Search Marketplace: State of the Union

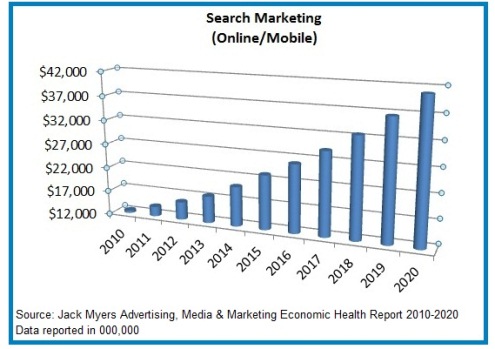

The Holy Grail of Marketing is to serve the right ad at the right time to the right person. This mantra has led marketers to invest an estimated $14 billion in search marketing in 2011, with Myers forecasting growth to $23.2 billion in 2015. But the definition of search is evolving to an ecosystem of performance-based advertising delivered via an expanding array of technologies and measured by increasingly sophisticated metrics. Search has, until now, been dominated by Google, Yahoo!, Microsoft, search agencies, marketers' own search departments, search engine marketing tools, search engine optimization platforms and search networks. Today's search landscape is likely to be unrecognizable in just a few short months.

Retargeting

While search retargeting has been around for awhile, display ad retargeting is bringing renewed vitality to a display ad marketplace that has slowed as supply dramatically outpaced demand.

Criteo, a display ad network focused on retargeting, defines the concept as "finding your previous website visitors across the internet and utilizing display-relevant-banners to drive them back (re-targeting) to your website to complete their transaction." Marketers can identify users who visited their sites and invite them to return with a specific value proposition delivered through display ads on other sites. In Europe, an estimated 20% of search marketing budgets are invested in retargeting. In the U.S. retargeting currently represents less than 5% of search budgets.

Greg Coleman, an industry veteran who is widely credited for the ad sales success of Yahoo! and The Huffington Post, joined Criteo as global president earlier this year with ambitious goals to introduce the European-based company to U.S. marketers and to establish retargeting as a differentiated marketing tool for achieving the dual benefits of both search-like performance value and branding impact. Retargeting, says Coleman, "performs on both brand and search metrics. We dynamically create our own banner ads that we know have a greater chance to work on a performance basis. We allow marketers to understand who visited their website and we then tap them on shoulder at the right time and invite them back to the site. Marketers have made major investments in their websites, yet less than 1% of their visitors actually make a purchase at the site. Having a marketing tool to bring people back is very valuable."

In addition to Criteo, other companies in the retargeting space include Dotome, Fetchback, Magneticand RadiumOne, which recently received $21 million in venture capital funding, and of course Google, which has introduced its own re-targeting service via Google AdWords. Yahoo! has established a beachhead in the retargeting space through the acquisition of Dapper. eBay and Amazon are seeking to build their own proprietary solutions. Advertising agency trading desks are also developing retargeting capabilities.

The Criteo arbitrage business model is focused on designing display advertising to achieve search engine marketing results and benefitting by the resulting increased value of the inventory. Almost 50% of all publishers' display ad inventory is monetized at highly commoditized pricing through ad networks, supply side platforms (SSPs), exchanges, demand side platforms (DSPs), and trading desks. The retargeting opportunity is to deliver higher value to advertisers through search-like results and deliver a higher cost-per-thousand (CPM) to publishers than they are receiving from ad networks. Criteo buys inventory on a CPM basis through real-time bidding and remarkets the inventory exclusively on a cost-per-click (CPC) basis. Criteo currently employs more than 100 engineers who are developing algorithms that help define "when" a retargeting ad should be delivered to an advertiser's prospective customers. This focus on "when," says Coleman, represents an important competitive advantage. "Deep science and product roadmaps are essential to achieve a meaningful market advantage and success will be elusive for those who don't have the dedication and passion to make the necessary investments," Coleman adds.

