From Fragmented Screens to Unified Buys: Modern Solutions for Premium Video Advertising

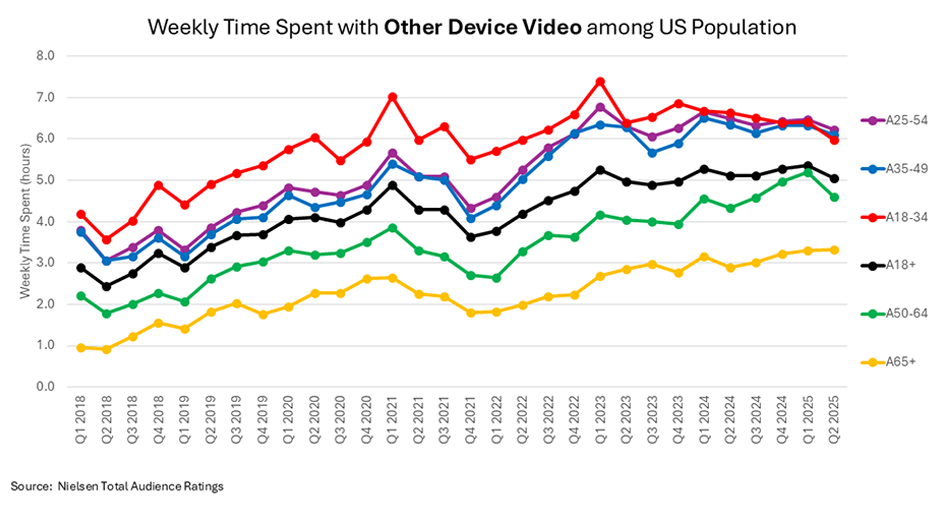

It’s no secret that the rapid growth of non-linear video viewing—first among 18-34-year-olds and now increasingly among older demographics—has led to a highly fragmented media landscape. Audiences are spending significant time watching video on smartphones, tablets, and computers, with younger adult groups stabilizing at around six hours per week and older groups catching up. [My consulting client, Nielsen, passively captures this non-TV set video viewing via meters and ad tags, making comparable-metric demo comparisons across screens possible.]

Although these newer platforms tend to be intentionally less commercialized, as viewing and inventory grows, the DAI (Digital Ad Insertion) commercial model has struggled to keep pace. Network-based streamers have received negative feedback for excessive repetition of commercials and gaps in ad delivery (“Zen Moments”) that frustrate viewers and diminish advertising effectiveness.

To effectively monetize non-linear viewing, the industry needs solutions that integrate audience measurement across all devices and platforms; unify inventory pools for seamless ad buying; enable programmatic and addressable ad buying to optimize frequency, relevance, and reach; and provide dashboards and tools modeled after digital platforms, making TV ad buying as easy and data-driven as buying on Facebook or Instagram.

One company leading the way is Tvbeat, which unifies all types of video into a single inventory pool for television programmers. Tvbeat’s platform, already deployed in the market, helps control the user experience across devices. While some publishers are developing their own solutions, Tvbeat stands out as a fully operational option.

Addressable commercials—introduced in the 1990s—are now a growing part of the mix, especially on non-TV devices. But for buyers to easily access this inventory, platforms like Tvbeat are essential.

Tvbeat and Spectrum are making it easier for digital programmatic buyers to purchase impactful, competitively priced linear TV placements in 30 million US households. Comcast’s Universal Ads is also simplifying TV ad buying with dashboards modeled after those of major digital platforms. They’re partnering with third-party sales measurement companies, using in-market matched geography experiments, and making these services easy to order programmatically—just like on big tech media platforms.

Together with my partners, we’ve developed the concept of UltiMedia, which uses Tvbeat and RMT AI technologies. UltiMedia is similar to Universal Ads but is inclusive of all types of television and open to all sell-side and buy-side players. It operates as a fair broker marketplace with minimal fees—a fraction of today’s DSP/SSP costs.

Legacy players won’t regain their audience share by sticking to old methods. The path forward includes:

- Smarter tune-in and subscriber acquisition marketing,

- Creative program development,

- And transforming television into a platform with all the ROI optimization benefits of Google and Meta, plus even more powerful advertising impressions.

