A Taxing Argument on Ad Deductions; Ad Tech's Best in No-Show - Brian Wieser-Pivotal

Trade associations related to the advertising industry have become vocal in recent weeks in response to Congressional proposals - from both the Democratic Senate Finance Committee Chair and the Republican Chair of the House Ways and Means Committee - that would alter rules surrounding the tax deductibility of advertising. Advertising is typically deducted during the period during which spending occurs, allowing for an immediate reduction in potential tax obligations. However, the proposals under consideration contemplate allowing immediate deductions for only half of conventional advertising in the year expenses are incurred with the remainder capitalized, amortized and deducted over five or ten year periods.

Trade association arguments suggesting tens of millions of jobs and trillions of dollars of economic activity are at risk struck us as hyperbole, not least as we do not consider that taxes have a noticeable impact on advertising budgets across the economy. Competitive intensity in a given category is more important, as we believe that most advertisers budget for advertising because doing so is better than the alternative of not doing so, especially in industries where advertising impacts category share changes. Nonetheless, we were curious to see what we might quantify as the real impact on the advertising economy.

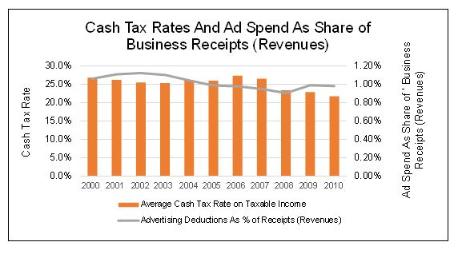

Using the most recent data from the IRS, we can see that the average cash tax rate on taxable income paid by US corporate taxpayers amounted to 21.7% of total revenue. This rate was well below levels observed during the prior decade, which were as high as 27.3% in 2006. At the same time, advertising deductions as a percentage of business receipts generally declined. So at least over the prior decade, it would seem that lower tax rates were actually met with lower ad spending levels. While we can point to years where taxes rose and spending intensity declined, we can also point to periods where cash tax rates rose, as was the case between 2005 and 2006, and ad spending was essentially flat as a percentage of receipts.

Source: Pivotal Research analysis of IRS data

As we suggest above, other factors related to the composition of companies in the economy probably has a bigger impact on driving advertising trends. Further, it is possible that direct response marketers who already capitalize their current period ad spending and amortize those expenses over time (per existing tax rules as we understand them) to match the creation of a provable customer associated with ad spending account for a growing share of the advertising economy as captured in the IRS' data sets.

So overall, it seems unlikely to us that changes to the tax code such as those which are contemplated will have a noticeable impact on media owners' ad revenues. But the tax bite will still hit, and it will likely be marketers who will pay (and thus we can imagine their interests in defeating any bill which might raise the taxes they pay). Further, the tax change would probably hit larger marketers disproportionately: approximately 2,200 companies account for almost 60% of total advertising deductions.

To illustrate the impact of the proposed tax changes, in 2010, the IRS estimated $202 billion in advertising deductions, and $1.021 trillion of income subject to income tax. If half of the $202 billion were to have been added back to taxable income and we used the 21.7% cash tax rate that was realized for the year, we would calculate $244bn in taxes collected rather than the $222bn that were actually collected. This amount would still have been far less than the taxes collected in 2005, 2006 and 2007, all of which were still pretty good years for advertising.

So while we do see an impact for marketers - in 2010 this would have amounted to approximately 0.1% of business receipts or 10% of actual ad spend for every marketer - it would seem unlikely to have any meaningful effect on the companies by itself. Still, there is probably good reason to focus Congress on the appropriateness of altering the tax treatment for the marketers who pay for advertising vs. the other sources of revenue they might pursue. Towards this end, perhaps the better strategy for might lie in focusing on broader tax reform across the entire tax code rather than simply fighting against this single initiative. After all, marketers are skilled at selling products to consumers; perhaps they could be equally good at selling ideas to Congress.

Brian Wieser is a Senior Analyst at Pivotal Research Group, where he covers securities which are impacted by the advertising economy, including Facebook, Google, Yahoo, Interpublic, Omnicom, WPP, Publicis, Nielsen, CBS, Viacom and Discovery Communications. Brian can be reached at brian@pvtl.com.

impacted by the advertising economy, including Facebook, Google, Yahoo, Interpublic, Omnicom, WPP, Publicis, Nielsen, CBS, Viacom and Discovery Communications. Brian can be reached at brian@pvtl.com.

Read all Brian's MediaBizBloggers commentaries at Brian Wieser's Pivotal Report.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates @MediaBizBlogger

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaBizBloggers.com management or associated bloggers. MediaBizBloggers is an open thought leadership platform and readers may share their comments and opinions in response to all commentaries.