Is the Juice Worth the Squeeze?

Pre pandemic, I met with the Atlanta agency of an automotive client. They spend tons on sports sponsorships, including local auto exclusives. I asked why this dominated the budget and heard what I hear so often: block competition, prestige connotation, dealer/client pressure, tickets. But one exec, in a fabulous drawl, hit the nail on the head: "I'll go to bat on this if you show me the juice ain't worth the squeeze!"

Marquee properties are a measurement dream:

- Mass impressions in a precise time/place = ideal framework.

- Usually fresh, quality creative

- Measurable "halo effects" promoting the sponsorship in owned and social channels

- Higher than average reach/engagement - less vulnerable to external variables.

A/B testing, pre-post or "intent design" can work. Intent design captures intent to view, then splits intenders into actual viewers/nonviewers to track results. Life happens: With big events you can find respondents whose intended viewing just didn't occur.

There is juice in marquee properties … just not enough.

Modern measurement can quantify context value: relevance, involvement and perceived quality enhance brand perception metrics. For businesses where perception drives sales, that lift has full funnel impact.

Having measured dozens of initiatives across verticals (fashion, beverage, retail, finance, B2B) and properties (Super Bowl, award shows, sports, specials) I've seen big wins. But most do not drive positive ROI, even with long-tail advanced measurement.

Lift is usually less than the enormous premium paid for these high-demand properties. Pricing for prestige properties has been driven by market forces and "media myths" that don't match results.

Surprising big successes:

- A B2B technology brand sponsored an awards show, delivering leads and sales with a positive ROI over the six months following the event. While I worried about the narrow target, the high revenue per customer more than compensated.

- Though paused for reinvention, in its heyday the Victoria's Secret Fashion Show was known for its "insane" cost. Former CEO Sharen Turney told Forbes in 2015 that the show "pays for itself five times over" and that is 100% true. I oversaw the meticulous measurement designed by Rex Briggs and Marketing Evolution that captured the show's bottom-line impact.

Surprising unsuccessful initiatives:

- I've marketed beverages (beer, soda, sports drinks) for much of my career. And the "beer and sports" drumbeat is as loud as decades ago. Category competitiveness helps support sports pricing so high that consumers would have to bathe in Corona or Pepsi daily to break even. Other category data (auto, entertainment, telcos …) looks similar.

- "Go-go" brands blow their budgets on one spot in a marquee event. I have never seen a positive ROI from this: It's too much for too little. (These brands may buy for other reasons, but that's a different story as noted below.)

You can value "added value."

The popular measurement critique is "this buy has benefits beyond advertising". Let's look at that because most can be quantified with effort.

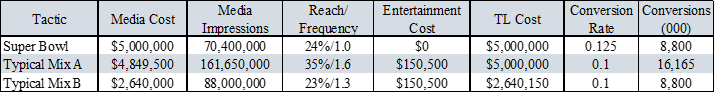

- Tickets. Companies use tickets to entertain key influencers: wholesalers, executives, Wall Street, etc. There is definite value. But ticket costs are negligible versus ad premiums. Consider the Super Bowl:

- A :30 is $5 million (net cost, good buyer)

- 10 "good" tickets (game/after-party)

- Brand data shows Super Bowl ads convert at 25% higher rates per impression than typical programming (the juice). Typical in my experience.

- CPM is $71 versus typical programming at $30 (the squeeze)

- "Good" tickets cost $14,000 on Seat Geek today. PR can buy your way into an after-party for $1,500 each. Thus "added value" is $150,500.

The brand can approach doubling the response for the money or match response and divert $2.3MM to other initiatives:

Although ads in the Super Bowl work 25% harder than typical TV and offers tickets, it's not enough to overcome the premium. Yes, the Super Bowl has other perks like PR, billboards and so on. Those can also be valued/equivalized, and the $2.3MM just saved can more than deliver.

Be candid about the "why behind the buy."

One rationale for sponsorships is to block or limit competitors from the program. Two thoughts here:

- It's tougher than ever to get full category exclusivity; media companies wisely don't want all their eggs in one basket. If you share the spotlight, it isn't really yours.

- If the property is overpriced, let your competitors waste money instead of you!

Buys happen for "non-business" reasons every day. It's a fact of business life. Measure the impact of those choices and ensure finance understands "the why behind the buy" -- yet another reason why partnering with finance is so important. I once directed a youthful brand whose C-Suiters were upscale adults 40+. We launched each new initiative with a spot each in "NCIS" and "The Big Bang Theory" at a huge target premium. I no longer heard "I never see our spots." (CBS, you're welcome.) Sophisticated brands acknowledge "non-business" costs and account for them in post-campaign analytics.

Is the juice worth the squeeze? Be the brand that knows for sure.

Marquee properties are generally overpriced versus pure business value, but the ones that deliver are precious jewels indeed. It's critical that you find those gems and take a harsh look at the rest in today's accountable world. The great news is that they can now be measured in their totality with smart research design.

Click the social buttons to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.