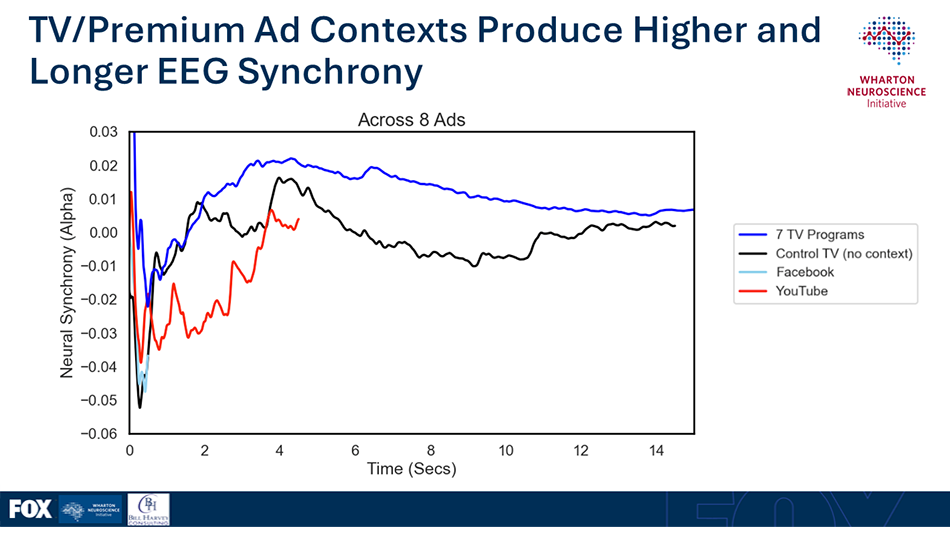

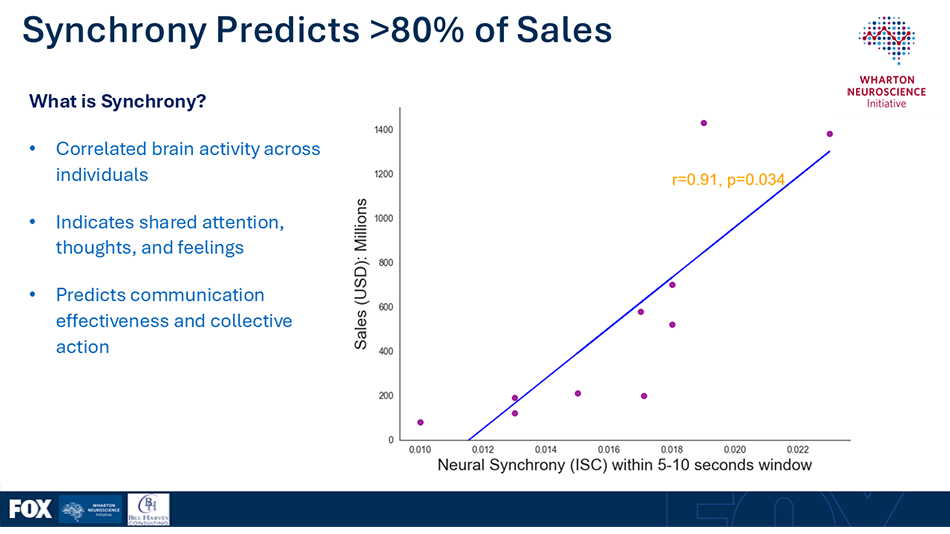

Television’s greater sales and branding power is well documented by hundreds of research studies, including findings from the Wharton Neuroscience Initiative.

Joe Willke of Nielsen IQ (now owned by GfK) has refined the BASES model for predicting new product sales. He recently found that awareness and trial levels for new brand launches are now half what they were when television was the primary medium. In today’s “digital-first” era, linear TV budgets have shrunk, while digital platforms receive billions for fleeting 1-2 second impressions. As a result, only 14% of top brands in CPG, Auto, and QSR are growing market share—down from 33% in 2014, before TV revenues declined.

Networks and advertisers who embrace unified, technology-driven solutions will be best positioned to reach audiences efficiently, maximize ROI, and reclaim lost market share. Adapting to these evolving viewing habits isn’t just important—it’s a strategic imperative.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.org/MyersBizNet.