New Media Math 2020–2025: Linear Dollars=Digital Quarters

The billions of dollars invested in quality content by legacy media companies is being rewarded not by increased investments in advertising, but by a drive toward commoditization and a transfer of media buying from marketing management to procurement oversight. The media economy is being weighed down by an explosion of commoditized digital inventory, reflected by the oft-quoted "linear dimes replaced by digital pennies" reference. The new reality for broadcast network television is linear dollars replaced by digital quarters.

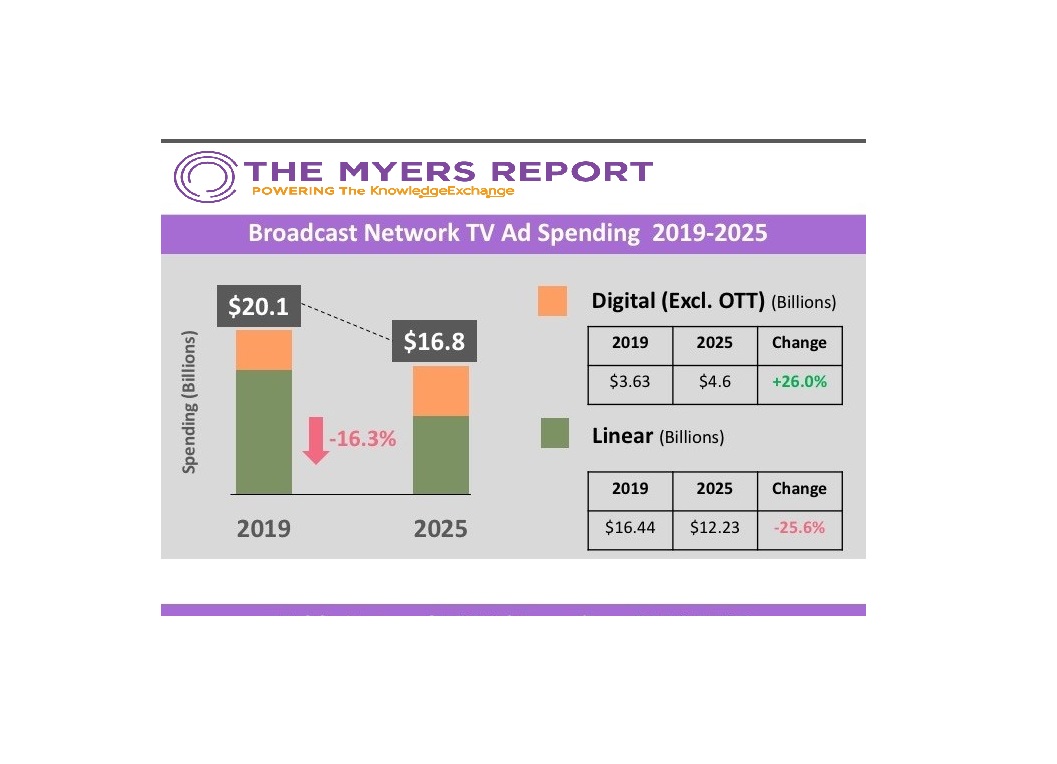

The Myers Report Marketing & Media Economic Data and Forecast 2000–2025, forecasts that annual broadcast TV network linear revenues will decline 26% (more than $4 billion dollars) by 2025. Digital revenues will increase 26% representing only $1 billion in additional annual revenues.

Broadcast Network TV Ad Spending 2019–2025: 16% Decline

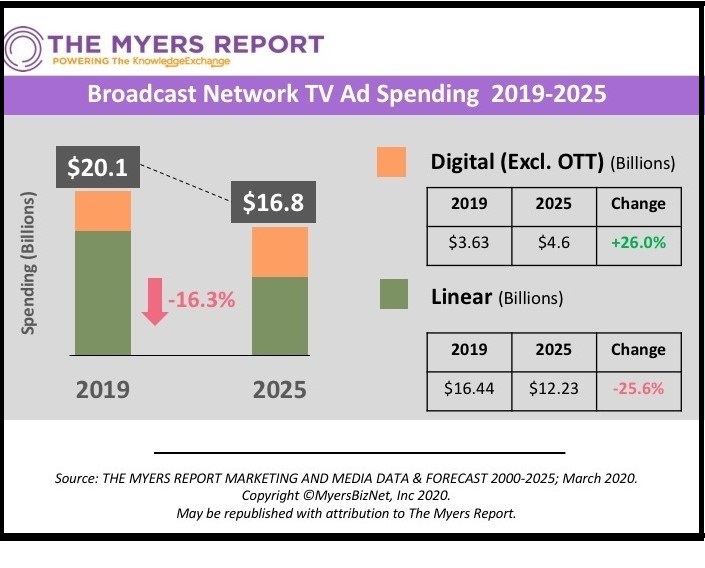

Algorithmically biased and efficiency-based media commoditization is projected to drive down network cable TV ad investments by 25% in 2025 compared to 2019. Linear revenues are projected by The Myers Report to decline by more than one-third from $26 to $17 billion, with 22% digital growth replacing only $3.2 billion of lost revenues

