Why Broadcasters Are Seeking Direct Negotiations with Streaming Giants

As the media distribution landscape shifts toward OTT streaming, traditional linear stakeholders like MVPDs, broadcasters, and network affiliates are facing revenue shortfalls and searching for new ways to maximize revenue.

Recently, broadcasters have found themselves in a particularly tricky situation. They currently collect a significant portion of their revenue from MVPDs’ retransmission consent fees – which will decline as subscriber counts fall. Meanwhile, network affiliates are negotiating direct deals with streaming services to offer broadcasters’ local content, reducing broadcasters’ influence on the decision-making process.

That’s why a coalition of broadcasters is now pushing to negotiate directly with OTT streaming services, touting the unique value of their local programming and perspectives on TV markets across the country.

Broadcasters’ shifting perspectives on revenue equality

The business model for pay TV distribution has been stable for decades, but the emergence of OTT is disrupting the delicate balance that previously existed between MVPDs, broadcasters, and network affiliates.

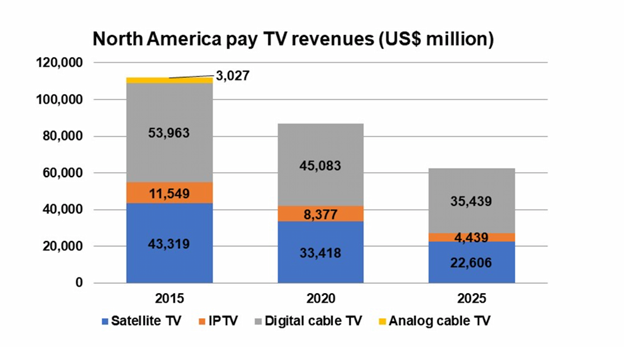

As OTT streaming continues to grow in popularity, MVPDs are seeing declines in viewership, subscriptions, and advertising revenue. The trend of declining MVPD subscribers means broadcasters earn less retransmission consent revenue for their content. This is obviously bad news for broadcasters that depend heavily on that revenue to meet their numbers.

Network affiliates, also feeling the downstream effects of declining pay TV revenue, are negotiating more competitively with broadcasters to keep the reverse compensation checks flowing. At the same time, some network affiliates are trying to plug the revenue gap by using what some commentators call the streaming loophole.

Under current FCC rules, MVPDs must negotiate carriage of local stations’ channels directly with broadcasters. However, vMVPDs (services like Hulu Live, YouTube TV, and others.) can negotiate streaming rights directly with network affiliates for those exact same channels -- without input from the broadcasters.

Once a deal is made between a network affiliate and a vMVPD, the network affiliate is in a position to dictate revenue-sharing agreement terms with broadcaster partners. One example, according to industry insiders, is that some network affiliates are offering broadcasters a share of streaming revenue in exchange for higher reverse compensation fees.

Not only are broadcasters prevented from negotiating terms under the current rule, but some network affiliates are leveraging special relationships with vMVPDs (e.g. those owned by the same company) to supply content at below-market rates. This practice can reduce the value of revenue-sharing arrangements between network affiliates and broadcasters.

Broadcasters push for direct negotiations with streaming services

Unhappy with prevailing financial arrangements and under pressure to increase revenue, some broadcasters are now advocating to close the streaming loophole. The goal: to negotiate directly with OTT streaming services for what they consider to be a more equitable share of streaming revenue, based on the value of the local content they provide.

In early 2023, the owners of 600+ television stations formed an organization, The Coalition for Local News, to call for regulatory changes that would establish broadcasters’ rights to negotiate streaming deals for their own content and, as stated in a press release, “protect local broadcast news.”

The Coalition for Local News is among the parties arguing that the streaming loophole puts broadcasters at an unfair advantage in a competitive media ecosystem that includes much larger production, distribution, and technology companies. For broadcasters to compete and thrive, they say, lawmakers must update FCC rules to ensure broadcasters get a seat at the negotiation table.

Shortly after FCC Chairwoman Jessica Rosenworcel proposed an investigation into the matter in July 2023, members of Congress challenged the FCC’s scope of legal authority. Cathy McMorris Rodgers (R-WA) and Bob Latta (R-Ohio) issued a letter of warning stating the view that it is “up to Congress to make updates, not the FCC.” Still, some senators are encouraging the proceeding to continue to make sure “our regulatory system….is not undermined by the explosion of new technologies that were not foreseen even a mere decade ago.”

A high-stakes regulatory battle

As traditional linear revenue declines, existing stakeholders are turning towards digital distribution. Experimenting with FAST/VOD platforms and adopting digital finance best practices can help fill the substantial revenue. However, the pace of change has left some parties feeling locked out of crucial revenue-sharing conversations.

Closing the streaming loophole from a regulatory standpoint would give U.S. broadcasters stronger rights to negotiate deals for their content and present new challenges to affiliates and vMVPDs. Regardless of how the rules evolve, stakeholders throughout the ecosystem will certainly continue to battle for their share of streaming revenue.

This article was written by Karin Bleiler, EVP & GM of Revenue Solutions, who oversees the Onboarding, Customer Success and Managed Services divisions at SymphonyAI Media, she brings over 15 years of experience in finance, accounting and licensing operations from numerous roles including her tenure at MPEG LA, LLC.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.org/MyersBizNet.