Nike, Adidas, Under Armour: A Routine Brand Health Check Reveals Surprises

Apparel had a particularly rough year in 2020. As noted in Just-Style, top executives expected U.S. textiles and apparel sales could shrink by more than 50% in 2020 due to the coronavirus outbreak. We are seeing this play out with retailers such as J. Crew and Brooks Brothers filing for bankruptcy and America's first department store, Lord & Taylor, going out of business and closing all its stores.

A silver lining for the apparel industry is the increased popularity of athletic, athleisure and leisure wear. Google searches for "sweatpants" were up +65% in 2020 versus the prior year as sweatpants became part of the everyday uniform in our new normal (Source: Google Trends).

Understanding this, I was curious to look at how brand health has fared for some leading athletic brands -- Nike, Adidas and others -- during this atypical year.

With the right data and the right tools, marketers and agencies can easily and quickly diagnose the real problems their marketing plans need to solve.

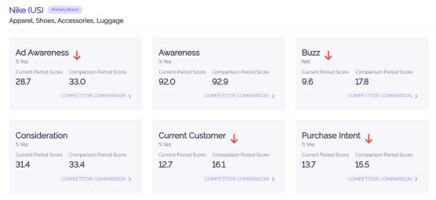

Since Nike is the top athletic apparel brand, let's start there. Nike's quarterly earnings report for September to November 2020 showed stability in the U.S. and even growth globally due to digital sales. However, insights from YouGov BrandIndex suggest a more complicated picture of Nike's brand health in the U.S.

YouGov's new BrandIndex scorecard functionality allows us to see a succinct roundup of consumer perceptions around Nike. Comparing 2020 to 2019, we see some softness in Ad Awareness and Current Customers. I've come to expect this with reductions to media budgets and declines in consumer demand that plagued many industries. However, the year-on-year declines in net positive Buzz and Purchase Intent suggest that Nike may no longer sit at the top of those brand perception measures.

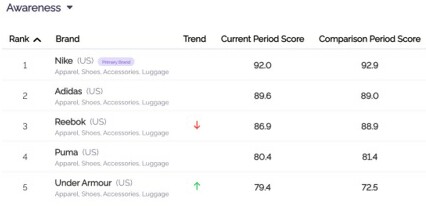

To understand where Nike's situation is brand-specific versus a category-level phenomenon, I looked at competive set scorecards. We see Brand Awareness largely held across the category. Under Armour was able to increase awareness, which may be in part due to news coverage of their facemask designed for exercising.

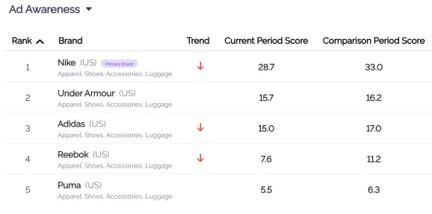

As suspected, declines in Ad Awareness were a category issue and not a brand issue specific to Nike.

As we've seen in other categories, there were slight but not significant declines in Consideration across the top athletic apparel brands -- again, with the exception of Under Armour, which saw a marginal increase.

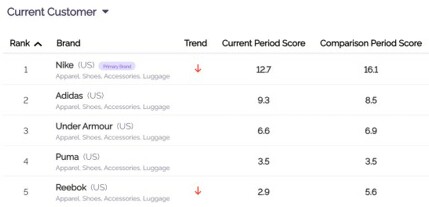

Measuring the top sports apparel brands by Current Customers is where the data starts to get interesting. Nike and Reebok show the types of declines we've seen in other categories during the pandemic, while Puma and Under Armour were essentially flat. But Adidas grew its customer base slightly -- I suspect being early to release facemasks and two drops from a high-profile collaboration with Beyonce's Ivy Park are contributing factors.

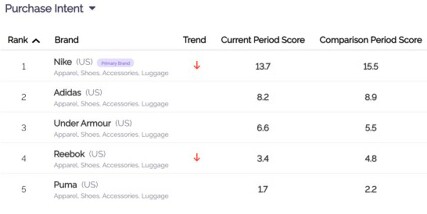

In many categories, we've seen that Purchase Intent remained relatively stable as people hold on to their brand preferences, even though they might not have purchased anything from a brand during the pandemic. But Nike and Reebok took bigger hits to Purchase Intent than others in the category, and Under Armour was able to grow Purchase Intent slightly.

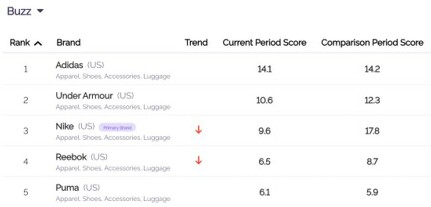

Nike is the top brand across all the traditional brand funnel metrics, but surprisingly this not the case with net positive Buzz (which is positive Buzz minus Buzz). In the past year, Nike fell from the leading spot to third place. When I dug in deeper, Nike still leads the category in positive Buzz but it's on the decline. And an increase in negative Buzz pulls down their net positive Buzz from a leadership position. Reebok also saw a significant decline in Buzz this year, and Under Armour saw a slightly decline (despite all the PR around their facemasks).

This makes me wonder how many brands could be struggling to find their brand's story in their data, or worse yet, don't have access to data that will help them quickly identify where to focus their resources to make the biggest impact. The opportunity for Nike and other brands seeing similar trends lies in building a connected marketing system across paid-owned-earned, feature content and activations that will fuel positive PR and word of mouth.

Investigations into various dimensions of brand health are essential for calibrating marketing plans and driving growth.

The best solution to the wrong problem won't accomplish much. Continuous tracking keeps a pulse on brand health and helps us adapt in real time. We also need to step back periodically to look at the bigger picture, such as annual planning exercises. Media fragmentation has not slowed down, and marketers must build Reach & Frequency with purpose. Contact me if you're interested in seeing this data, and more, broken out for your specific target audiences, brands, etc. I'm here to strategize and help.

Source for all charts: YouGov BrandIndex | Current Period: 1/1 - 12/31/2020; Comparison Period: 1/1-12/31/2019

Click the social buttons above or below to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.