Business At The Speed Of Light - What is Millisecond Worth? - Tony Greenberg

The low-latency world of high-speed computing is turning financial markets, news providers, online media and many other businesses on their heads. Some players will lose, no matter how smart their systems and people. Can you catch up? Or should we slow them down?

Speed thrills, especially near the speed of light. For Wall Street traders, speed creates new fortunes on the world's fastest networks, for makers and users both.

fortunes on the world's fastest networks, for makers and users both.

But those technologies require lots of money and brainpower, creating questions about unfair advantages for privileged insiders with the fastest networks and best relationships, even as regulators ponder what to do.

Welcome to the future, where winners are determined by who arrives first with the most intelligence. Whether it's making a killing with a million-dollar trade, shipping the hottest financial news milliseconds faster than any competitor, buying prime slots for online video ads, or even snagging choice concert tickets or sniping an eBay auction, technology's next big leap is arriving in many corners of business. Low-latency networks will reshape most industries, even if those industries' networks need never approach the speed of light.

My first whiff of media and speed was while at Exodus being hired by MSNBC head of operations in 1997. It was their commitment to delivering Election 98 news faster than CNN, who was currently the leader. Back then measurement was a combination of Keynote Systems and an online research panel. 300 servers and thousands of hours later, we beat them hands down. And for a while, they retained the heavyweight title of "King of Speed". That meant oodles of dollars from advertisers.

Finding Alpha Between Each Tick of the Clock

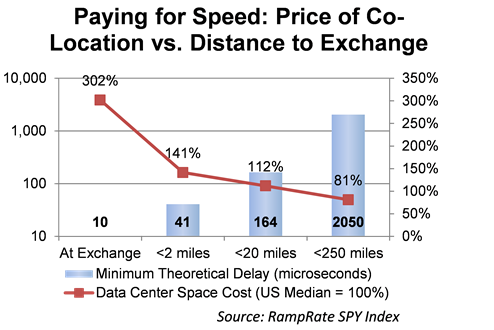

Through my firm RampRate, I have watched companies pay big money to get even a mile closer to the trading floor. Trading speeds have accelerated to millionths of a second, with nanosecond reactions coming. Sophisticated financial traders are zipping in and out of positions in less than a heartbeat, generating billions of dollars in arbitrage profits.

"The people who are upset with the leaders of the pack (for being) like genetically altered Olympic hopefuls hopped up on performance-enhancing drugs are people who want to be big players," says Chuck Ocheret, formerly head of Deutsche Bank's platform solutions. "But they don't have good alpha-generation principles, and aren't smart enough to achieve ultra-low latencies anyway."

But are the millions spent optimizing latency (some of which trickle down to my company, which advises companies on the right co-location centers and networks) truly creating market efficiency? Who really needs this speed?

How Low Is Low? Depends on Your Business

Low latency is heady stuff. But not all industries need to flirt with the speed of light t to create competitive opportunities now. What counts, as low latency in your industry will be a crucial differentiator in your success?

"Latency matters a lot and means different things, depending on where you are in the value chain," says former BBC and CBS digital chief Mark Kortekaas. "On the one extreme are the high-frequency traders where physical distance is crucial. On the other is the time it takes for an end user to see your service. Google has said even half-a-second delays to search results can significantly drop traffic."

So, speed is vital, but so is and end-users perception. Companies such as Gomez and Keynote prevent latency gaffes a user might notice that can affect brand image, customer satisfaction and employee productivity. Slow can be a blow, no matter the industry.

The most likely immediate low-latency candidates are industries with lots of bidding or trading and massive data analysis. Financial news outlets are obvious candidates, the velocity of information they transmit creating arbitrage potential for their wealthy clients. Companies such as Activ Financial not only get the news to traders faster, but interpret it too.

Auction sites are ripe for adjustment, as seen with eBay "sniping attacks." So too is the legalized gambling of the penny auction. Second place in a penny auction is worse than not playing, because you've spent money on all those penny bids, yet bought nothing.

Real-time bidding systems that optimize placement of online video ads can benefit too, nabbing prime placements while saving customers money in a data-driven, fast-growing business whose importance will only grow as more high-value video content makes its way to (legal) online outlets.

