MAGNA GLOBAL's New Programmatic Forecasts - By Magna Global

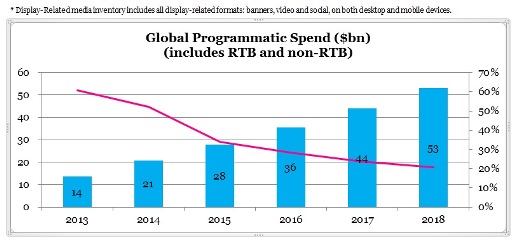

Global Programmatic Spend to Reach $53bn by 2018

Programmatic will Account for 42% of Global Display-Related* Ad Spend this Year

· Digital media buying is being revolutionized by programmatic buying technologies. Over the 35 countries analyzed by MAGNA GLOBAL, media inventory transacted through programmatic methods will reach $21 billion globally this year (+52% compared to 2013), of which $9.3bn will be transacted through Real-Time Bidding (RTB) methods.

· Growth will remain strong over the next four years, with an average annual growth rate of 27%, to reach $53bn by 2018. The main drivers behind this growth will include the opportunity to reduce transaction costs on both the buying and selling side, the opportunity to monetize a broader spectrum of digital media impression (the "long tail"), and the opportunity to leverage consumer data at scale to improve the efficiency of ad campaigns.

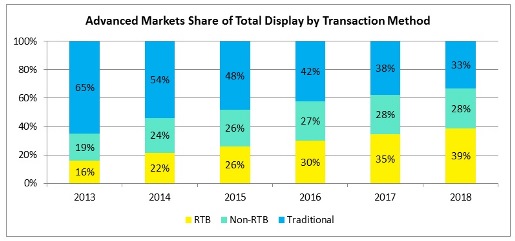

·Globally, programmatic spend will grow to 42% of total display-related spend this year (2014), compared to 33% last year, and to 48% of total spend on a global basis next year (2015).

· The pace of programmatic adoption varies by country, by format and by platform. Among the formats analyzed by MAGNA GLOBAL, social inventory is already predominantly traded programmatically. Display and video, starting from a much lower level today, will reach adoption rates of 54% and 43% respectively by 2018.

· The US is leading the global adoption of programmatic: with $10.9bn worth of transactions in 2014, the US represents 53% of the global programmatic market. Programmatic transactions will represent 62% of display-related digital dollars this year in the US, growing to 82% by 2018.

Programmatic technologies are reshaping the way digital media inventory is bought and sold. They are now being used on a large scale in the US and in other advanced digital media markets. While other markets are lagging behind in the adoption curve, the programmatic phenomenon is global and irreversible.

In its latest study, MAGNA GLOBAL is defining "programmatic" trading as advertising transactions that are based on automated platforms and that are driven by consumer data. This definition includes real-time bidding (RTB), as well as automated transactions, where some aspects in the transaction (e.g. price) are pre-defined instead of being discovered in real-time (Non-RTB).

The US is leading the global adoption of programmatic: with $10.9bn worth of transactions in 2014, the US represents 53% of the global programmatic market (58% of the global RTB market). Programmatic transactions (RTB and Non-RTB) will represent 62% of display-related digital dollars this year, growing to 82% by 2018. By 2018, only the most premium digital inventory (sponsorship, full episode video, non-standard formats) will still be transacted through traditional mechanisms. In the last 18 months, adoption has been boosted by increased usage by large verticals (such as CPG, automotive and pharmaceuticals) and direct-response verticals (such as real estate, dating, gaming, and education). That large vertical usage was made possible by the availability of new tools allowing marketers to measure and benchmark the impact and efficiency of programmatic campaigns on branding goals (and not just immediate conversion).

The transition to programmatic trading is now a global phenomenon, as a sizable portion of digital media spend is now transacted through programmatic technology in every one of the 35 countries analyzed in the MAGNA survey. The largest 10 markets still dominate total global spend (91% of the total programmatic spend is represented by the largest 10 markets), however, with the US alone representing 53% of global spend.

By format, programmatic is still dominated by banner display. Among MAGNA Advanced Programmatic Markets (Australia, Canada, China, France, Germany, India, Japan, Netherlands, Spain, the United Kingdom and the United States), banner display represents 72% of total RTB spend. This will decrease significantly to 31% by 2019. Video (29%) and social (40%) will make up the remainder of total RTB spend, up from a combined 28% this year.

