Despite Some Headwinds, MAGNA is Still Predicting Strong 2022 Ad Revenue Growth

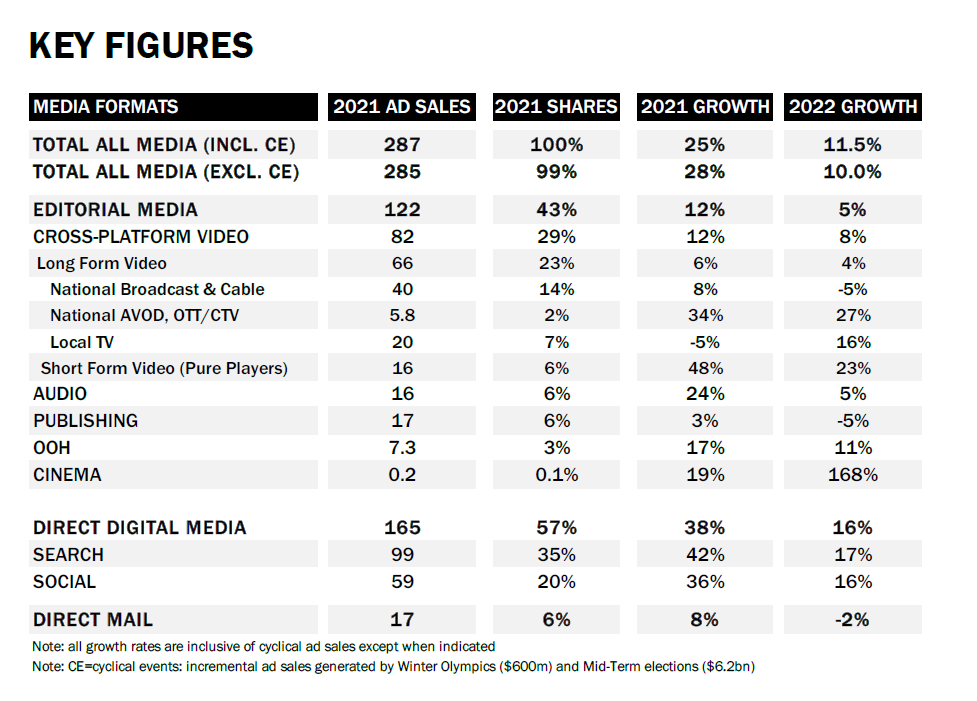

IPG Mediabrands' intelligence arm, MAGNA, is predicting an impressive 11.5% growth in ad spend versus 2021 with revenues surpassing the $300 billion milestone to an estimated $320 billion. With hyper-inflation, supply chain challenges and the Russian/Ukraine conflict weighing heavily on consumers' minds, the headwinds, however, are getting stronger.

Given those growing issues, the latest forecast from MAGNA does reflect a revision downwards of 1%. Yet, according to MAGNA's forecast, there is no reason, as of now, for real concern. Driven by midterm elections and continued recovery of certain sectors such as travel, live entertainment and the ongoing streaming wars, advertising spend looks to be solid with search (+17%), social (+16%), out of home (OOH) (+11%) and cross-platform video (+8%). And with a strong slate of blockbuster films and what seems to be audiences more than willing to return to theaters, cinema advertising is back, according to MAGNA, with a growth rate of 168%.

"Looking at marketing and advertising, the macro-economic headwind will be mitigated by the organic drivers (innovation, emerging verticals, ecommerce) and stronger-than-expected political fundraising," says Vincent Létang, Executive Vice President Global Market Intelligence at MAGNA and author of the report. He sees very strong spend in political, which will lead to at least $6 billion in incremental ad spend.

With the return to work in progress, OOH -- in particular, commuter media -- looks to be a prime beneficiary in 2022. MAGNA is predicting an 11% increase in revenue to $8.2 billion for OOH, with the transit segment significantly higher with a 29% increase.

Successful in-theater releases such as Spiderman: No Way Home, The Batmanand Lost City, along with a strong slate of upcoming films like Marvel's Dr. Strange and the Multiverse of Madness, Thor: Love & Thunder, Black Panther: Wakanda Forever and Avatar 2,are resurrecting cinema advertising as audiences appear to be looking at movie theaters as a welcome change of scenery from their home entertainment centers. In 2021 share of ad revenues for cinema advertising had baselined down to .1%. MAGNA's current projection is that in 2022 cinema advertising will resurrect back to a $450 million.

Not that consumers are abandoning their pandemic-formed in-home viewing habits. MAGNA's forecast for national advertising-based video on demand (AVOD), over-the-top and connected TV (OTT and CTV) revenue looks on track to grow by 27%, with local advertising set at 16%.

One large driver pushing against the economic headwinds is that 2022 is likely the most important midterm election in recent history. With the political polarization in the country and the House of Representatives currently a dead tie, both parties are pulling out the stops to ensure victory in November.

According to the Federal Election Committee, $5.7 billion had already been raised as of February, and MAGNA estimates that $6.2 billion will reach media owners through the entire cycle, representing a 41% increase vs. the 2018 midterm cycle. MAGNA is projecting that local TV and digital will be the big winners with a $4.2 billion and $1.5 billion spend, respectively. And Direct Mail is expected to receive $600 million from political spending.

There are three areas where MAGNA is expecting a slowdown in growth: short-form video (pure players, down from 48% growth in 2021 to 23% in 2022), search (from 42% in 2021 to 17% in 2022) and social (from 36% in 2021 to 16% in 2022). While still seeing double-digit growth, the growth of long-form OTT, maturation of search and recent challenges with social (in particular, new targeting restrictions tied to privacy from Apple and Google) are having an impact on marketer spending.

Otherwise, barring any new economic or geo-political surprises, it appears that 2022 will be a strong revenue year overall for the media business.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.com/MyersBizNet.