Zappos' Tony Hsieh and The Entrepreneurial Addiction - Steve Rosenbaum - MediaBizBloggers

Spending time with folks who build companies, there's one thing that's clear - they look at the world a little differently than most folks.

Last week I spent an hour with Tony Hsieh, the CEO of Zappos. And the conversation reminded me that folks like he and I probably have a screw loose, at least by conventional standards.

Tony was clear about one thing, failing doesn't count. He explained it this way: "I think entrepreneurs view the failures as getting one step closer to the success. As opposed to oh, like I'm a failure."

Tony's start-ups included a worm farm (FAIL), greeting cards (FAIL), button printing (WIN) and then a long line of college entrepreneurial endeavors that including buying pizza by the pie, and selling it by the slice, and crowd-sourcing and re-selling test-prep materials for class. Tony didn't count the failures, in fact from his point of view, there are no points off for failing.

Here's a bit of the conversation we had:

Steve Rosenbaum: So you realize of course, from an objective standpoint, that's kind of crazy because they could be one step closer to another failure with an endless number of... The idea that there's an inevitable success and you just have to keep working to get it is one of those kind of entrepreneurial broken brain things...

Tony Hsieh: I think it's true though. For any successful business there's at least one or two times in the company's history where you just got incredibly lucky. And so one way to look at it is oh, it's just luck. But another way of looking at it is, even if it's something that happens, even if it's that 1% luck factor that happens, if you just keep trying enough times, eventually it's gonna work out. Like you kind of create your own luck.

Steve Rosenbaum: And arguably Link Exchange, timing of it turned out to be just prescient...

Tony Hsieh: Or lucky.

Steve Rosenbaum: Yeah, okay, or lucky. But if you'd been two years later or two years earlier, not likely to have gotten that kind of valuation. You were exactly the right time. You built the right product. It took off like a...you know, the hockey stick that everybody wishes for.

Tony Hsieh: Yeah, and so I think if people look at that and go oh...that yes, if you look at that one company in a vacuum. But that was actually venture number you know, 20 in a string of things that didn't work out quite as well.

Steve Rosenbaum: So, in hindsight is there ever a moment when you say, "You know what? I wish I waited longer like we could have run that play another…"

Tony Hsieh: You're talking about Link Exchange?

Steve Rosenbaum: Yes…

Tony Hsieh: No, I actually think…the only thing that we actually debated about, 'cause we had actually an offer from Microsoft and one from Netscape at the time, and, I think if you actually looked at what happened to the stock price of Netscape, and then they got acquired by AOL, I think, and then, and so that would have actually turned out better financially, but for us, really the main motivation was, you know, the company * are head gone downhill 'cause we didn't know any better to pay attention to it. And, and so, really get, and I..I left Microsoft shortly thereafter and that what eventually led me to Zappos so, who know what would have happened if we had gone another route.

Of course, just because you've got the 'bug' and you believe, that doesn't mean your bankers are going to believe quite as deeply.

Steve Rosenbaum: I guess the thing I found surprising as I read it was so Sequoia says, okay, you haven't met enough milestones, we're not ready to be in for more money. In a sense what they said to you is you've got to bridge it.

Tony Hsieh: No, I don't think they viewed it that way. I think they just assumed the company would either go out of business or possibly get funding from someone else. But this was back in what 2002? So the dot com crash had just happened, Pets.com went out of business, and e-commerce in general was just...for internet companies in general, we're not looked favorably upon. And on top of that with any internet companies, e-commerce companies specifically were kind of the least desirable investment. So I don't think it was Sequoia. I think VCs in general at the time weren't making investments. And everyone was kind of scared. I mean actually one of the things that I didn't talk about in the book was there was actually a small -- I don't know if you'd call them a VC or not because they were a smaller dollar amount -- but another investment company that had loaned $250k as a convertible loan with the understanding it would convert automatically; and they actually asked for their loan back, which was very painful at the time.

Steve Rosenbaum: Much easier to talk about it because it has a good ending. But for a lot of entrepreneurs, you stare down the valley of death and then it goes all away.

Video: The Button Project: Better than Worms:

Now Zappos is on a roll - with 2010 sales year over year to Q1 of 2009, up almost 50%. And so Tony's thinking about where his Happiness formula is needed most:

"We talked about starting maybe a Zappos Airlines" says Tony Hsieh - grinning.

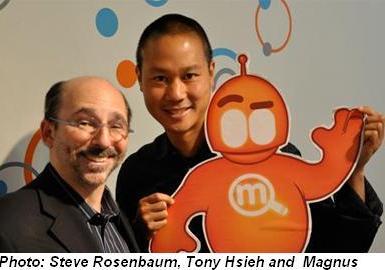

Steve Rosenbaum is founder and CEO of Magnify.net, a NYC-based platform for Realtime Video Discovery and Curation. He has been building and growing consumer-content businesses since 1992. He was the creator and Executive Producer of MTV UNfiltered, a series that was the first commercial application of user-generated video in commercial TV. Steve can be contacted at steve@magnify.net Follow Steve Rosenbaum on Twitter: www.twitter.com/magnify

Read all Steve's MediaBizBloggers commentaries at Steve Rosenbaum - MediaBizBloggers.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates @MediaBizBlogger