Google: AT&T Returns to YouTube -- Pivotal Research

In this column we review issues brands consider when looking at YouTube against or as a complement to traditional TV. We retain our $1240 YE2018 price target and Buy recommendation on Alphabet Stock.

AT&T cut its spending on YouTube following increased awareness of brand safety issues in early 2017. With $6.3bn in pro forma spending during 2017 ($3.8bn on the AT&T side and $2.5bn on the Time Warner side) it was probably the largest advertiser not to return during 2018, but it is now doing so. As reported in the New York Times on Friday, AT&T "has raised the number of subscribers and the viewership that video makers must have in order to carry ads and is subjecting videos to more human and automated oversight."

We have observed that large brand advertisers returned in part because they believe YouTube has generally taken brand safety seriously and have taken steps to improve its capacity to identify and eliminate problematic content. Services such as Open Slate have also scaled and helped advertisers achieve their brand safety objectives on the platform. However, it also seems to us that brand safety is never going to be 100% solved, and marketers generally have to accept that if they choose not to buy manually curated content, they will be taking risks. Large advertisers with younger skewing audience targets are more likely to balance those risks in YouTube's favor because of the relative advantages it is perceived to offer relative to or as a complement to traditional TV.

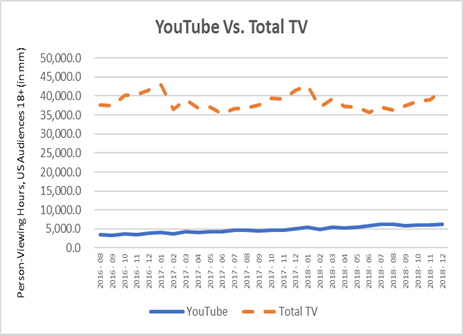

First, YouTube is massive and still rapidly growing. With U.S. audiences over the age of 18 increasing consumption by approximately +25% during December 2018 and +29% for all of 2018 over the prior year, YouTube now equates to 15% of total TV time. This is similar to the share of viewing the industry's largest player (NBCU) has. Of course, much (most?) of the content is nowhere close to the quality of professionally produced platforms, but YouTube's advantage for many advertisers lies in its age skew. During November 2018, traditional TV accounted for more than 2x YouTube's consumption volumes, but at YouTube, 45% of time spent among adults 18+ was accounted for by adults 18-34. Second, its reach is also comparable to national TV among 18-34s. While methodologies will differ between DCR and traditional TV measurement, DCR data for the calendar month of November indicates that out of approximately 76mm 18-34s in the US, YouTube reached 70mm 18-34s. By contrast, television (at a 1-minute minimum tune-in threshold) reached 67mm. Presumably the "brand safe" reach of YouTube would be significantly lower than traditional TV.

Importantly, not all advertisers actually buy TV with guarantees against 18-34s. Probably fewer than 10% of all national TV ad buys are made against this demographic target, equivalent to a few billion dollars annually in the U.S. However, for those advertisers who need younger skews, YouTube is helpful because it meaningfully adds to the available inventory an advertiser might consider buying. This likely helps reduce the cost per incremental point of audience reach an advertiser will realize if they know that the audience reached on YouTube includes some of the audiences not reached on TV. (Nielsen's Total Ad Ratings is a product that is intended to help advertisers assess unduplicated reach across platforms.)

While the aforementioned analysis does not cause us to assess Alphabet differently, at this time we are refining our model slightly, primarily updating it to correct inadvertently produced revenue estimates for 4Q18 and 4Q19. Thematically, we continue to expect solid top-line growth and ongoing margin erosion while the company continues to reinforce its dominant industry position. Our valuation on the company is unchanged at $1240 on a YE2019 basis and maintain our Buy recommendation.

Valuation. We value Alphabet on a DCF basis. Our valuation incorporates a long-term 5.5% growth rate, a short-term 8.5% discount rate and a 11.4% long-term discount rate.

Risks. Core risks for web publishers relate to: 1) high degree of rivalry in lieu of barriers preventing competition from emerging, 2) high and increasing capital needs to remain and 3) government regulations and consumer pushback related to data management and privacy.

Full Report Including Risks and Disclosures Can Be Found Here: GOOGL 1-22-19.pdf

Click the social buttons above or below to share this story with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.