There Is No "Planning as Usual" During a Pandemic

As I mentioned in my last post, it’s important to understand what happened last week to decide what to do next week. Now more than ever. While we are all suffering from some degree of “COVID fatigue,” COVID has created tumultuous marketing challenges that none of us have had to plan for before.

Massive disruption to our routines — namely a LOT more time spent at home — has changed what & how we watch, what & how we eat, what & how we buy. Wouldn’t it be great to have an up-to-date understanding of changing consumer behaviors at your fingertips? And even better, one that you can filter for the specific audiences that are important to you?

Since March 2020, YouGov has been doing just that — tracking consumer sentiment, media usage, eating patterns, shopping patterns, and more through a COVID lens. And unlike one-off studies about COVID’s impact, our questions are integrated into our continuous tracker for YouGov Profiles, which has over 450,000 profiling variables, allowing you to cut the data by till your heart’s content. As a planner — an obsession, I know.

Annual Planning Needs Fresher Data This Year

Many of you are finalizing your marketing budgets and plans for 2021, which is always a daunting task, even without a global pandemic. There is a lot of uncertainty about the coming year, and much of the data available to you is a rear view window into a year ago — not exactly representative of your consumer’s current reality.

I thought I’d use today’a article to share some recent stats from YouGov Profiles that I hope will help guide decisions about 2021 with more confidence. This info can help you recalibrate the channel mix coming out of your planning tools, which may be backed by stale data, and identify where to plan for flexibility as conditions continue to change. And if what I’ve shared isn’t enough — reach out — I’m happy to do a live example with you to investigate what’s most important to you.

More Time at Home = More Time with Media

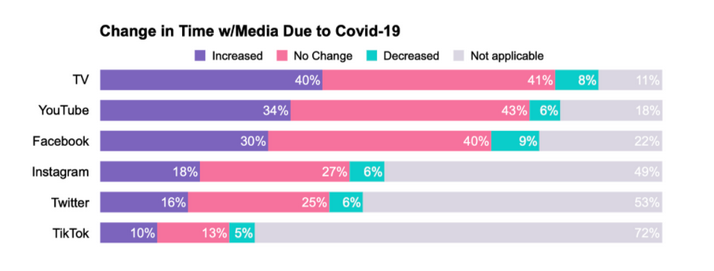

It is no surprise that working from home, remote/hybrid schooling, and reduced availability of out of home activities has led to more time with screens. We’re seeing increased time for all measured media platforms, with the biggest changes being increases in time spent with TV, YouTube and Facebook, with 30-40% of people saying they’ve increased their usage.

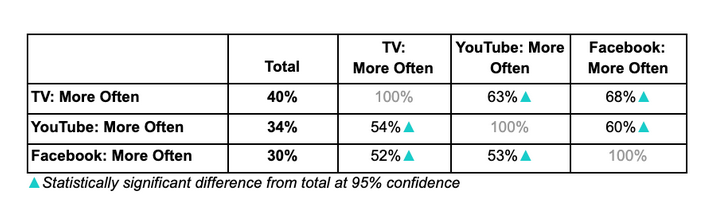

People who increased usage of one of the top media platforms are more likely to have also increased usage across platforms.

With these increases in time-spent on and across platforms, it will be important to be mindful of your campaign’s reach and frequency. I’d suggest this may be a good time to consider diversifying your mix, look to reach consumers in streaming media (video, audio) or high reach content platforms where consumers are spending more time reading / engaging.

