Don't Count Out the Holding Companies -- At Least Not Yet

The latest holding company news, gleefully reported in the trade press, shows a shortfall in WPP's first half 2017 growth rates, with forecasts of lower long-term growth in coming years. WPP's share price took a dive. Campaign U.S. headlined "Sorrell under pressure to streamline WPP as FMCG clients cut back on marketing." Panic! WPP is not the only holding company affected by advertiser spend cutbacks, but Sir Martin is highly visible, and he takes most of the industry flack. How concerned should investors be? Don't count out the holding companies yet. They have not played all the potential cards in their hands.

Holding companies have been visibly with us for the past 30 years, and during that time they have pursued Three Big Growth Strategies: 1) acquiring marketing communications and research companies; 2) setting and enforcing aggressive portfolio company budgets, requiring agency revenue and margin growth through business development, cost reductions and other efficiencies; and 3) selling "holding company relationships" to give clients a broad range of agency services across media disciplines -- required because their individual agencies did not integrate across disciplines. There are other holding company initiatives, of course, like providing back-office services for portfolio companies (travel, accounting, IT, etc.) but the Three Big Growth Strategies have dominated their activities.

Individual agencies have been highly affected by the budget setting and margin growth priorities. Indeed, over the past 30 years agencies have become veritable cost-reduction machines, and even though chronic cost reduction has had adverse effects on agency capabilities and relationships, it has remained Job No. 1 for agency CEOs and CFOs. "Making the holding company margin" has dominated executive thinking and action, and even though their client relationships were slowly deteriorating -- becoming shorter and more marginal over time -- and their client fees were being reduced, these factors did not alter in any way their focus on improving margins by lowering costs.

What agency CEOs did not react to, though, were the growing threats to their clients' brands, brought about by competition from e-commerce, the generational shift from Baby Boomers to Millennials, the growing strength of the trade's private label products, the proven ineffectiveness of the current mix of advertising/content and the increased difficulty their clients were having in generating improved shareholder value.

I'm not suggesting that agency CEOs were unaware of these problems or could not talk about them in intelligent and profound ways. What I'm suggesting is that their awareness of these client problems did not get translated into a call for action at their agencies. They did not say, "If we don't help our clients get their brands moving again, they'll cut their marketing spend and we'll be even more screwed than we are today."

Well, there you have it -- today's cuts in marketing spend are screwing everyone. Marketing cuts do not solve client brand growth problems or improve shareholder value in sustainable ways. The marketing cuts are reactionary and tactical, resulting from frustration -- a last resort. And everyone suffers.

The missed opportunity by agencies to help their clients maintain brand growth represents the holding company opportunity for the future.

Sir Martin does not need to merge any of his legacy agencies, as some observers have suggested. He should not restructure or simplify or redouble cost reduction efforts at his agencies -- they are already starved and feeble. Cost management should not be the holding company priority in the face of client spend cutbacks. Instead, holding companies should refocus their agencies so that they are committed to understanding and solving their clients' brand performance problems, giving their clients analyses, strength and conviction that marketing spend levels can be restored -- generating a positive ROI and making a hero out of their CMOs.

Holding companies need to see their portfolio companies as problem-solving companies with marketing implementation capabilities. That's a far cry from what they've become after 30 years of an intensive focus on cost performance. Today, agencies are mostly passive recipients of client-dictated fees and inflated (and partially unpaid) Scopes of Work. Agencies do not participate as equals in SOW planning to solve brand problems. They do not even document or measure uniformly the SOWs that they carry out, much less negotiate their fees based on the growing amount of work they carry out every year.

Imagine the growth potential for WPP and other holding companies if client brand problems could be solved and spend levels not only restored but increased.

Higher revenue and profit growth is possible, but the holding company business model -- and mission -- must change. That's the real challenge for Messrs. Sorrell, Wren, Roth and Sadoun. They are not passive victims of their unreliably-spending clients. In some ways, the holding company long-term focus on margin performance has brought them to this point.

Now is the time for new priorities, new operational skills, new commitments and new successes. All of these are much more difficult to achieve than bringing down costs.

