Advertising Economy 2021: Recession or Depression?

In the earliest days of HIV/AIDS, before the public was responding to the growing plague, two of my closest business colleagues died. One was an incredibly talented chief creative officer of a major fashion chain and the other a network TV buyer at a large agency. It wasn't until friends began getting visibly sick and dying that the immensity of the human tragedy resonated for many. For those in the gay community, AIDS was a pandemic. For me, like too many others, reality dawned slowly.

Decades later, in an always-on news environment, the distance between comprehending the reality of COVID-19 and responding to its personal relevance is days versus years. Yet, I fear that far too many of us are failing to grasp the inevitable human, economic, and political consequences. The only way we can manage through this crisis will be to bind together as one community focused on economic realities and human needs. Sadly, media and advertising as an industry has been failing for decades on both counts. As a community, we are depressingly unprepared to respond effectively to the deep preexisting conditions that leave media and advertising vulnerable. While we criticize governmental and institutional lack of preparation and slow response, we need only look at our own community for similar and equally devastating realities.

As a student of the marketing and advertising economy for almost 50 years, I've consistently advocated for increased commitment to four pillars of growth: Knowledge, Wisdom, Community and Talent. As an industry, media under-invests by 200% to 600% versus global industry standards in each pillar.

As an outspoken advocate for media as the foundation of a democratic society and of advertising as an economic driver of growth, I've dedicated my career to developing, piloting, and implementing solutions for industry growth. I've actively worked with and for every media sector and sat on every side of the table. Across the media ecosystem, companies and industry sectors are dependent on gaining share of market at the expense of others, driving a wedge — distance — between competitors. Compared to almost every other industry, advertising and media invests the least in Collective Action to generate growth. While crises demand short-term focus and proactive response, it's equally essential to address the implications of long-term inattention to the basic tools for survival.

ENDING OUR ADDICTION TO SHARE-SHIFT AS A GROWTH STRATEGY

As we respond to looming economic and human realities, we must end our addiction to growth by share-shift and refocus investments on new revenue models. Redefining and communicating our marketing value and responding to brand marketers' behavioral shifts is a priority. While we self-quarantine and remain socially distanced, as a community it's imperative that we bind together. The need to redesign the failing advertising industry architecture is no less critical than responding to immediate and very real human needs.

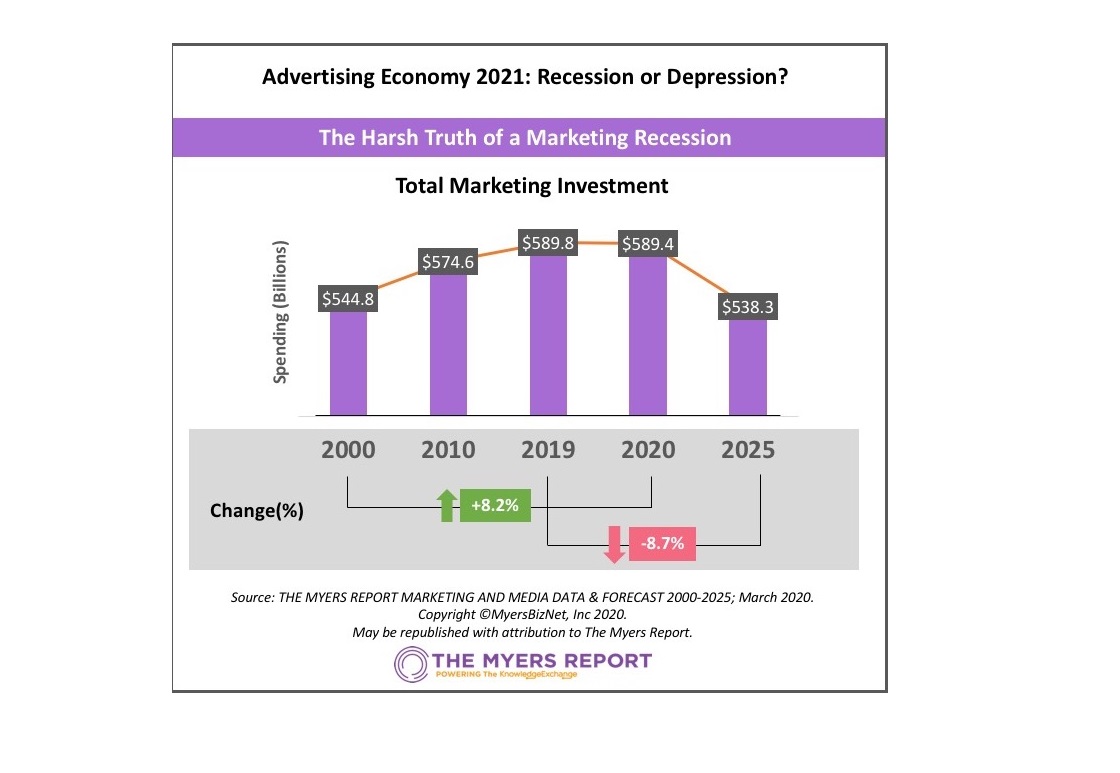

ADVERTISING 2021: RECESSION OR DEPRESSION?

