Waiting for Advertising Economy to Rebound is Waiting for Godot

What's happening to the advertising economy? From 1963 to 2007, advertising investments in media grew from $13.1 billion to $244 billion and as we entered 2008 we appeared to be chugging along at a steady growth rate, albeit with some concerns. Digital media, many believed, would be the panacea to cure whatever might be ailing the media industry. All of a sudden, the proverbial shit hit the fan. Between 2007 and 2011, overall advertising will decline an astounding 25 percent from $244 billion to an estimated $185 billion (Myers estimates). Advertising is in a flight toward the bottom, and while some executives are in crisis mode, most continue to plod along as if the market will soon turn positive and normal growth will return. Many of these executives blame the general economy and some blame fragmentation and over-supply. Few, however, are awakening to the need –- no the absolute necessity – that they quickly reduce dependence on current business models and begin investing in where marketers' investments are heading rather than where they have been. This report outlines the economic challenges faced by advertising dependent companies beyond the current recession, and suggests the single greatest opportunity for sustained growth.

Corporate subscribers to Jack Myers Media Business Report can access the rest of this report below, including advertising and media spending forecasts for 2011, at JackMyersMediaSpendingForecast. (log-in required)

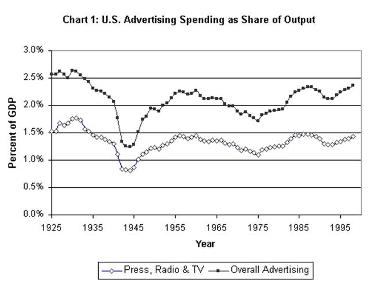

Advertising has traditionally expanded at the same rate as the gross domestic product, with about a six month lag as the economy entered and exited from recessionary periods. Dating as far back as 1952, advertising has consistently ranged from a high of 2.5% of GDP to a low of 1.7%.

The steady increase of media inventory supply creates a problem for the industry that is compounded by the current decline in demand precipitated by the economic downturn. Douglas A. Galbi, in a 2001 report (http://firstmonday.org/htbin/cgiwrap/bin/ojs/index.php/fm/article/view/870/779) explains "The long-term constancy of advertising spending relative to total output suggests that advertising revenue will not drive relative rapid growth in the digital economy. Radio and television, dramatically new media, did not affect the relative amount of revenue generated by advertising. Such evidence is good reason to think that in the future new media technology, such as broader bandwidth and more interactivity, will not affect revenue flow from media advertising. New media can attract advertising revenue from old media, but the historical evidence also suggests that aggregate changes in the composition of advertising spending are likely to be slow. Relatively rapid revenue growth in the digital economy will have to come from sources other than advertising spending."

These insights would lead to the logical - but wrong - conclusion that ad spending will accelerate as the economy normalizes and returns to a reasonable post-recession growth rate based on overall growth in the U.S. GDP. There are two primary reasons this won't occur. First, advertising is also based on an overall cost per thousand paid for consumer advertising impressions, which has also been steady over this same period of time at around $15. The expanding array of media choices, increased emphasis by media buying agencies on cost efficiencies, and improved technological solutions for media transactions are conspiring to lower the per-impression cost of advertising. Targeted cost per thousand impressions will decline steadily over the next several years, settling in at between $8.00 and $12.00.

Secondly, marketers have been progressively turning away from advertising as a primary communications strategy. While advertising investments grew from $13.1 billion in 1863 to $244 billion in 2007, at the same time total NON-ADVERTISING marketing investments grew from $5 billion to $521.8 billion, more than twice the annual growth. And while both advertising and non-advertising marketing dollars are declining in consecutive years for the first time since the depression, advertising investments are declining at twice the rate of non-advertising marketing investments. Non-advertising marketing expenditures include direct marketing, consumer and trade promotion (incentives, sweepstakes, coupons), merchandising and licensing, point-of-purchase, public relations, cause marketing, conversational marketing and other "below-the-line" expenditures. Typically, many of these budgets are controlled by corporate sales rather than marketing departments.

Galbi believed that "relatively rapid growth in the digital economy will have to come from sources other than advertising spending." But he misread the speed at which dollars would flow from newspapers, magazines and local TV into search and cheap display advertising. Both these online ad vehicles, which ultimately added more inventory to an already oversupplied marketplace, are now stabilizing and declining along with all media advertising-based investments. Galbi accurately read the long-term digital ad market. Not just digital, but all media will be increasingly dependent on sources other than advertising for their growth and vitality in future years. Advertising's share of GDP is declining and is unlikely to recover.

Jack Myersconsults with media, agencies and marketers on transformative business models and revenue growth strategies. He can be contacted at jm@jackmyers.com.