The Demise of Vice Media: Not the First or Last to Fail

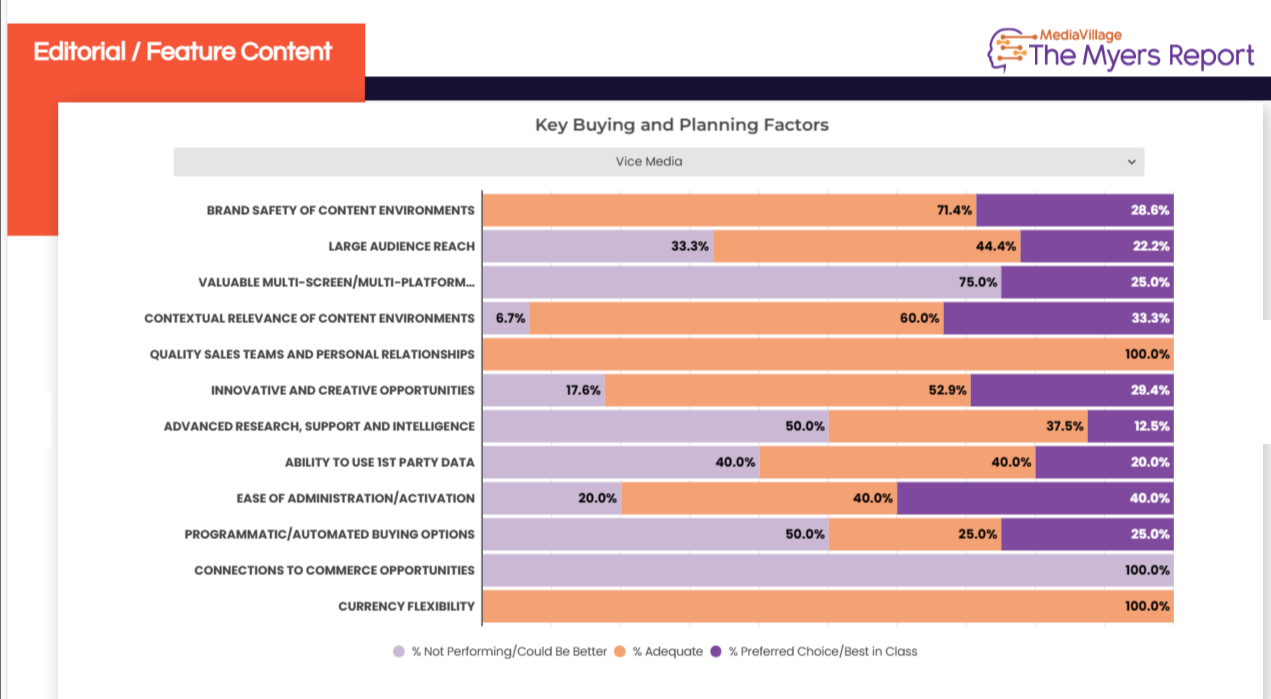

In a 2023 The Myers Report survey of 4,200 media agency and brand marketing professionals, Vice Media underperformed in its delivery on key factors that are fundamental for achieving ad sales success. Among survey respondents who self-identify as being in a business relationship with Vice, negative perceptions outweighed positives on a five-point scale for Vice's delivery of:

- Large Audience Reach (33% negative/22% positive);

- Multi-platform Opportunities (75% negative/25% positive);

- Research Support (50% negative/13% positive);

- Ability to Use 1st Party Data (40% negative/20% positive);

- Programmatic/Automated Buying Options (50% negative/25% positive);

- Connections to Commerce Opportunities (100% negative/0% positive).

Compounding the business challenges for the sales organization, 100% of respondents in a business relationship with Vice rated the quality of the sales team and personal relationships as "adequate" (3 on the 5-point scale). Even Vice's more positive qualities reflected a troubled business model. For Contextual Relevance of Content Environment seven percent of respondents rated Vice's performance as negative (bottom 2-box) but only one-third of its clients assigned a top 2-box rating. While Vice's competitors averaged 55% positive ratings for Brand Safety and 54% for Large Audience Reach, the two primary factors leading to brand consideration, Vice significantly underperformed with only 29% positive perceptions for Brand Safety and 22% for Large Audience Reach.

Among the fifteen "Editorial/Feature Content" publishers evaluated by The Myers Report, perceptions of Arena Media Group and Trusted Media Brands also underperform compared to their competitors but are challenged more by lack of awareness than negative perceptions. Trusted Media, for example, is a market leader for advanced research and first-party data opportunities but has not translated those assets into commerce opportunities.

Here are other highlights on the Editorial/Feature Content category from The Myers Report:

- DotdashMeredith is the overall category leader.

- Bustle Media Group is positively recognized for multi-platform opportunities and a quality sales team.

- 100% of The Atlantic's business partners at agencies and brands rate the organization's sales team positively but share concerns about their ease of administration and programmatic/automated options.

- The New York Times benefits from positive brand safety and a quality sales team but has failed to activate relevant programmatic and automated technologies.

- The Wall St. Journal outperforms the category for valuable multi-platform opportunities, large audience reach, brand safety, and quality sales team. Yet it ranks among the least positive for ease of administration and innovative opportunities.

- USA Today is among the category leaders for large audience reach, multi-platform opportunities, programmatic options, and advanced research support, but is challenged by the underperformance of its sales team.

- Vox Media had no meaningful positive attributes, some clear business concerns, and appears to be solidly positioned in the "adequate" category.

Vice Media recently announced plans to lay off several hundred employees and will no longer publish at Vice.com. Vice filed for bankruptcy last year and was sold for $350 million to a consortium led by the Fortress Investment Group, which is apparently looking to sell its Refinery 29 publishing business. The Messenger, BuzzFeed News and Jezebel have also shut down in the past year, and media outlets across the industry are slashing overhead through budget cuts and layoffs. Based on data collected by The Myers Report on more than 200 media sales organizations, the demise of additional content creation and distribution platforms appears inevitable.

The Myers Report offers a comprehensive solution for revenue optimization through proprietary market intelligence, targeted business connections, custom B2B marketing, streamlined operations, and organizational preparation. Proprietary market research and exclusive one-on-one access to decision-makers powers our Revenue Optimization Program. Custom programs deliver one-to-one targeted connections informed by custom intelligence, supported with targeted communications, enhanced through meeting preparation, advanced through engaged follow-up, measured based on R-o-I. Subscriptions to The Myers Report include earned and paid media activation at the MediaVillage Knowledge Exchange and MeetingPrep.ai, a non-profit community of advertising-supported media, agencies, industry suppliers, and thought leaders dedicated to fostering collective advocacy for growth through education and diversity.