24/7 News Cycle and Digital Save the Day for the Ad Market in First Half

Thank the continuing chaos in Washington and the health of the digital market for a respectable 3% jump in the U.S. ad market for the just-finished first half of 2017. While National TV overall was flat, there were some stand-out performers, as well as some signs of concern. What is apparent, as we review SMI's data, is that there are some fascinating trends playing out. The long-term success of the market will be determined by how these develop over the remainder of the year.

The stand out performers of the first half of 2017 included:

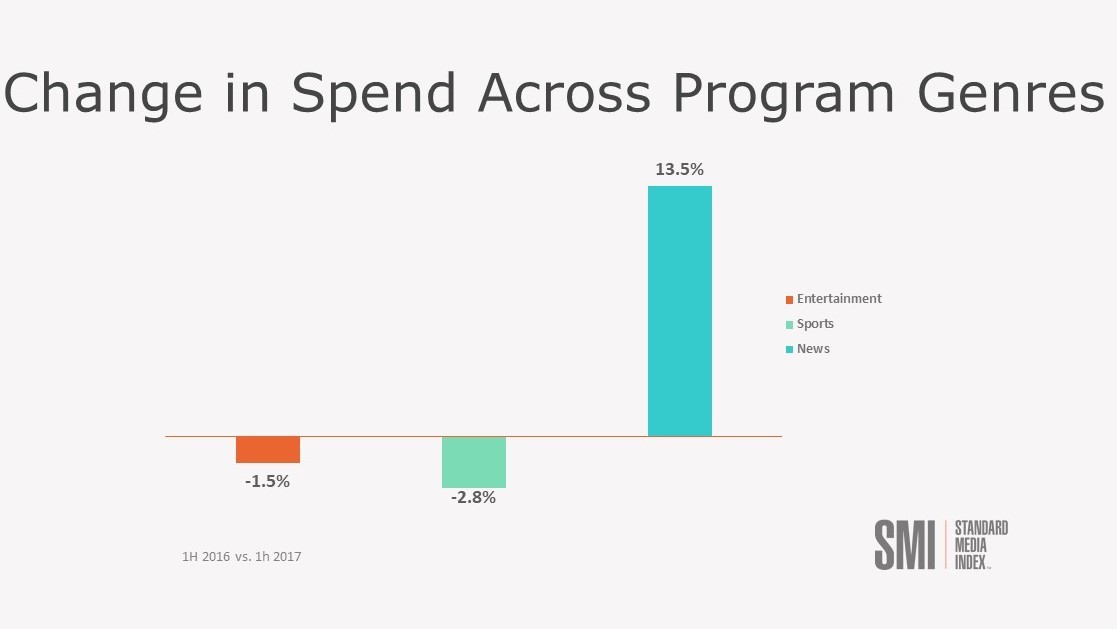

- News programming. Driven by the unprecedented news cycle coming out of D.C., ad spend around news jumped a whopping 13.5% across both cable and broadcast. CBS won big on the broadcast side with a 33% increase in news programming ad revenue. MSNBC was the clear winner on the cable front, with a "yuge" increase of 42% on its news programs compared to the same period in 2016. That being said, Fox News is still way out in front from a revenue perspective racking up two-and-a-half times more revenue than MSNBC.

- NBCU. Looking at the coveted broadcast entertainment primetime period NBCU was the clear winner, delivering a very healthy gain of 8% for the half. This Is Usmanaged to bring in $54 million in new revenue when you include both new episodes and repeats. Other programs that performed strongly included Shades of Blue, Chicago Fire and the long-running Law and Order: SVU.

- HGTV and Discovery Channel. The best performers of the non-news cable networks were HGTV coming in with a healthy 17% jump in revenue and Discovery Channel, up 10% -- setting up a powerhouse team with Discovery's just-announced acquisition of Scripps.

- Digital media (with a caveat). While digital media continues to be the best performing sector, growth has significantly slowed from the heady days of 2014 through 2016. Spend in digital still delivered a healthy 9% increase, but this is a far cry from the 30-40% growth we were seeing a couple of years ago. Safety and reliability issues have definitely crimped growth. P&G's recent announcement of slashing $100m in digital marketing spend, citing its lack of impact, may influence other brands and will make for some fascinating SMI releases in the coming months.

- Social and video. The stars of digital were social, which slammed on 55% growth for the half, with videobooking a very healthy 12% growth. Interestingly, the big winners in video were the premium content publishers over those in user-generated content.

- Pharma and QSR/CDR. They were the categories pumping the money fastest into the ad market in the first half. Pharma and QSR/CDR were up 13% and 8%, respectively. Allergan was a standout pharma advertiser on national TV, jumping 45% as they put muscle behind a few new products.

While there were high points in the first half of the year, we've also noticed a few worrisome trends:

- Primetime entertainment on broadcast continues to be weak. This important daypart fell 1.5% in the half. There is little doubt that cable news is bringing over audiences during primetime viewing. Fox, ABC and CBS were all off the pace with NBCU being the only network in the black for the half.

- Advertising in sports was down 3%. This was mainly off the back of softness at ESPN, which shed 6% for the half.

- TBS fell 27% in the half. This can be directly attributed to the NCAA Finals gamesmoving to CBS this year.

- The print industry continues to face major headwinds. The sector fell more than 16% in the first half of the year, as the industry struggles to successfully reinvent itself in the face of the digital onslaught.

- Worryingly for the large media groups, auto and entertainment categories fell 10% and 13% respectively in national TV. Combined, these two sectors reduced spend by more than $400m in the half. Ford was one of the few OEM's to increase spend, pumping an additional $38m into the TV market over the same period in 2016. Universal Studios spent $16m less on national TV in the first half as it moved heavily towards digital.

Additionally, with the conversation around commercial load growing, we looked at the trends across cable and broadcast. Interestingly, cable networks increased their ad load by 3.8% in the period but revenue fell by 3.5%, driven by lower ratings and the loss of the NCAA finals to broadcast. Broadcast networks, on the other hand, decreased their ad loads by 2.8% but saw a jump in revenue of 3.7%.

It was a fascinating first half with lots of moving pieces. We will be following the ongoing questions around digital's ability to demonstrate a clear ROI and whether the public will continue to be drawn to the cable news networks and the daily dramas that continue to be thrown up by our friends in Washington.

Click the social buttons above or below to share this story with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.