Wall St. Speaks Out on the CBS Upfront -- Anthony DiClemente

We attended the CBS 2015/16 Upfront Event at Carnegie Hall in New York.

CBS finished the season in a strong position -- 1st among adults aged 25-54, and 2nd place in the 18-49 demo, marginally behind NBC (which benefited from the Super Bowl). It therefore did not come as a big surprise to us that CBS renewed the vast majority of its 2014/15 lineup. With few spots to fill, the network is introducing just five new shows this fall, which all stand to benefit from the leverage of strong lead ins/outs. Our key takeaways from CBS's upfront presentation are 1) stability off of 2014/15 positions the schedule well, and the existing lineup is largely preserved; 2) the return of Thursday Night Football continues to present a viable promotional platform for new shows while limiting the number of reruns on CBS; and 3) Campaign Performance Audit (CPA) is CBS's results-measurement solution aimed at demonstrating effectiveness and ROI of ad campaigns on CBS's platforms.

As a reminder, CBS's entertainment segment is ~60% of the company's 2015E revenue and ~46% of 2015E operating income (with the broadcast network a smaller portion thereof). Please refer to our 04/21/2015 upfront preview; we estimate that CBS will grow dollar volume commitments nicely, this based on 3% CPM increases and a 78% sell-through rate.

Bringing back what works

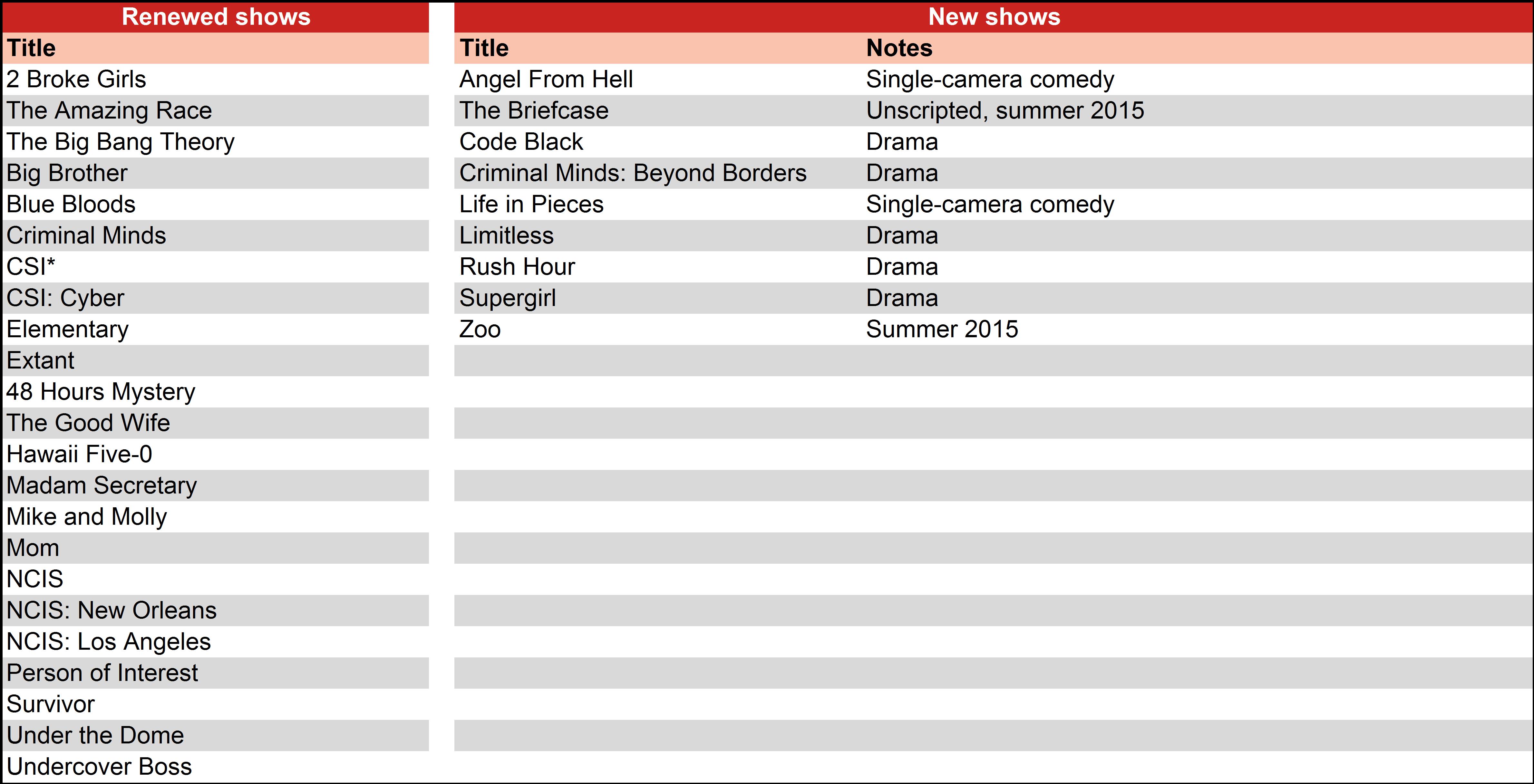

For the 12th time in 13 years, CBS will end the season as broadcast's most watched network. The 2015/16 lineup presented at today's upfront suggests the network will continue to build upon its momentum. The network added DC Comics adaptation Supergirl to its lineup as the lead-in to Scorpion; we note this is not a CBS-owned show. Other new shows Limitless (based on the 2011 film starring Bradley Cooper) and Code Black (a medical drama) will act as lead outs to NCIS: New Orleans and Criminal Minds, respectively. While Supergirl is a slight deviation from CBS's typical playbook, the success of recent superhero shows including The Flash on CW (of which CBS owns 50%) suggests this could be a worthy venture. Overall, our take is that the new schedule represents a good mix of reliable, often older-skewing procedurals, returning freshman series, and newer, differentiated shows that should preserve ratings momentum. Further, the conclusion of 15-year veteran show CSI is an event worthy of note. The addition of Stephen Colbert who will replace David Letterman on theLate Show should spearhead a late-night shift towards a younger target audience.

Thursday Night Footballfacilitates more original programming and provides a promotional platform for new shows

