Media's Most Critical Challenge: Over-Supply

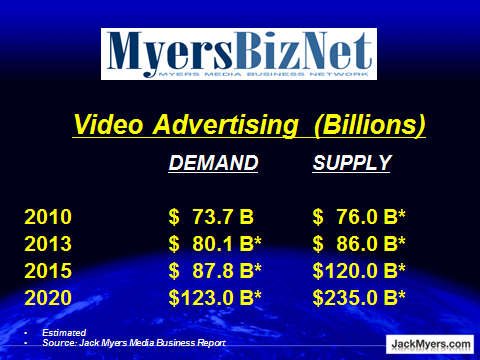

The programmatic and automated systems being developed for media buying and selling are, of course, the hottest topic in the industry today. What's being ignored in these stories is the fundamental shift in demand vs. supply. In the video advertising ecosystem, demand and supply have been relatively balanced for the past several decades, with demand keeping up with and often exceeding the rapid growth of video advertising supply, allowing for cost inflation. The role of revenue officers of leading TV media companies has been demand management, and the responsibility of media buyers has been to manage client expectations and explain TV realities to questioning client procurement officers who are trained in supply-chain economics. These responsibilities and realities will shift dramatically in the next several years as the growth of video ad inventory supply will outpace demand by a two-to-one ratio, dramatically altering the historic dynamics of the industry. Quite simply, marketers will exploit the increasing cost efficiencies of legacy advertising models and simultaneously expand their focus on implementation of below-the-line tactics through digital media applications.

Total marketing communications budgets will be generally flat through the end of this decade, and down significantly when factoring in inflation. Marketers'total communications investments are estimated to grow from $598.6 billion in 2012 to only $610 billion in 2020. Investments in media advertising (above-the-line) will increase from $203 billion in 2012 to an estimated $304 billion at the end of the decade. Promotional spending, direct marketing, event, public relations and other "below-the-line" marketing communications will decline from $396 billion to $306 billion. Of the $100 billion of increased ad spending in 2020, $90 billion will be focused on achieving below-the-line promotional goals through partnerships with media companies. MyersBizNet estimates that only $10 billion will be incrementally invested in 2020 across all media to achieve traditional awareness, reach, frequency and impressions-based advertising goals. Media inventory supply during this period will increase at an exponential rate. Marketers will achieve their traditional reach/frequency/awareness objectives in an over-supplied and highly fragmented media marketplace by commanding greater cost efficiencies using automated and programmatic systems. Even the most valuable of media outlets will experience cost deflation unless they offer high targeted reach, exceptional performance metrics, and/or integrated promotional and marketing tie-ins.

The growth of advertiser demand since the 1950s has enabled the expansion of print, radio, television, out-of-home, and more recently Internet-based media. While some traditional supply, especially in print media, is eroding, the growth of online, mobile, digital out-of-home and television media is accelerating. All indications are that the amount of digital inventory available to advertisers and their media buyers will increase exponentially, driving down costs for both legacy and digital media inventory. The downward pressure on costs will intensify. It's inevitable.

If you are receiving this report, you are a registered member to Jack Myers Media Business Network or are receiving it as part of a registered corporate membership. As a member, Jack responds personally to your e-mails, requests and comments. He is available to speak at your company events. In addition to Jack Myers Media Business Reports, your membership underwrites MediaBizBloggers.com, Women in Media Mentoring Initiative,Jack Myers Wall St. Report, Jack Myers Video Media Report, plus our exclusive industry economic forecasts, trend forecasts and corporate performance research. Re-distribution in any form, except among approved individuals within your company, is prohibited. As a member you have full access to all archives and reports at www.jackmyers.com. If you require your ID and password, contact maryann@jackmyers.com