By economic standards, marketing has been in a deep recession for more than two decades and is now bordering on a depression. Annual average growth of U.S. marketing spend since 2000 is only 0.5%, with 2020 investments of $590 billion — the equivalent of only $400 billion in 2000 pre-inflation dollars. Thanks to media cost-efficiencies, marketers are achieving their advertising and promotional goals while effectively reducing marketing budgets by one-third. Of course, we're concerned about our industry dropping into a recession. We've been in one for more than a decade. The question is whether we can avoid a 2021 depression.

HISTORICAL CONTEXT: SOBERING REALITIES FROM 9/11 AND 2010

COVID-19 is a global disaster with potentially catastrophic business impact, yet advertising professionals and pundits remind us that advertising during periodic downturns has been proven to work. That truth, still grounded in 20th-century data, has never actually translated into economic growth. Advertising is a historically lagging economic indicator — slow to enter recessions and even slower to rebound.

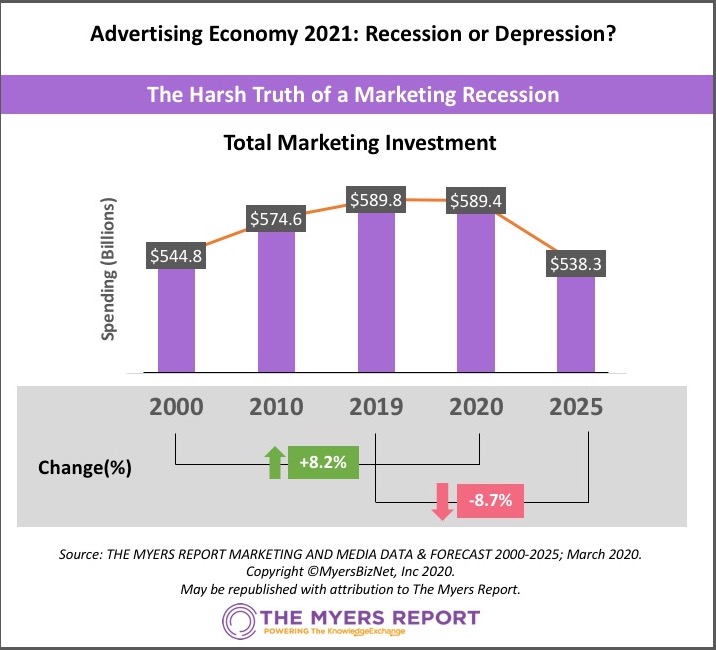

In both 2001/02 and 2010/11, marketers and agencies found more efficient options to achieve their objectives and never turned back, driving media advertising into a commodity marketplace from which it may never emerge. Cable network TV advertising, a more cost-efficient alternative to broadcast network TV, more than doubled between 2000 and 2010, increasing from 1.8% of total marketing communications to 3.6%. Broadcast network advertising grew only from 3.1% to 3.2% in the decade, and today captures a 3.5% share versus cable network TV's 4.6%.