STATS LLC provides sports fans (bettors) rich, fast data on 234 sports, including pitch-by-pitch and play-by-play updates, using the same analytic concepts used in financial markets. Betfair.com, the UK gambling giant, uses high-frequency data to respond to news that causes rapid adjustments of prices and odds.

Who Profits? The Infrastructure Play

In my work, I've seen buyer approaches range from bashful to brazen. Some clients strongly prefer specific geographic and network topology locations that we know are extremely close to trading floors. Others say money is (almost) no object if it speeds their London-Singapore link by 10 milliseconds.

"It can be difficult to imagine how milliseconds or nanoseconds of latency make a significant difference," says Internet technologist and RampRate CTO Steve Hotz, "but from the viewpoint of a data transaction making the trip hundreds or thousands of times, that incremental advantage can add up."

To get an idea of the returns providers expect to see when they invest in speed, Hibernia Atlantic is building a $300 million trans-Atlantic cable to cut data transmission 6 milliseconds compared to arch-competitor Global Crossing. Spread Networks just linked Chicago to New Jersey with a high-speed connection. And if anyone figures out how to bore straight through the Earth, you can be sure they'll have customers.

Eyebrows are raised particularly when exchanges themselves sell low-latency links. Nasdaq's co-location business has been under regulatory scrutiny since 2009, and the NYSE is seeking special permission from the SEC to sell more co-lo.

Others can't help wondering if this game is rigged. Are some competitors being kept away from fast links? And do some others get a cross-connect a few feet shorter, and few slices of a second faster in even the best locations?

Many of these complaints are spurious, but can't be totally dismissed. Markets thrive on confidence and transparency, and when people suspect cheating, they stop playing.

The blame game is not reserved to unsuccessful players. Complaints erupted after 2010's "Flash Crash," when the Dow Jones Industrial Average plunged more than 600 points in 5 minutes, and then magically bounced back 20 minutes later.

High-frequency traders did have a role in the crash, but analysts have said they were not at fault, there or in similar events.

Some believe high frequency trading unfairly advantages a privileged few. Others complain that it disrupts conventional trading. And though it creates undeniable efficiencies, it also creates undeniable perceptions of impropriety, which may outweigh benefits.

What Now?

Despite calls for more regulation, these networks are moving forward, evolving quickly. Already, more than 60 percent of U.S. financial trading (and a third of European trading) filters through an HFT platform. With physical laws doing what man's laws cannot in limiting speeds, some believe current concerns will soon go away.

"Unless we change the laws of physics, the high-frequency/low-latency game has played out," writes Larry Tabb of the Tabb Group research firm. Tabb says we ask the wrong question in wondering whether high frequency trading is bad for the market. It's already been transformed, with more to come.

"We have seen a 2,000-fold drop in average core-trading latency in the last three years, and I think the move to measure trading latency in picoseconds is nearing," says Christian Sommer, Intel's director of capital markets.

It may be that the need for speed will simply hit a wall. Even measuring latency in picoseconds requires such sophisticated tools that it practically requires a CERN physicist. After all, a picosecond is to one second as one second is to 31,700 years.

"Light travels 30 centimeters in one nanosecond," says Neil McGovern, Sybase's senior director of strategy and financial services. "So if light can go only a few centimeters in a picosecond, how much faster are you going to get?"

In which case, markets will have to look elsewhere for competitive advantages, like being smarter. High frequency, low-latency architectures will just be tools for executing a strong alpha-seeking strategy.

"The truth is that if you really have the talent on board smart enough to achieve true ultra-low latency," says Ocheret, "then you are probably smart enough to make money without it."

As CEO of RampRate Sourcing Advisors and DeepStrat, Tony Greenberg has been an idea generator transforming perceptions and industries since he was 17. Under Greenberg's leadership for more than a decade, RampRate has radically changed how IT services are purchased, creating actionable, data-driven, sourcing information that has saved tens of millions of dollars and thousands of hours of headaches for major clients in entertainment, Internet services, finance, media and video games. DeepStrat, a spinoff from RampRate's strategic research arm, focuses on growth-advisory services for companies in the digital media value chain, particularly in mergers & acquisitions, ramp-ups and funding plans.

Read all Tony's MediaBizBloggers commentaries at Only Time Buys Trust.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates @MediaBizBlogger

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaBizBloggers.com management or associated bloggers. MediaBizBloggers is an open thought leadership platform and readers may share their comments and opinions in response to all commentaries.