How to Target the People Most Likely to Sales Respond

Now that addressable media include not only direct mail and telemarketing, but also digital and an ever-growing part of television, the age-old question demands to be answered: To whom should I be targeting? It's obvious that one should protect the current customer base. But that's a leaky bucket strategy. Byron Sharp and others hasten to point out that a brand must constantly bring in new customers. One way brands try to do this is by reaching current customers on the assumption that new customers will look exactly like the old ones. Another approach is to target category users, thereby reaching one's own brand users and also users of competing brands.

At TRA, I coined the term Heavy Swing Purchasers, meaning category heavies who buy your brand occasionally, as we observed this to be the most sales-responsive group for most mature CPG brands studied. However, I've always believed in principle that advertising ought to be directed to those people who are most likely to begin/increase their usage of your brand as a result of ad exposure -- where you can make the most difference. In CPG, this turned out to result in the selection of almost the same media vehicles as Heavy Swing Purchasers.

Being able to fine-tune targeting to this degree appears to be widely available today in digital. However, most advanced targets being sold and bought today in digital and in television are not based on direct match (deterministic) a la TRA, but on fusion (probabilistic). TRA compared direct match car ownership data with Zip code-level fusion car ownership data and found that only a handful of very expensive cars had a strong enough relationship with Zip+4 for the fusion to be more than random.

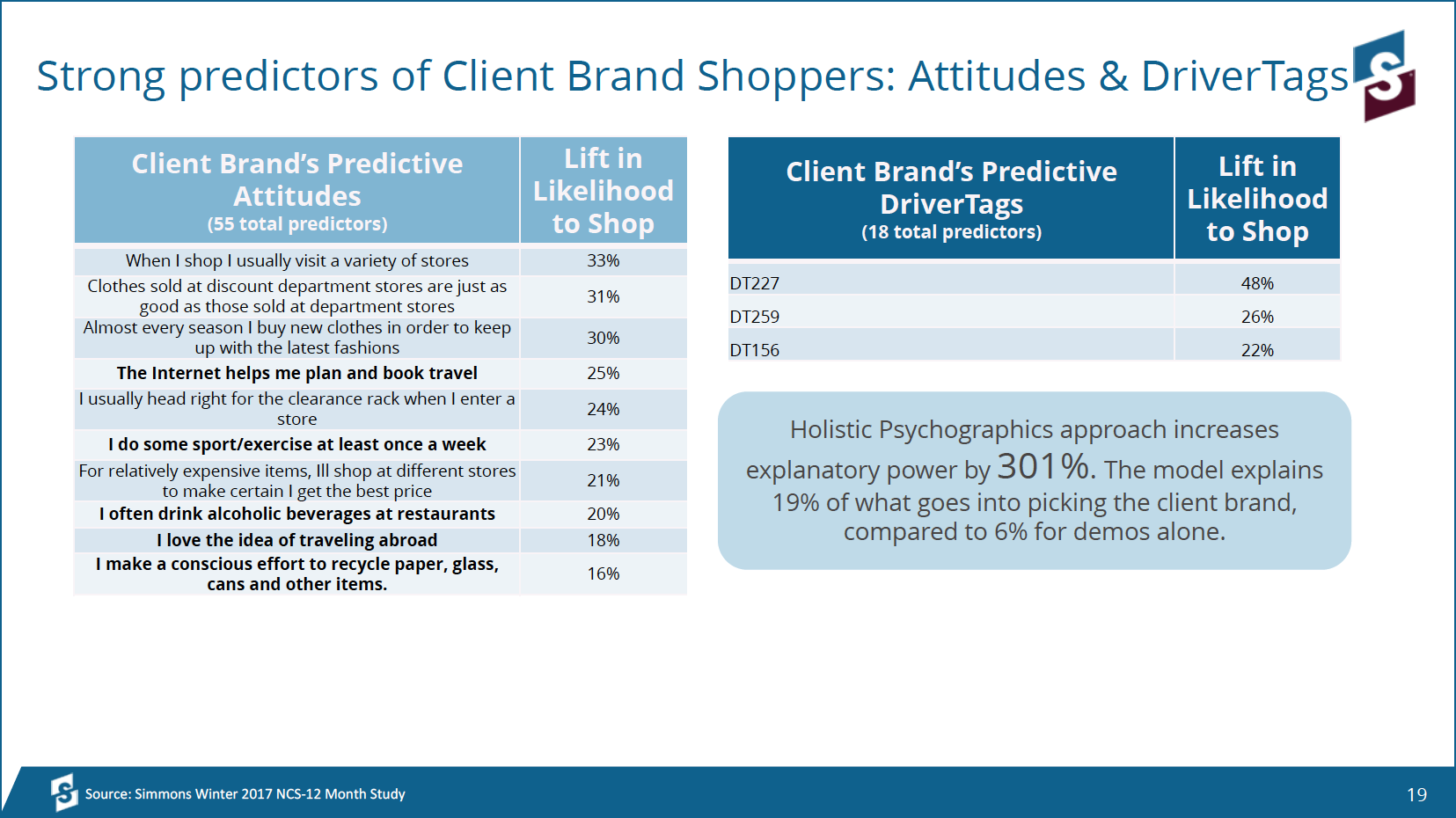

These fusions by demographics and geographics, according to results revealed by Simmons Research at the ARF Annual Conference, on average explain only 5% of the variance in predicting brand usage across thousands of brands (including media) in all verticals. More recently however, Simmons developed an innovative new approach -- called Predictive Consumer Insights -- in which they use psychographic statements and RMT DriverTagsTM to triple the predictive power to 15% on average.

It's not the demographics that cause the use of the specific brand -- the demographics are a blunt tool for predicting brand choice, when compared to characteristics that are more psychological in nature.

Predictive Consumer Insights also reveal what makes a brand special to its consumers, based on what motivations predict usage. This understanding looked at in a competitive context can be very clarifying to the process of developing new creative executions.

If you'd like to watch a replay of the Simmons webinar or download the slides, it is available by visiting here.

Because DriverTagsTM infer subconscious motivations from the full set of programs that people watch, they contribute in much the same way as self-reported psychographics to increase predictivity across brands and, as expected, are especially predictive of viewership for specific TV shows. The addition of Simmons psychographics and DriverTagsTM has more than three times the predictive power of demographics alone when predicting viewers of specific TV programs. Simmons working with Experian has already made programmatic digital activations available for the whole population using psychographically grounded fusion techniques like these.

As exciting as these new developments are for planning advertising strategies and executions, target selection, and offline media selection, there's still a problem for digital targeting activation: Psychographics are not available on a census basis by household or individual and so cannot be used as fusion hooks for identifying which cookies/device IDs etc. are the target and which are not. So, are we left with the same old demographics and geographics as the only fusion hooks for digital targeting?

That's where the MVPDs -- cable satellite and telcoTV operators -- and manufacturers of Smart TVs have a leg up. Those parties and any others that collect big data on the TV show viewing of specific households/people can convert TV show viewing into DriverTagsTM -- and by that means they can have DriverTagsTM as additional psychographic fusion hooks. Demographics, geographics plus DriverTagsTM nearly triple the predictivity for the average brand over demos/geos alone.

What this suggests is that the MVPDs and others with program viewing big data can sell digital advertising directed at their customers with three-times the targeting efficiency as anyone else including Google and Facebook. That should provide KPI and ROI lifts of such magnitude as to make MVPDs the leaders in digital advertising. This disruptive angle so far appears to not have dawned on anybody with the possible exceptions of AT&T and Verizon who are continuing to acquire access to more homes with TV program viewing data.

Click the social buttons above or below to share this story with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.