Navigate New Media: Television's War of Confusion - Jason Blanck - MediaBizBloggers

Introduction

This past September, Netflix won the war over home DVD viewing when its rival Blockbuster filed Chapter 11 bankruptcy. For over a decade, Blockbuster controlled the major non-cable distribution channel until Netflix charged into the space with mail delivery services and its watch-instantly online service. Although this bankruptcy ends the war over hardcopy-rentals, a more important war is now on the horizon.

The next battle in entertainment television won't involve any pre-stamped envelopes or late fees. Instead, the new battlefront is the online space.

Streaming movies and television to consumer screens—computers, gaming systems, and mobile devices—has the potential to fundamentally change the way people choose, use and pay for content. Audiences are no longer bound by the limitations of broadcast, cable, and satellite TV, and are instead moving to an experience model for consuming entertainment

Netflix Model

It turns out interactive television is here, but it doesn't look anything like the predictions. Content creators thought people would want to select alternate plot lines or various endings. Instead, interaction means being able to chat with distant friends, send clips, or pause a film to bring up a related YouTube clip that enhances the experience of watching entertainment. This behavioral change creates new opportunities for technology and software companies to position themselves in the entertainment supply chain and compete or partner with many major incumbents. Some of these new companies will provide cloud services where digital content is stored until ordered by online customers. Other companies will make the devices and software that will connect the consumer to the content. Still others will try to control the pipes the content flows through. These new opportunities naturally result in a crowded marketplace, where companies like Apple, Google, Sony, Netflix, ISPs and the various wireless carriers jockey for a viable position. And with such a crowded field, new mega-alliances and shakeouts are inevitable. We believe the new players are already aligning as evidenced by recent moves among the major entertainment companies (NBCU, News Corp., Disney, Sony, Viacom, and Time Warner). These established players have begun to experiment with emerging "server side" companies such as Apple, Netflix, and Hulu, as well as their own in-house online distribution efforts. They are watching tracking audience response, pricing models, cross-promotional opportunities, and other business functions. By spreading their efforts across many possible technologies and partners, they hedge their risks with a resilience strategy. Among the experiments, studios are –altering the release windows with online content now coinciding with theatrical/television releases while simultaneously promoting their content heavily through online advertising at the expense of traditional television advertising. The majors are also partnering with various device manufacturers – the "client side" of the new equation. TiVo, Sony Play station 3, Xbox 360, Apple TV, Google TV, Boxee and other in-home devices that connect the Internet to the TV and other screens such as mobile devices. Anyone who controls or reaches a consumer screen is a potential ally.

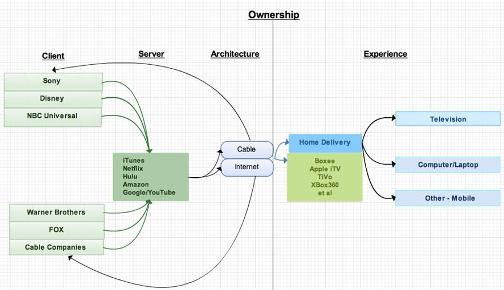

These new server/client technologies are disrupting the old look of the media supply chain. For example, over the past fifty hundred years, media corporations have vertically integrated their supply chain – maintaining complete control of acquiring intellectual property, producing, marketing and promoting, and distributing films and television shows. These vertically integrated media giants staked their claim when it was pretty clear what the supply chain looked like. But now, stakeholders throughout the entertainment Industry and the Internet/tech market will be forced to adapt to changing consumer preferences, which are driving a different winning distribution method than today's near linear connect the dots model: that is, from studio ? cable provider? on-demand channel? customer. Below is a picture of how the dots are being rearranged to bring content directly to consumers on-demand, and in the case of new films, often very close to the theatrical release.

This phenomenon of customers owning their experience of media viewing, on their own terms, fundamentally shifts the standards of film and television releases.

Predictive

Chaos is coming. The happy monopolies that Comcast, Time Warner and Liberty Media have stood their profitability upon are eroding beneath their feet. When Netflix, Google, Apple and Amazon start supplying a better entertainment experience, consumers will expect their entire entertainment supply chain to support these experiences. And in the interest of increasing their profits, manufacturers and technology companies will have to improve their bundled services to better distinguish themselves or risk obsolescence.

We believe the cable MSOs will resolve to lock up content libraries through strategic alliances with content creators, mergers, and acquisitions. They will also try to control the distribution channel. In an action that precipitated the entire net neutrality debate, Comcast has already begun toying with the idea of controlling high-speed broadband Internet streaming. If legislation is not passed prohibiting such actions, look to see more cable providers forming alliances and merging with studios and networks and then creating tiered access services on their cables. With alliances occurring rapidly and across the board, streaming aggregators (other than Netflix) are struggling to come to terms with this experience economy.

Hulu has struggled to maintain relationships with major cable companies and "does not have sufficient revenue streams to cover its cost of programming." (Advertising Age) Many of Apple's customers are using Netflix to stream content rather than paying extra for a new Apple TV or iTunes download. (CNET) While on-demand streaming services currently have the momentum, content creators must play with everyone until a clear winner begins to emerge. Looking to capitalize in this fragmented market space the major networks, film studios, and broadcasting corporations have begun ceding control of their content to on-demand distributors in exchange for larger paychecks and guaranteed space on multiple platforms.

In particular, we will see shortening release schedules for TV episodes, films, sporting events, and any type of live broadcast towards the on-demand/online everywhere model. By pushing their content to a wide variety of platforms, networks and studios will feel less pressure to keep traditional viewers and ensure they monetize at every opportunity. This is an important short-term strategy. Some consumers are cutting their TV cable subscriptions and using only internet devices for viewing. Although current research shows cable cutting is not yet widespread, we will inevitably see a drop in subscriptions.

In order for Netflix and other streaming services to fully convert cable subscription customers however, they "are going to have to cut a bigger piece of the pie" for library content acquisitions. – footnote Michael Pachter, security analyst.

And digital distributors (Netflix, Hulu, VeVo) may ultimately merge with technology companies. On natural partnership is Netflix with Scientific Atlanta. Set top boxes should merge with the TV and support universal streaming, rental and downloading.

The shift in consumer viewing preferences is on. Netflix signed up its 20 millionth subscriber last month – making it a very real rival to Comcast, the largest cable company in America (24.6 million cable subscribers). While it will ultimately be difficult to choose the next dominant company, the next home entertainment battle is already shaping up, and the field is crowded with high profile and well-financed companies.

What will the next war look like? Look for these players to behave in these ways:

– Cable MSOs – will adapt to consumer cable splicing behaviors to win back customers who have cutting the cord. The MSOs need strategic alliances with on-demand services and software companies to put programming on multiple platforms – i.e. TV Everywhere. Push broadband and wireless high speed Internet to customers who will access content on their terms for their experiences.

– Broadcast Networks and Cable Channels – need to invest in development and improve quality programming. Push content to the periphery as quickly and frictionlessly as possible. Hey should also use live events such as sports to protect their franchises.

– On-demand/online distributors – Increase quality and size of their libraries. Continue to push product to as many peripheries as smoothly as possible (new platforms, on-demand services, set top boxes, game consuls, etc.). Work with creators to shorten window period for rapid releases.

– Tech/Software – Become the consumer advocate, Innovate relentlessly to improve accessibility, technology, and speed of streaming services.

Summary

No one definable company will win the war over home entertainment viewing. The experience of watching TV will evolve as new companies form new experiences and help consumers realize the full value of their many entertainment platforms. The shift in home entertainment viewing toward providing content on all devices for as yet undefined experiences will be the only predictable event for the foreseeable future.