The holding company CEOs should give their agencies new directions. Success will rekindle holding company growth. The game is not played out by the holding companies.

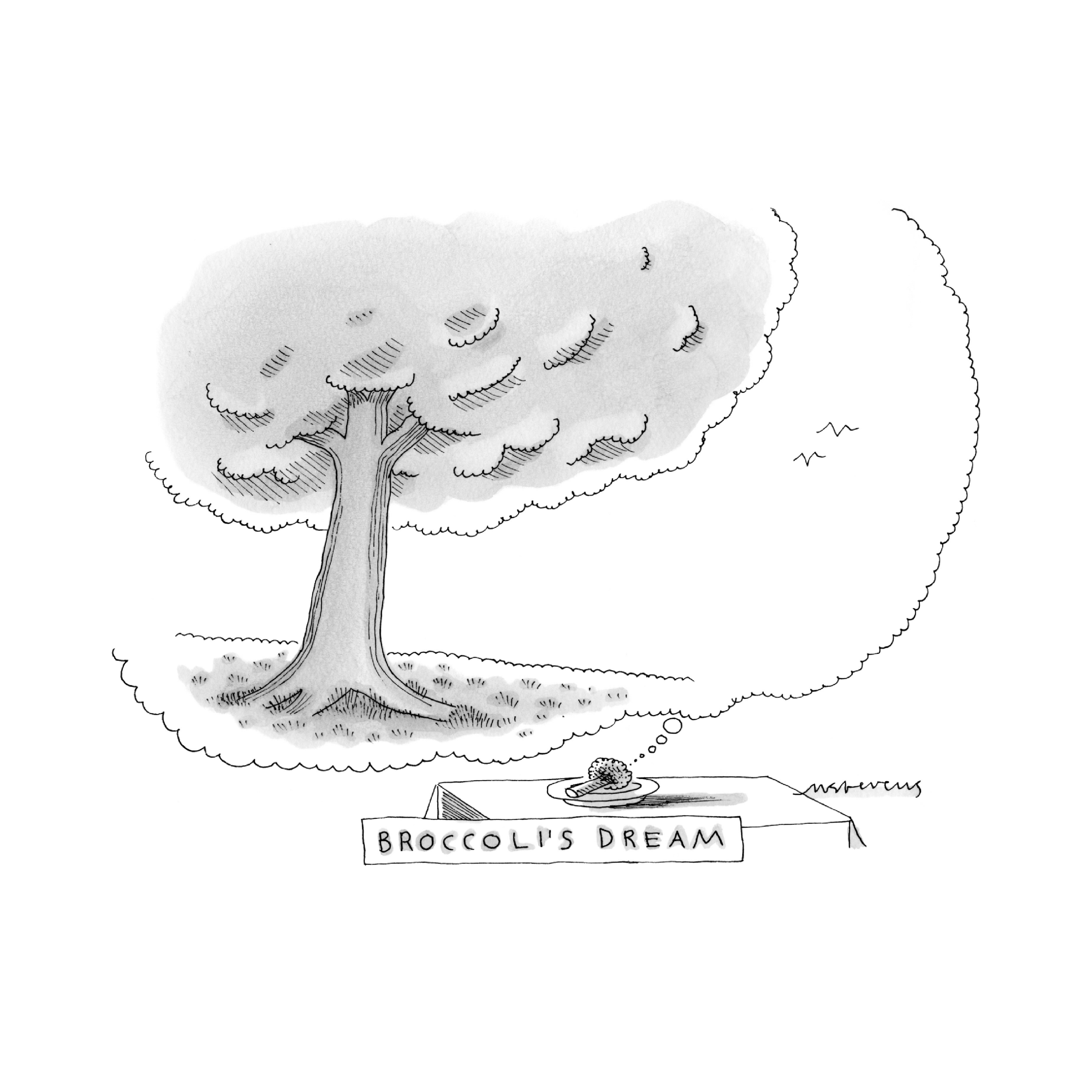

Cartoon credit: Mick Stevens, The New Yorker, The Cartoon Bank. With permission.

Click the social buttons above or below to share this story with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.