Where Are All the Ad Budgets Going?

Where have all the ad budgets gone? Long time passing … Where have all the ad budgets gone? Long time ago … Where have all the ad budgets gone? Advertisers have shifted them everyone … When will they ever learn? ... When will they ever learn?

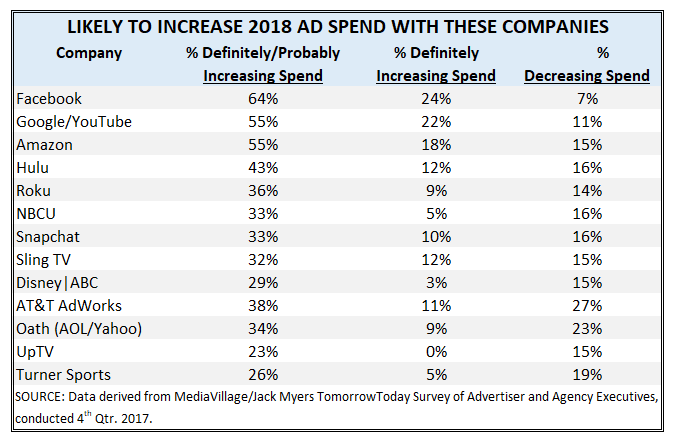

Paraphrasing the legendary Pete Seeger song that was a 1962 No. 1 hit by Peter, Paul and Mary, the only major media category poised for meaningful growth is the category known as GAF -- Google/Amazon/Facebook. According to the new JackMyers TomorrowToday economic data published exclusively by MediaVillage, overall ad spending will vary from 2% growth to 2% declines (excluding GAF, Olympics and mobile) into the foreseeable future, with only these three companies and a handful of others (see chart below) able to confidently forecast growth. TomorrowToday is forecasting low single-digit 2018 increases for network TV, heavily weighted to Olympics, World Cup and (to a lesser degree) political spending. With more marketer and agency media decision-makers anticipating budget declines than increases in their video ad budgets, which media sellers are best positioned to capture growth in a challenging 2018-2019 competitive environment? Scroll down for the answer.

Media executives can ask when marketers "will ever learn" that their growing dependence on three companies is misguided, but many marketers are learning -- and the more they learn the more they shift budgets away from traditional media options to mobile, commerce, cost-efficient and measurable performance-and-commerce-based content distributors. And the more they learn, the more dependence they place on machine intelligence to do the learning for them.

MediaVillage asked 750 advertiser and agency executives how likely they are to increase their 2018 ad spend with each of 55 media companies. Here are the companies (among the 55 evaluated) that appear to be best positioned to generate meaningfulrevenue growth in 2018. Our analysis is based on the percentage of respondents rating each company "5" (Definitely) and "4/5" (Definitely/Probable), and that do not have commensurate or greater percentages of respondents anticipating reductions in their investments with these companies.

The Jack Myers TomorrowToday Advertising, Shopper Marketing and Trade Communications Spending Data and Forecast 2000-2020 is available at no cost to MediaVillage members and to non-members for $4,950. Download/purchase the report here. The full MediaVillage Survey of Advertiser and Agency Executives is available exclusively to MediaVillage member company executives.