Unlucky 7: Modern Viewing of "Modern Family" - Jonathan Steuer-TiVo

Last month I critiqued Bill Carter's discussion of network ratings trickery in the New York Times and said that perhaps this is an opportunity for the TV industry to begin (FINALLY!) to focus on the shifts in viewing patterns brought about by new technologies.

Maybe Mr. Carter somehow missed my brilliant commentary (I'll forgive you just this once, Mr. Carter), because today's front-page-of-business-section follow up also fails to capture important aspects of modern TV viewing behavior. The focus of today's story is that delayed viewing (as measured by Nielsen's C3 metric) is pushing ABC's Modern Family ahead of Fox's perennial winner American Idolas the most-viewed show in America among adults 18-49. According to Nielsen, Modern Family shows a 44% increase in viewing from the Live to the Live + 7 day viewing window (10.2 million vs. 7.1 million) among this group. Carter reports that advertisers are happy to pay based on the C3 window, and that ascribe "some value" to the incremental viewing of advertisements in the days beyond C3. He quotes Magna's Tim Spengler, who believes that viewers are "more attentive" and "less distracted" when watching recorded programming (as compared to live). Carter goes on to quote Spengler: "We're finding that viewers are more attentive. They are less distracted. They have picked a time when they have the opportunity for more engagement than they would have if their kids were bugging them or they had three things to do at once."

More attentive? Mmm, perhaps. But there's one little detail that the Nielsen data miss: Viewers are allocating some of that additional attention to skip commercials. Pretty much all of them. Pretty much all the time.And unsurprisingly, Nielsen's not capturing that behavior. (Or, if Nielsen is capturing that behavior, they sure aren't telling.) In order to see the level of detail required to understand what viewers are really doing, you need accurate second-by-second data (which is a lot easier to collect when you designed the DVR in the first place!), drawn from a much larger sample than Nielsen uses (about 300,000 TiVo homes, in TiVo's case).

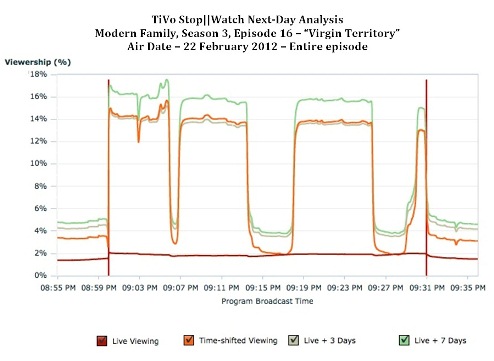

Specifically, take a look at the chart below:

Here's the good news: Based on TiVo data, there's about a 600% increase in viewing of Modern Family between Live and Live + 3 days, and almost a 700% increase if viewing is counted out to 7 days. This isn't surprising, given that Modern Family has consistently ranked among the most time-shifted shows since its debut.

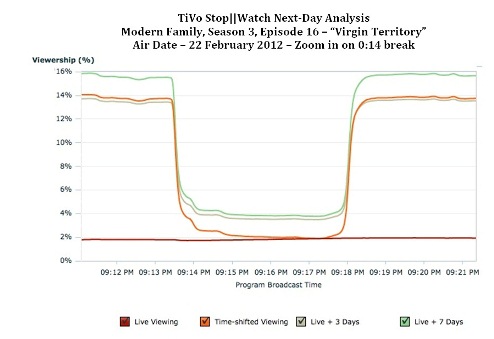

Now for the bad news: A closer look shows that while viewing of the program shows significant increases from Live out to Live + 7, the increase in viewing of the commercial pods is much much less:

Specifically, including the viewing of this commercial pod all the way out to Live + 7 days barely doubles the viewing of the commercials, compared to a 7x increase in the viewing of the program material.

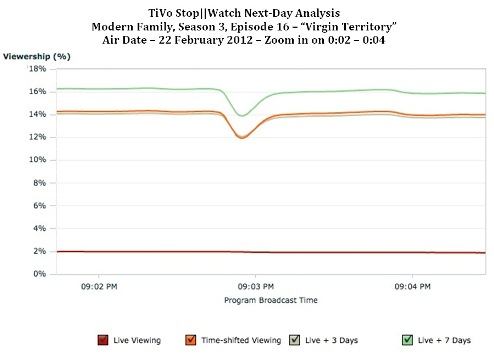

Lest you choose not to believe that attentive viewers have itchy skip fingers, here's a zoom in on the first couple of minutes of the program itself. The dip you see is 1 in 7 Modern Family DVR viewers skipping the VERY brief (13-second) opening credits:

Whether or not advertisers derive any benefit from ostensibly-more-attentive viewers seeing their commercials whizzing by at many-times-normal speed (that is, among those viewers who don't simply skip them outright), the reality is that, at least among DVR viewers, virtually nobody who is paying attention is watching ads at normal speed.

Yeah, I know. I've heard the objections before. "TiVo owners are special. They're atypical. Of course the people who went out of their way to buy a DVR on their own are different." Even if that's true, TiVo data have been remarkably stable in showing pretty much this same picture across a wide range of programs and commercials over the 8 or so years we've been looking.

This resolute focus on a single currency (i.e.C3) is costing a lot of folks good money. If I were an advertiser, I'd want to know the magnitude of the commercial avoidance issue so I could get on to the finer points:

· How are advertisements in the shows in which I place ads viewed, compared to those in other programs?

· What are the factors that make a spot more or less likely to be viewed or skipped?

· Is there anything I can do with my advertising creative to help maximize audience retention?

· Is there anything I can do to adjust my media buying habits to maximize the number of my commercials that actually reach their intended audience?

Then again, I've always been a "bad news first" kind of guy. I'd rather see the problem as soon as possible so I can do what I can to make things better. Sticking one's head in the sand makes useful data-gathering rather difficult.

But how to do it right? I'll get to that in a future installment. Stay tuned.

Jonathan Steuer recently joined TiVo as Vice President, Audience Research & Measurement, where he leads TiVo's efforts to develop innovative new media research products. Jonathan can be reached at jsteuer@tivo.com.

Read all Jonathan's MediaBizBloggers commentaries at InteracTiVoty.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates @MediaBizBlogger

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaBizBloggers.com management or associated bloggers. MediaBizBloggers is an open thought leadership platform and readers may share their comments and opinions in response to all commentaries.