The return of Thursday Night Football enables CBS to schedule more original programming later in the year, limiting the number of reruns the network will air throughout the season. Repeats have largely underperformed, given stepped up industrywide competitiveness in the arena of original programming. Having the NFL on Thursday nights also creates a powerful promotional launch pad for the company's fall lineup. We therefore believe that CBS's chances of generating a hit show are greatly enhanced, creating additional advertising growth potential, leverage in retransmission consent fee negotiations, as well syndication opportunities down the line.

Campaign Performance Audit - CBS's answer to the big data game

CBS also highlighted its attribution analysis platform that aims to demonstrate TV's reach power and ROI to advertising clients. CPA incorporates several 3rd party data comprised of numbers from Nielsen units including Catalina Solutions, Buyer Insights, MotorStats, MRI Fusion, Brand Effects, and Cambridge Media Demand Landscape. These connect purchase data with television viewing data across a wide range of consumer categories. CBS will utilize this performance-based data to assist clients in achieving ideal reach, frequency, targeting and placement on CBS marketing campaigns. We believe these ad tech investments may offset some of the concerns advertisers typically had relating to the lack of precise targeting and a clearer ROI analysis within TV advertising.

Fig.1: Renewed and New CBS Shows

CBS's 2015/16 lineup

Source: The Hollywood Reporter, Nomura research *Renewed for a two-hour series finale on Sept. 27

This e-mail (including any attachments) is private and confidential, may contain proprietary or privileged information and is intended for the named recipient(s) only. Unintended recipients are strictly prohibited from taking action on the basis of information in this e-mail and must contact the sender immediately, delete this e-mail (and all attachments) and destroy any hard copies. Nomura will not accept responsibility or liability for the accuracy or completeness of, or the presence of any virus or disabling code in, this e-mail. If verification is sought please request a hard copy. Any reference to the terms of executed transactions should be treated as preliminary only and subject to formal written confirmation by Nomura. Nomura reserves the right to retain, monitor and intercept e-mail communications through its networks (subject to and in accordance with applicable laws). No confidentiality or privilege is waived or lost by Nomura by any mistransmission of this e-mail. Any reference to "Nomura" is a reference to any entity in the Nomura Holdings, Inc. group. Please read our Electronic Communications Legal Notice which forms part of this e-mail: http://www.Nomura.com/email_disclaimer.htm

CLICK BELOW TO ACCESS RESEARCH REPORT/PRESENTATION (including important disclosures):

U.S. Media - Quick Thoughts on the CBS Upfront

Prepared by Nomura Securities International, Inc. For complete details of the research together with the associated important disclosures, analyst certification, valuation methodology and discussion of risks, please see the full publication attached.

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaVillage.com management or associated bloggers.