Hungry for News & Escapism

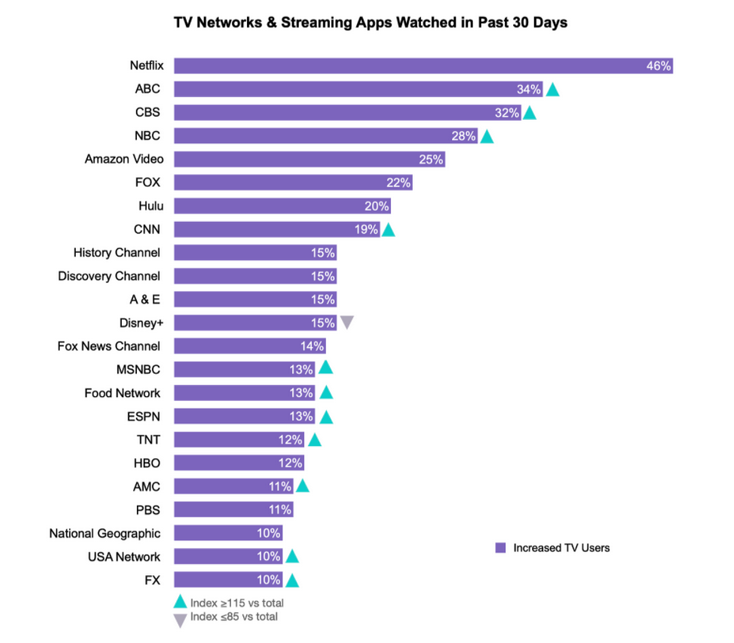

Increased TV users over index for watching all day parts and especially for weekday morning 7am-9am (index 134) and weekdays 9am-4pm (index 131). They watch network TV, news networks, cable mainstays and lifestyle channels. It will be interesting to see if networks aligned with News (i.e., ABC, CBS, NBC, CNN) see a decrease in the coming weeks post election. These consumers are neither more nor less likely to use the major streaming apps (i.e., Netflix, Amazon Prime, Hulu, Disney+), where they over-index is for live TV.

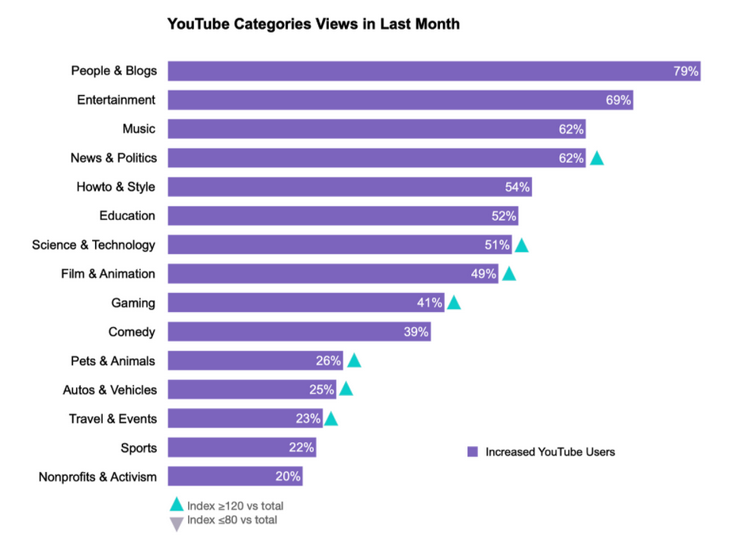

Increased YouTube users are 77% more likely to watch YouTube multiple times per day than general users. They’re spending their time on YouTube watching all kinds of content from News & Politics to Pets & Animals. Important to note, this data is for A18+ and does not include kids.

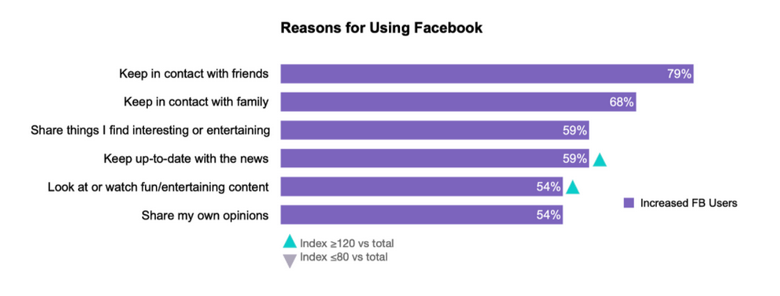

Increased Facebook users check Facebook multiple times every day (67% vs 49% among general users). In addition to staying connected with friends and family -- the top reason for everyone for using Facebook -- we see that Facebook is also a more important source of news and entertainment for them compared to general users.