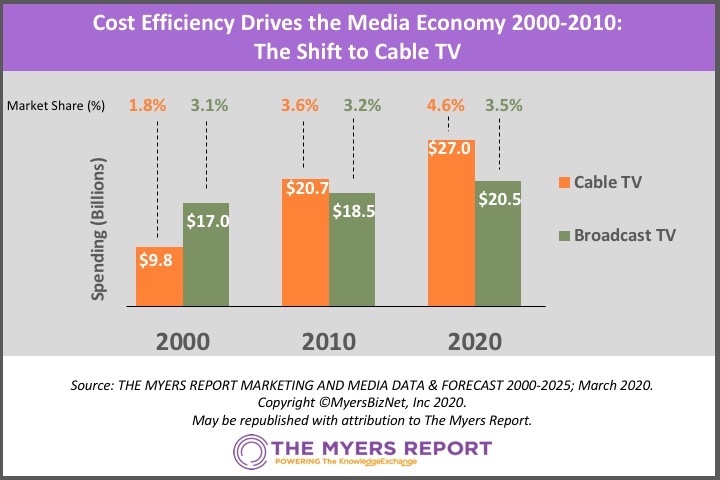

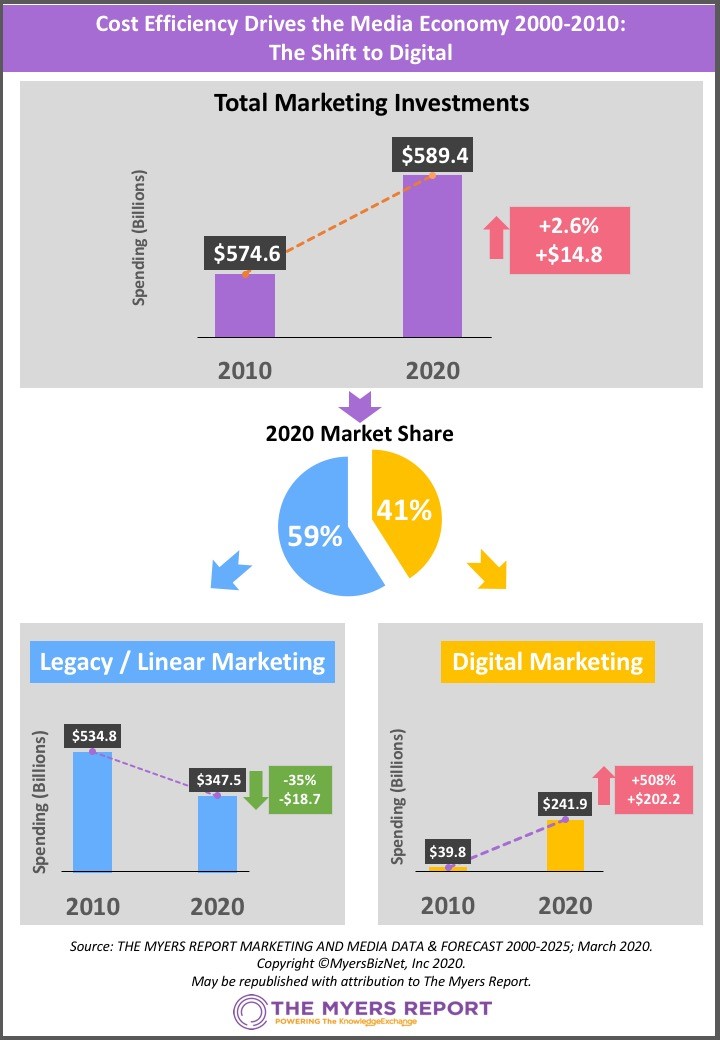

Between 2010 and 2020, digital investments increased from a 6.9% share of total marketing communications to 41%. The Myers Report estimates that it will surpass legacy/linear marketing investments in 2024 and will reach 55.2% share in 2025, driving 1.5% average annual declines in marketing budgets.

THE TALENT ECONOMY: MEDIA AND ADVERTISING ARE FAILING

In my 1983 book Adbashing: Surviving the Attacks on Advertising, I warned of the headwinds that continue to buffet the media and advertising world. In 1998's Reconnecting with Customers, I urged the industry to embrace new revenue models focused on brand connections and to avoid the threats of media fragmentation and commoditization. I warned that the media and advertising community was becoming disconnected from marketing decision-making and on a track toward radical technological disruption.

In my two books focused on the generation we now refer to as Gen Z, published in 2012 and 2016, I urged greater attention to diversity and inclusion to be competitive in attracting and retaining talent. As an industry, media and advertising lags most other corporate sectors in almost every standardized measure of diversity, equality, and inclusion. Veteran D&I leaders working in media and advertising are increasingly frustrated and disenfranchised by our community's failure to invest in future growth through cultural reinvention.

IT'S TIME TO INVEST IN SOLUTIONS

If corporate reinvention is overly aspirational, redesign and renovation are essential. However they define it, CEOs must redirect B2B investments and join to address the preexisting economic and talent deficits that COVID-19 is amplifying and exacerbating. If they fail to be proactive, companies that depend on advertising growth without a clear competitive and brand differentiator beyond cost efficiency will remain in a downward and accelerating spiral. Google, Facebook, Amazon, and a handful of others will further dominate a commoditized and automated ecosystem. We will watch sadly as one former media and advertising giant after another goes the way of legacy retailers who failed to compete with massive category-killing box stores.

The solutions are clear, built on a framework of:

- KNOWLEDGE

- WISDOM

- COMMUNITY

- TALENT

Next week, I'll share the economic and talent development models that can shift the advertising and media business from reverse into neutral, and for those willing to invest, into forward gear. Forward-thinking, focused on economics and talent, is our only path to avoid a 2021 advertising depression.