Ultimately, retargeting can help marketers direct their ad dollars toward users who have already shown some level of engagement, which sets the stage for a higher conversion rate and thus a greater return on advertising dollars for marketers. Behavioral targeting was intended to deliver search-like metrics to display advertising, but it was still focused on branding. If someone was in the market for a big ticket item, targeting them when they were looking at related content was the focus. Coleman believes "the holy grail of display advertising has been to prove that branding impact could also be taken a step further to make display perform like search. The goal of retargeting is to utilize display ads with their branding value but to add a high impact performance capability." Criteo describes its mission as "making display ads perform better than search."

Google, Bing, Facebook, Yahoo!

The other big story in the world of search engine marketing is Google's recent update to its algorithm, an event known as the Panda update. This update continues the trajectory the major search engines have been on for some time -- which is to increasingly favor their own content.

Search engine blogger Frank Watson noted this much in his review of the Panda update, observing that after Panda, the biggest boost in rankings seemed to go toward Google's own properties. Google continues to invest in building its own properties and sources of user-generated content, such as Google Places and Google Offers, and is even moving toward deeper integration via its recent acquisition of Motorola and its plan to build its own broadband network.

Are we on track to a world in which Google increasingly delivers its own web pages across its own broadband network to devices it designs -- thus ensuring tight integration on an end-to-end basis? I think so, and this trend is not exclusive to Google. Yahoo! already has a large focus on its own media properties -- with destinations for everything from stock market research to fantasy football to celebrity gossip and more. And Rob Young of SearchEngineWatch has reported that Bing is now powering Yahoo's search results everywhere except Korea (which is coming soon).

Moreover, rumors of Facebook creating its own phone also fit into this trajectory. As such, marketers may benefit from building on the respective properties of each search engine in which they wish to rank. Bing is also deepening its presence on Facebook, as it will have its translation API integrated into the social network. This is particularly noteworthy since Google is discontinuing its translation API as a free service this December, thus making Bing's translation API more appealing and a tool that could lead to greater market share. Bing currently boasts a market share of approximately 14.7%, up from 8.4% at the time of its launch.

At their core, these market shifts translate into less control by marketers and agencies over search inventory and the cost of search marketing. Retargeting is one tool that enables buyers to regain some control over their investment strategies by focusing on consumers who have already engaged at their sites. Of course, the Panda update is far from complete, and marketers have ample opportunity to monitor this trend. Google staff members claim that the Google algorithm receives over 500 updates per year -- over one and a third per day -- and so marketers will need to keep a close eye on their rankings and observe if the trend toward more tightly integrated search engines continues.

DuckDuckGo: Leveraging Niche APIs

In other search engine news, startup search engine DuckDuckGo recently got funding from venture capital firm Union Square Ventures, investors in Internet behemoths like Twitter and Zynga. DuckDuckGo has a slightly different approach to creating its algorithm; it relies on grabbing select APIs and manipulating them accordingly, rather than the typical search engine approach of using bots to crawl the web, and then querying this entire data set to create rankings.

DuckDuckGo's approach is more decentralized, focusing on customizing niche APIs to create its search engine. If DuckDuckGo can succeed with this approach, search engine marketers may benefit from identifying niche aggregators, and ensuring that their content and links becomes deeply enmeshed in content that goes through the niche aggregator's API and into API-based search engines like DuckDuckGo. A similiar company is Vertical Search Works.

Privacy

Certainly, privacy advocates are likely to be suspicious of all forms of cookie-dependent targeting, in spite of the efforts of firms like Criteo to provide opt-out measures as well as publishing clear privacy policies reflecting a commitment to anonymous cookies and abstaining from collecting data regarded as personally identifiable.

Summary

Assuming the privacy issue does not pose as an insurmountable obstacle, ad networks centered on retargeting could be the innovation that unlocks the next wave of efficiency in search engine marketing and growth in the display ad marketplace, as it helps marketers weave an even tighter feedback loop and build rapport with prospective customers by engaging them more frequently with personalized ads.

Jack Myers serves as an investor and/or advisory board member for several companies, including Criteo. Visit Jack Myers Portfolio Companiesfor a full list of portfolio companies.

You are receiving this e-mail as a corporate subscriber to Jack Myers Media Business Report. Re-distribution in any form, except among approved individuals within your company, is prohibited. As a subscriber you have full access to all archives and reports at www.jackmyers.com. If you require your ID and password, contact maryann@jackmyers.com