DRTV and DTC Marketplace Outlook

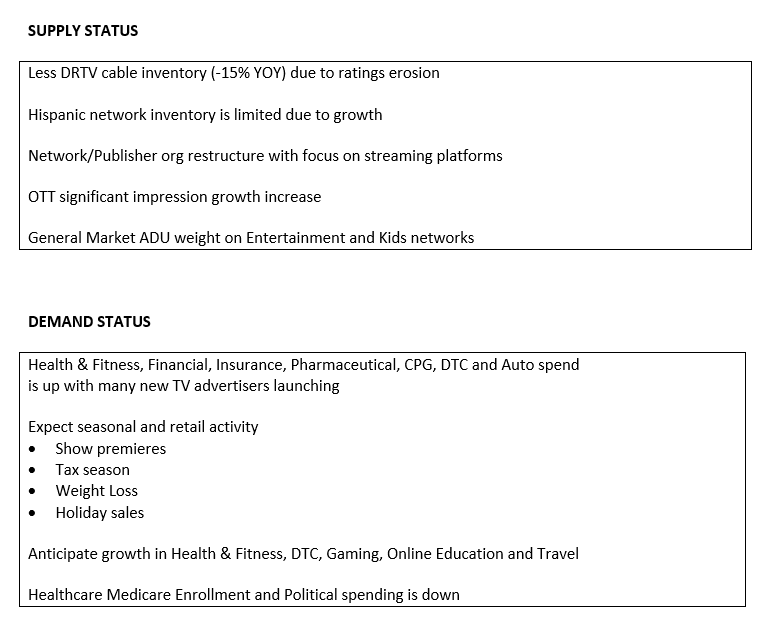

After canvassing the media sales community to get a sense of the marketplace, we find that the markets are taking an optimistic view of the economy, with the 1st Quarter Upfront allocations strong and limited options taken. Due to ratings erosion, coupled with greater adoption of subscription streaming services and other media during 2020, networks have been challenged to make-good on ad units that ran but under-delivered on the agreed-upon number of people.

These obligations or "liability" mean that networks are trying to settle their debts with advertisers using make-good ads or ADUs (Audience Deficiency Unit). In order to provide the inventory for the ADUs, it appears that several networks have (once again) shifted DRTV inventory to the general market by as much as +10% from 4th Quarter and +15%+ YOY. Suggesting a need to be more aggressive while limiting liability in the general market, networks are running ADUs early in 1st Quarter (Entertainment/Kids) or selling scatter without audience guarantees.

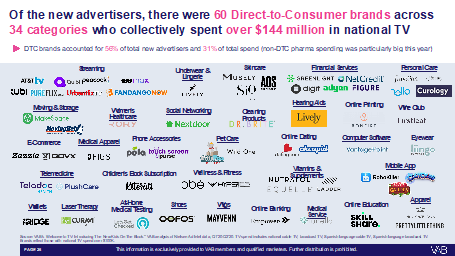

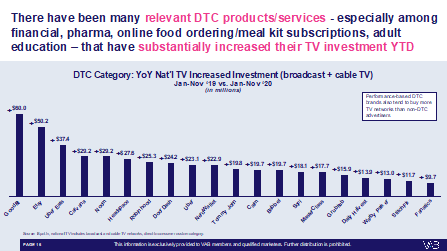

The DRTV market closed out 2020 by notching higher than average demand by new, emerging and mature brands. Direct-to-Consumer (DTC) brands have been super-active and are well-positioned for continued growth as the pandemic continues. The Video Advertising Bureau (VAB) reported 60 new DTC brand entrants in 2020. Many brands are launching their first TV campaigns earlier in their brand life stage and are seeing a strong impact to their digital performance as a result.

Remarkably, the unusual strength of DRTV activity from fourth quarter has held solid in Q1 2021 of every category with the expected exception of Healthcare Medicare Enrollment and Political.

In addition to DTC, the quick shift in consumer's purchasing behavior and media consumption led by the pandemic combined with advertisers' desire for agility and flexibility has led to a greater number of DR advertisers in the market. As an example, online used-car exchange, Carvana, is an advertiser with a greater need for flexibility and has apparently shifted all or most of their TV spend to DRTV. Several categories to watch include Gaming, Online Education, Travel and Health & Fitness.

It appears that many brands are incorporating DRTV into their media mix and DRTV is evolving from a linear efficiency tactic into a far more important channel for many brands.

First Quarter, with January in particular, is shaping up to be even busier than usual in the DR Marketplace. Several categories have increased spending including Health & Fitness, Finance/Insurance, CPG (household cleaning) and DTC. For CPG, Church & Dwight, RB (Reckitt Benckiser) and Telebrands have all increased spending in First Quarter 2021.

As streaming has had a significant effect on cable TV, media conglomerates are investing more on streaming content. Comcast, Disney, ViacomCBS and AT&T have all had reorgs with a focus on streaming. As the race continues for increased subscribers across platforms, OTT publishers (Pluto, Roku, Hulu, NBC, ABC) are reporting more inventory and increased demand.

News and Sports networks continue to be the drivers for Live -TV viewing and in-parallel to the general market. The Hispanic DRTV market has gotten tighter and tighter due to shift to general from DRTV and supply/demand issues.

There are quite a few unknowns for the coming months driven by the change in administration and how successful they will be in increasing distribution of the COVID-19 vaccine; in addition to their approach to improve the jobs market. GasBuddy is a mobile app that helps users find the lowest cost gasoline in their immediate vicinity. Patrick DeHaan, their head of petroleum analysis, recently was quoted as saying, "Gas prices have jumped to yet another multi-month high as crude oil price rise amidst perceived improvement in the COVID-19 pandemic, which continues to pump prices up as demand shows renewed signs of recovery."

While the pandemic is far from over, we expect categories like travel to begin a resurgence as they recognize that they need a long runway to convince travelers that it is safe to fly, stay at a hotel, for summer travel. This could serve to tighten the inventory in market in the months ahead.

We will continue you to keep you informed on marketplace conditions on a regular basis.

Direct to Consumer brands and direct response/performance media; whether traditional or digital media, have kept the advertising economic engine churning throughout the pandemic. In recognition of its growing importance, we have made an editorial decision to put a greater focus on the marketplace and the companies doing business in performance media and marketing.

We welcome Wendy Arnon, who ran Omnicom Media Group’s performance business unit for 13 years, to our team to cover the topic.

We have partnered with MediaVillage member, Quigley Simpson, to co-create a newsletter, TViews, that is meant to provide marketplace intelligence, best practice insight, and relevant news around the topic.

Please download the first TViews Newsletter below.

Click the social buttons to share this story with colleagues and friends.The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.com/MyersBizNet.