The largest markets in programmatic dollars are the US, UK, China, Japan and Australia. China and Japan, however, are currently lagging behind in terms of adoption (below 20%). It's only the massive total size of these markets that elevates their programmatic spending totals. In the UK, US, and Australia, by contrast, programmatic spend already represents 60% to 70% of total display-related ad dollars (RTB and non-RTB combined). Markets such as the Netherlands, France and Spain are more developed programmatically but are much smaller in total RTB spend.

By device/platform, programmatic is still dominated by desktop. Among MAGNA Advanced Programmatic Markets, desktop devices represent 80% of total RTB spend. Mobile growth (smartphone and tablets) is much higher, and by 2019, mobile will represent 55% of total RTB spend.

In the report, MAGNA GLOBAL also analyzes some of the most important drivers and inhibitors to the transition to programmatic: privacy concerns, inventory bridging, measurement and attribution, and viewability.

Finally, programmatic buying methods have the potential to move beyond internet media and affect trading mechanisms in other electronically-served media categories. In the report, MAGNA analyzes early developments in television and digital out-of-home. These developments are still nascent and represent a very small percent of total spend.

About MAGNA GLOBAL Advertising Research

For more than 60 years, MAGNA GLOBAL forecasts have been the industry's leading source for measuring and forecasting advertising revenues. MAGNA GLOBAL forecasts media owners' advertising revenues in the US and around the world through financial analyses of media companies' public filings, government reports, trade association data and local market expertise. MAGNA GLOBAL's new methodology was introduced to the industry in 2009 and has redefined measurement for the advertising-supported media economy, delivering unparalleled authority and accuracy.

Global Media Suppliers Advertising Revenue Forecasts include television (pay and free), internet (search, display, video, mobile, social), newspapers, magazines, radio, cinema and out-of-home (traditional and digital). Our report monitors media suppliers' revenues in 73 markets, including all major countries, representing 95% of the world's economy. Detailed forecasts are updated twice a year and available to our subscribers.

US Advertising Revenue Forecast study, first published in 1950, includes detailed data for more than 40 categories of media on a quarterly basis from 1990 to 2012 and on an annual basis from 1980 to 2019, updated quarterly. Please contact vincent.letang@magnaglobal.com for further details.

About MAGNA GLOBAL

MAGNA GLOBAL is the strategic global media unit of IPG Mediabrands, comprised of two key divisions.

MAGNA GLOBAL Investment harnesses the aggregate power of all IPG media investments to create power and leverage in the market, drive savings and efficiencies, and ultimately make smarter, more effective media investments on behalf of our clients.

With a stated goal of reaching 50% automated buying by 2016, the team in North America invests across digital, programmatic, broadcast and all traditional media platforms and is therefore considered the most comprehensive buying and negotiating unit in the media industry. The architects of the MAGNA Consortium – a powerful committee of executives from A&E Networks, AOL, Cablevision, Clear Channel Media and Entertainment, ESPN and Tribune – MAGNA North America is also dedicated to shaping industry automation and audience specific buying.

MAGNA GLOBAL Intelligence has set the industry standard for more than 50 years by predicting the future of media value. MAGNA GLOBAL Intelligence produces more than 40 annual reports on audience trends, media spend and market demand, and ad effectiveness.

MAGNA GLOBAL has offices in 24 countries around the world.

For more information, please visit www.magnaglobal.com or follow us @MAGNAGLOBAL.

If you are receiving this report, you are a registered member to MyersBizNet or are receiving it as part of a registered corporate membership. As a member, Jack responds personally to your e-mails, requests and comments. He is available to speak at your company events. In addition to MyersBizNet Media Business Reports, your membership underwrites MediaBizBloggers.com, Women in Media Mentoring Initiative,MyersBizNet Economic Media Business Report, MyersBizNet Video Media Report, plus our exclusive industry economic forecasts, trend forecasts and corporate performance research. Re-distribution in any form, except among approved individuals within your company, is prohibited. As a member you have full access to all archives and reports at www.jackmyers.com. If you require your ID and password, contact maryann@jackmyers.com