passionate about, discover top picks from within the community and meet other rankers sharing similar interests.

Early Sense, adopted by the California Hospital Medical Center in Los Angeles, is a contact-free, continuous patient monitoring system for critically ill patients. The system consists of a sensor-studded mat that is placed under a patient's mattress. The device alerts nurses if any of the patient's vital signs drop to problematic levels. The product then wirelessly transmits an alarm to a variety of locations, including the nurses' station, the patient's room, as well as nurses' Smartphones. The system costs about $230,000 for a typical 30-bed hospital unit, with annual maintenance costs of $50,000.

Sequoia Israel is a dedicated $200 million, early-stage venture fund, the only new fund raised for the Israeli market in 2009. No new venture funds were raised in 2010. First investments last year included Taykey, Mintigo and Scodix

Taykey: Taykey performs semantic analysis across the web in real-time, to find out what's trending for key demographics at any given moment, and automatically deliver a targeted ad. Leveraging the expansion of real-time data and social media sites, Taykey has adopted a trend-based approach to advertising that enables advertisers to react in real-time.

Scodixfocuses on Print Service Providers (commercial printers, digital print shops, etc) and the enhancement printing stage. Their digital press for enhancement printing provides texture and 3D to images and text, including embossing, gloss and matte selective coating.

Mintigo, addresses what a Feb, 2001 Gartner survey identified as the number one priority for CIO's- Business Intelligence. Working with fixed and wireless operators, such as Orange,Mintigo profiles all potential customers, scores their value and receptiveness and then triggers the right contacting platform. This has helped to improve conversion and retention rates, quality of new customers, sales efficiency and bottom-line revenue.

Magma Ventues focuses on communications, semiconductors, internet and mobile. The fund also makes pre-seed investments, which included SightEra last year. Other first-time investments in 2010 were Onavo and Triapodi.

Onavo is a downloadable mobile application to help consumers measure, monitor and reduce mobile data usage. Their cloud-based tools Onavo perform well with applications favored by travelers, such as email, maps, Facebook, Twitter and web browsing.

Sight Era was a consumer web tool for auto-editing video into compelling clips. Founders Oren Boiman and Alex Rav-Acha, are applying their expertise in computer-vision research toward refining the way people browse, search and share visual information.

Triapodi has tens of thousands of Android users and specializes in mobile content discovery. To deliver targeted content that corresponds to a specific individual's preferences, Triapodi uses artificial intelligence algorithms and consumers' social networking activity to improve their user experience.

Aviv Ventures is a micro-fund, focusing on revenue-stage high-tech companies in low-tech industries like security, clean-tech, automotive, printing, etc. The three investments made last year were Jettable, Minicom Digital Signage and ScaleMP.

Jettable develops and manufactures pigmented ink and inkjet platforms for ceramic tile decoration. Tile manufacturers are able to expand their product portfolio, improve profitability and adjust to market changes. Jettable is also the only company in the ceramics sector to develop both inks and printers, enabling an holistic approach toward support.

Minicom Digital Signage provides media distribution solutions for the Digital Signage and Digital out of Home (DooH) marketplace. MDS' technology is deployed on over 400,000 screens worldwide, and facilitates the distribution of content to consumers in retail, education, finance, transportation, and hospitality environments.

ScaleMP focuses on virtualization for high-end computing. This helps to improve performance and reduce cost of ownership. Using a software-only solution, customers do not need extensive internal R&D or proprietary hardware components to develop high-end x86 systems.

These are some of the Israeli start-ups to watch in 2011.

Levi Shapiro is a Partner at TMT Strategic Advisors, a research and strategy firm focusing on the technology, media and telecom sectors. He can be reached at levi@tmtstrat.com or via twitter: @levshapiro

Read all Levi's MediaBizBloggers commentaries at Unleavened Media.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates @MediaBizBlogger

MediaBizBloggers is an open-thought leadership blog platform for media, marketing and advertising professionals, companies and organizations. To contribute, contact Jack@mediadvisorygroup.com. The opinions expressed in MediaBizBloggers.com are not those of Media Advisory Group, its employees or other MediaBizBloggers.com contributors. Media Advisory Group accepts no responsibility for the views of MediaBizBloggers authors.