Search Summit Takeaways: Search Fragments, But It’s Still Good To Be King

Good industry conferences give the pulse from the practitioners’ perspective, along with the chance to pick up some scuttlebutt and contacts. On these counts, the recent Transformation of Search Summit 2018 (sponsored by ClickZ, Search Engine Watch and Catalyst) filled the bill. Top takeaways follow:

Between crypto’s futurism and capital markets’ current quarter-ism lie important trends affecting key industries at scale now. Tiptoe past the deflated blockchain bubble-heads. Elude the vexing vendors. Find experts trying to make the novel practical.

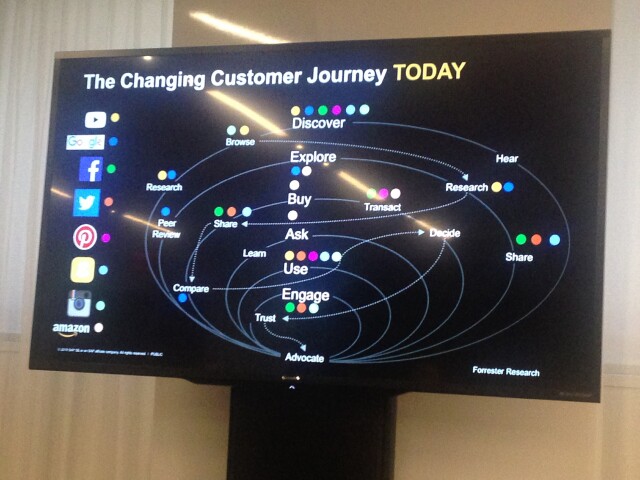

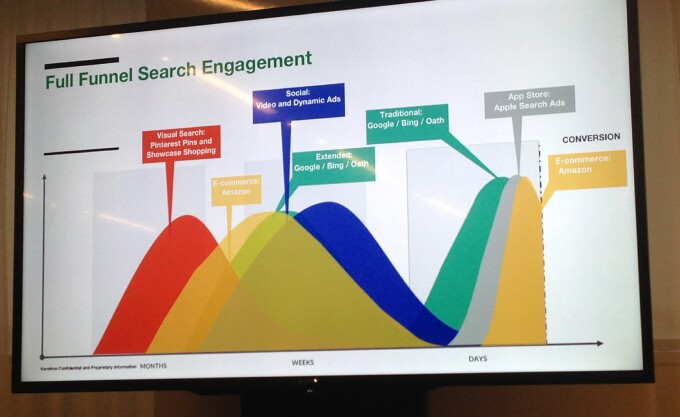

In the advertising market, digital is where it’s at, and search advertising remains the largest part of the digital ad market, roughly half. Search results remain the most broadly and clearly linked to the purchase path, however more winding that path is becoming.

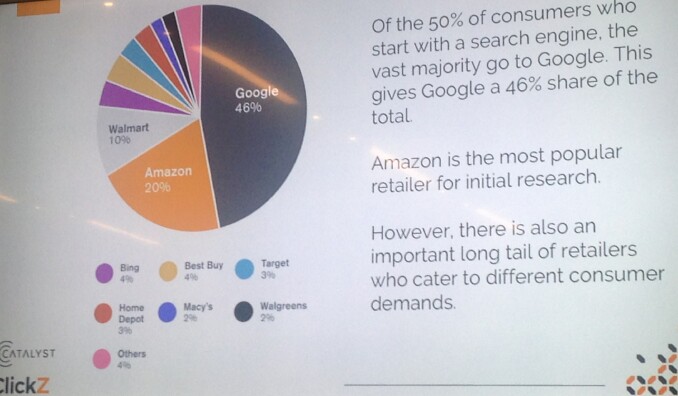

Despite consensus concern about the surging challenge from Amazon in search, the outlook there for Google could surprise positively, at least over the next year. A search exec from LEGO acknowledged onstage that Google’s budgets are “under pressure.” Nevertheless, a new ClickZ survey presented from the same stage showed that brands largely lack a strategy for using Amazon, and that the “tangible ROI” of spending linked to measurable results remains Google search’s bulwark. To wit, 63% of surveyed brands plan to increase spending on Google search, but only 26% on Amazon. Only 28% of brands have an Amazon ad strategy, up from 17% last year, but still low. The bottom line is that brand performance budget increases look set to go largely to organic and paid search on Google.

The ClickZ survey results also suggest that the threat from Amazon of displacing Google as the starting point in the consumer journey may be overstated. Per ClickZ, when consumers know what they are looking for, 50% start with a search engine and 50% start with an e-com retailer. This compares to publicized figures in the past couple years that the majority start with Amazon. Moreover, when consumers do not know what they are looking for (i.e., they only know the category to be searched) 62% start with a search engine.

A relative newbie as an advertising platform, Amazon has ad loads with room to grow, and they are doing so. One presenter endorsed the view that the recommendation engine was transforming from a democracy to an “advertocracy.” For example, 8% of product views now come from sponsored ads, up 2x in 6 months. More recently, Amazon has been adding ads at the bottom of the page.

Blockchain’s hype “valuation” remains high, as measured by the ratio of the size of promised market disruptions to actual usage. Jeremy Epstein of Never Stop Marketing gave his usual crypto stem-winder. Consider first just a sample of the media and marketing sectors which crypto projects are targeting for disruption: social networks (e.g., Steemit), YouTube (e.g., LBRY), search (e.g., Presearch), ratings and reviews (e.g., Chlu), product market places (e.g., OpenBazaar) and even data marketplaces (e.g., IOTA, Ocean Protocol). Then come back to earth with the stat that the top-five crypto decentralized apps in aggregate have just 10,000 daily active users. Steemit has paid $40m in incentives to users over the past two years, which is, charitably, better than nothing. The evangelist’s view is that scaling is the big challenge for crypto to overcome, leading to mass market adoption over the next five years, Epstein said. The realist’s view is that the self-imposed shackles of creaky infrastructure (e.g., do you need the blockchain to offer contributors a better cut of economics than YouTube does?) are in service of achieving insufficiently compelling consumer benefits.

Fragmentation in search behavior is opening the door wider to competition in niche use cases. People use different search engines for niche purposes. The number of different purposes is increasing, including image search and shopping by vertical. Challenger “search engines” better compete in these niche use cases. When users want to view imagery, they are as likely to use Pinterest as Google. When users are shopping for electronics, they are as likely to use Best Buy as Amazon.

Another fragmentation affecting the incumbents’ hold on search is by interface, in particular search by voice, although voice’s impact on the path to purchase may take longer to be heard than expected. When users search by voice -- the summit stat was that half of searches would be by voice by 2020 -- they are using Amazon's Alexa more than Google's Home. However, voice results do not lend themselves to ads. A Hertz exec suggested that voice does not lend itself to purchasing, at least not yet. Advertisers may hesitate to restrain their search ad budgets unless and until they see a negative impact of voice on the return from those ads.

The old saw that TV is best for building brands is out of key with recent counter-examples from the brand-centric FMCG verticals. The list of niche consumer brands built online, shunning TV in their early days, and then sold to large TV-dependent FMCG companies grows longer. It now includes Dollar Shave Club, Harry’s and Bai. The market impact of these insurgents can be material; for example, Gillette’s market share dropped to 50% from 75% from 2010–16.

Finally, data can come before distribution, as online brands open brick and mortar stores. Casper, Everlane and Warby Parker have opened physical retail outlets, leveraging online data that legacy brick and mortar retailers lack.

Click the social buttons above or below to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.