The One Mindset That Makes The Difference

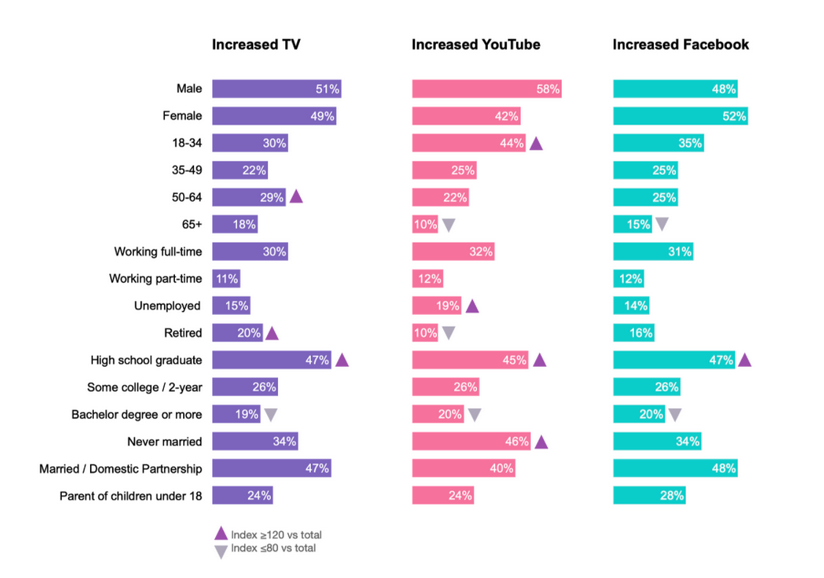

We see slight demographic differences in consumers who have increased usage of one platform vs another. People of all age groups have increased time with TV, but the increase is highest among 50-64 years of age. Increased time on Facebook is higher among people under 65, including the 18-34 year old who were “supposedly” leaving Facebook. The increase in time spent watching YouTube skews somewhat younger, male, and more likely to be unemployed. People with higher education are less likely to have changed their time spent with any of these media.

So what makes people who are spending more time with the media different? Largely, we only see slight differences in their interests, hobbies, values, the content they watch, the devices they use, how they shop...and all these things align with the differences expected based on their demographics.

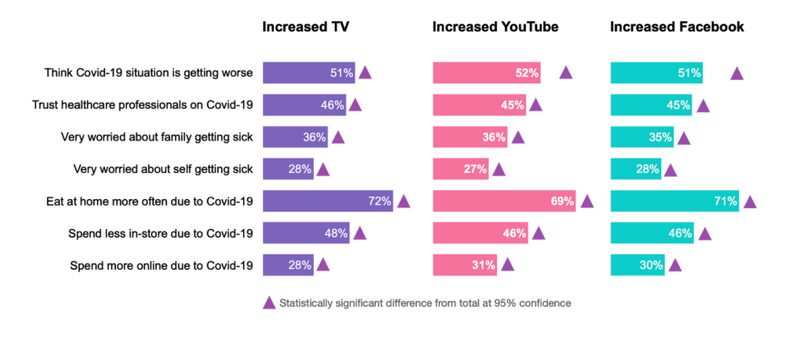

But their relationship with the virus is different — they’re more worried for their health and that of their family. As a result, they are eating at home more often and have made a bigger shift in their shopping from in-store to online.

They may be spending more time with media simply because they’re at home more, or it may be that their worry about the virus creates a greater need for escape/distraction…it’s probably a bit of both. These heavy media users are probably a part of your target audience. They’re an engaged audience for your content and a prime target for ecommerce.

As a marketer, if I was building new campaigns, I’d take these considerations into planning. Is there an opportunity to help consumers feel more at ease? Is there an opportunity to lean into family messaging? Is there an opportunity to inspire? Lots of questions to be asked and lots of opportunity to fine tune an approach to create stronger, longer lasting relationships between brands and consumers. In the end, context matters more than it ever has before.

It’s a challenging time to be a media planner, but up-to-date data is available to help. The right knowledge partner can help you go forth into the new year with confidence. Contact me if you’re interested in seeing this data, and more, broken out for your specific target audiences. I’m here to help. Send your request here.

Source for all data in this article: YouGov Profiles 10/18/2020

Photo courtesy of Tamara Alesi

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.com/MyersBizNet.