McDonald's, Chick-fil-A, Subway: Will the Fast Food Customer Forever Be Changed?

Fast food, or Quick Service Restaurants (QSR), are among the many businesses that have been radically impacted by COVID. As we're spending more time at home and our eating habits have changed, we're uncovering shifts in who is eating at leading QSR brands.

A big decline in commuters has eroded breakfast traffic and long lines are evidence of the shift to almost exclusively drive-thru usage. As we've seen in the headlines, QSR businesses are having to adapt at warp speed to our new COVID normal to keep foot traffic up and cash registers ringing. McDonald's stopped serving breakfast all day and removed salads and wraps from their menus to streamline service efficiency. Chick-fil-A introduced "Safe Service," new safety measures not only to protect guests and restaurant teams, but also to uphold the restaurant experience guests have come to know and expect from Chick-fil-A.

Having worked with QSR clients for years, I am naturally intrigued and curious about the category and the challenges it's currently facing. I found myself geeking out a bit -- swirling in the amounts of change. Volatility in the consumer I've never quite seen in my years of experience has been piquing my interest even more. While there are stories to be told against many demographic and psychographic trends, age alone proves to be a story worth telling -- potentially provoking some big shifts in strategy, messaging and choice of media.

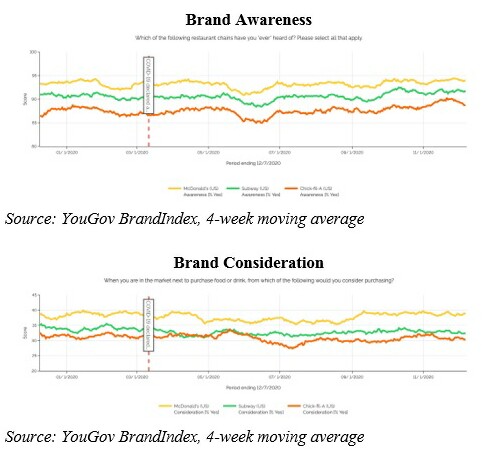

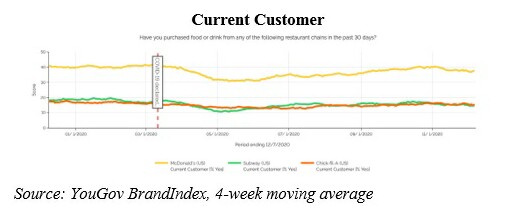

While there are many players in the category, for this analysis, I focused on brand health and usage among three of the top brands in the U.S. using YouGov BrandIndex.

The data demonstrates that COVID doesn't appear to have taken a toll on brand awareness and consideration for these brands. They have maintained high awareness and even largely maintained consideration, which demonstrates strong brand health even after nine months of radically changed conditions.

However, current customers took a dive in the spring. It's been steadily recovering, but we see that McDonald's and Chick-fil-A are down -9% and Subway customers are still down -19% from pre-pandemic levels. This makes the QSR marketer's job clear: How do I win the next meal?

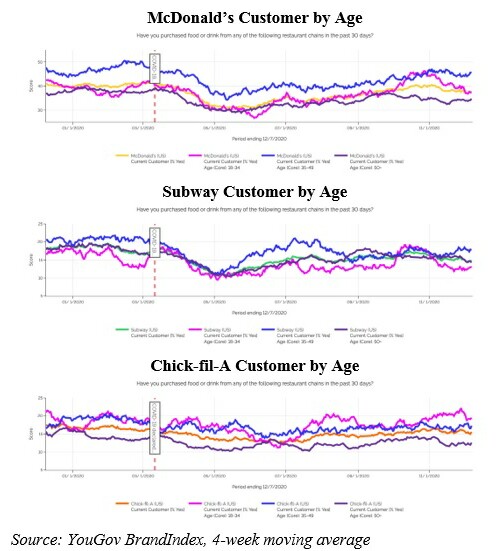

While this is interesting, it's not game changing. I'm more curious about the QSR customer. Has the consumer profile changed during COVID times? We know our lifestyles and eating habits have changed as a result of COVID. Fast food restaurants have responded, optimizing their offering for what's now a majority drive-thru business. Is there in fact a new QSR customer as a result of these two phenomena?

When we filter by age, it turns out the overall picture for brands obscures the fact that there has been a shift in who their customer is. Adults 18-34 are outpacing adults 35-49 as Chick-fil-A customers and are at pre-pandemic levels for McDonald's. Just as important -- or perhaps more importantly! -- customers 50+ are down for all three brands.

We are witnessing a category level change in consumer behavior by age. Time will tell if younger people switch back to their prior behaviors once commuting, indoor dining and office lunches fully return. But will the 50+ crowd have a reason to return to their prior levels of fast food usage post-COVID?

There are potentially major implications coming out of this data. Media investments and plans are built around customer understanding (demographics, psychographics, media usage and consumption, etc). If your audience has changed, and you're unaware, or you haven't shifted your advertising investment for that new customer, your investment is having to work harder to make an impact -- brand health and commerce.

A younger consumer will have a different media profile, with new placements to consider, new celebrities to tap into ... and even new flavors to consider for menu items. If your investment historically focused on older men, you could be losing significant market share by not messaging to a new and younger customer with your investment. Missing the right audience, with the right investment, in the right place means dollars lost in the end. In a market where leading QSR are losing -9 to -19% of customers, missing the mark on audience compounds those loses.

Watching consumer behavior rapidly change and brands make quick pivots reminds me again of the importance of not only having the right data but making sure it is recent and continuously trended.Brands know their own sales and traffic volume, but they need a knowledge partner to help them understand who is driving foot traffic and how that is changing on a continuous basis.

It's a challenging time for marketers, but up-to-date data is available and helps a lot. I have a feeling this isn't the end of our QSR storyline. Lots of interesting data on consumer behaviors to share. Contact me if you're interested in seeing this data, and more, broken out for your specific target audiences, brands, etc. I'm here to strategize and help.

Click the social buttons above or below to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.