Cable Network TV Ad Spending 2019–2025: 25% Decline

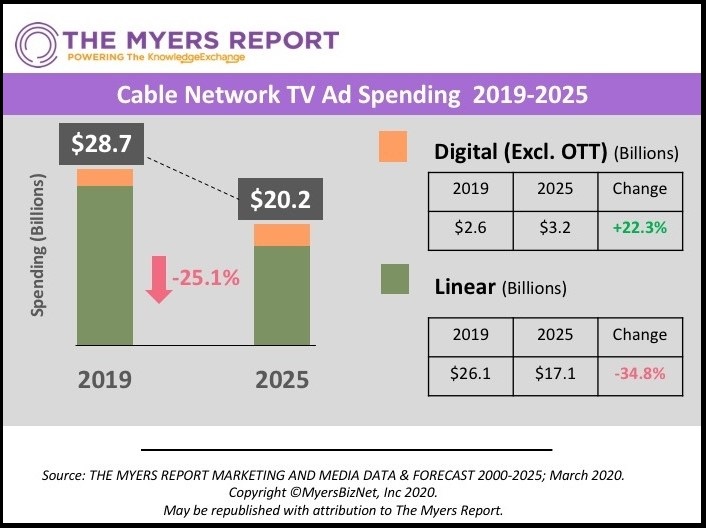

The dimes-for-pennies analogy is more apt for consumer magazines, which The Myers Report forecasts will lose almost $3 billion in annual legacy print ad revenues by 2025, replaced by only $500 million from digital, translating each dollar of lost legacy revenues into 15 cents.

Consumer Magazine Ad Spending 2019–2025: 18% Decline

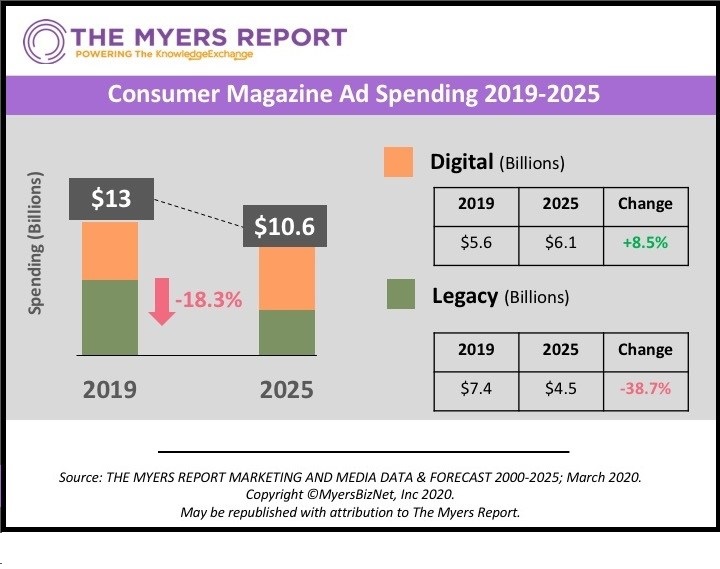

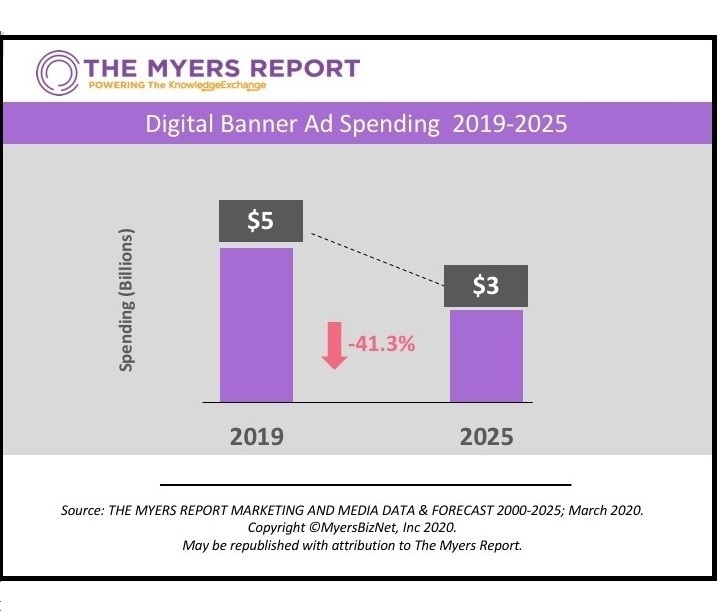

Ironically, among the hardest hit by digital commoditization is banner advertising, which The Myers Report predicts will decline more than $2 billion in 2025 versus 2019, impacted by an inventory glut and increased availability of cost-efficient video impressions.

With overall ad spending increasing, as reported by The Myers Report, where's the growth being generated? Our next report will focus on categories most benefitted by digital commoditization and those that are best navigating the shift.

Digital Banner Ad Spending 2019–2025: 41% Decline

For more data and analytics visit www.MyersReport.com. The Myers Report's detailed data and forecasts will soon be available to MediaVillage member companies at www.MyersReports.com. Members may contact maryann@mediavillage.com to request password access.