Managing “Infinite Inventory” - Leo Scullin

Managing “Infinite Inventory”

The plethora of ad networks, pulled to life by a market that needed aggregated sites and ad impressions at scale, have been harnessed somewhat by the ad exchanges. Both ad networks and exchanges help manage advertising transactions at a scale and speed suitable to growing market needs.

As network growth peaked, a new intermediary, the demand side platform (DSP) entered. They make their profit margin by arbitraging as they disintermediate the ad networks. With the DSPs taking their cut, the agencies see a threat and an opportunity. At first it seemed that access to this technology would be a perfect solution – agencies wouldn’t need to invest in technology, and instead they could focus on the service aspects of their business. But such hopes were quickly dashed, and the agency response, especially at the holding companies, is the agency trading desk (ATD). Proprietary technology, coupled with their service offerings, now sets them apart in front of their clients.

As Sarah Fay, a veteran of industry giant Carat and a current board advisor to DSP [x+1], notes, the primary driver of the DSP segment is performance advertising. Low CPMs are the focus at this end and, with so much ad supply, continued pressure on rates looks to continue for the foreseeable future. But some change is likely, and soon, according to other media agency giants. Display advertising, with different metrics, initially centering on engagement, is in the DSP mix already, according to sources within the top media agencies.

Other advertising measures, such as awareness, consideration and purchase intent, while not as easy to isolate in the short term, will be baked in – somehow. The DSPs have also yielded some extra benefits, as pointed out by a top agency analytics expert: “no RFP, better CPMs and frequency capping!”

Today, on the agency side, the experience with DSPs is being continuously evaluated and extended beyond performance buys. It remains to be seen how far automation can go to displace or complement the “people based” components in this secondary tier.

The sell side has answered the automation call with algorithm-based, supply side platforms (SSP). Here, the media owners have called on the services of a handful of new players who are helping them optimize the yield on the display advertising. More and more name brand publishers are retreating from the ad networks, turning to SSPs or even looking into private exchanges. With either approach, SSP or private exchange, the idea is to tightly control the sale of inventory with strict business rules and pricing parameters in place to prevent channel conflict. And, of course, to keep upward pressure on CPMs.

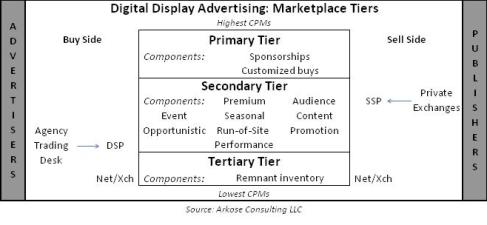

Given the complexity of this landscape, brand marketers need to view this ecosystem through a set of filters. The following market grid from Arkose illustrates the expanded view of the market tiers, noting the new forces coming in from the buy and sell sides:

Digital Ad Marketplace Tiers – Expanded View

The primary tier is all about high-touch, people driven business, usually represented by sponsorships, customized packages or special annual commitments that initially require a request for proposal (RFP). Based on IAB reports for the first half of 2010, Arkose estimates that sponsorships will account for about $500 million in 2010.

The secondary tier represents a combination of people-driven transactions and, increasingly, algorithm-driven business. Nearly every single secondary component in this middle tier relies on RFP’s, which is a necessary but time consuming phase. The component parts look like a laundry list, as the experts used this variety of terms for the inventory in this segment. Hence, there is a lot of noise in this space as every player within this ecosystem is jockeying for market and mind share, perhaps further confusing brand marketers with hype and complexity. Amidst this noise the market needs to gain knowledge – what works, and how, and what are the costs associated with one strategy versus another.

When it comes to Audience, some echo Andrew Kraft, SVP at Collective Media, when he says, “standardized data in this space could be useful.” In addition to the overall usefulness of an ICD, Mr. Kraft is referring to standardized cost data that highlights the relative value of one audience versus another. This will further cement in the minds of brand marketers the value proposition of digital advertising.

Our panel of experts all seemed to concur that the tertiary tier is the exclusive province of the networks and exchanges, but not just among direct marketers. For instance, brand marketers from the consumer packaged goods (CPG) field have dabbled with ad networks in the tertiary tier, and as one media director said, “to take advantage of the favorable pricing” while maintaining their concerns about the quality of the environment. The continued over-supply of inventory and the automation supporting this tier will keep it in the mix for the foreseeable future. But the Digiday Report from December 2010 indicates that “DSPs are being seen as a substitute for ad networks in the coming year.”

To further assist the marketer the market structure below highlights the role of technology-enhanced versus the people-based parts of the business:

Digital Ad Marketplace – High Touch versus Automation

Automation is central to the tertiary tier and the Performance segment of the secondary tier. The dotted line above automation represents the inexorable trend to bring more business-rules based approaches to the market.

Arkose estimates that almost 2/3rds of display expenditure are spent north of the dotted line. On the other hand, it seems as if 80% to 100% of the discussion today, punctuated with LUMA’s technology landscape, falls below the line. Technology may be a godsend to this industry but it does not and will not eliminate many costly and time consuming aspects of the work flow needed to support digital ad campaigns.

It is in the high touch aspect of the display spectrum where negotiation prevails (human) and where an industry cost database can bring a market price framework to better define this market place. This would also allow media owners to bring an industry-based price / value component to their conversation. Nevertheless, the touch aspects of the digital industry remain the most costly.

About the Author: Leo Scullin is a Partner at Arkose Consulting LLC of New York, a firm that offers strategic, tactical and management guidance to clients seeking to leverage their interactive marketing investments and initiatives. He has extensive experience in internet professional services, as well as deep expertise in launching and positioning online and traditional media. lscullin@arkoseconsulting.com

Read all Leo's MediaBizBloggers commentaries at Arkose.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates @MediaBizBlogger

MediaBizBloggers is an open-thought leadership blog platform for media, marketing and advertising professionals, companies and organizations. To contribute, contact Jack@mediadvisorygroup.com. The opinions expressed in MediaBizBloggers.com are not those of Media Advisory Group, its employees or other MediaBizBloggers.com contributors. Media Advisory Group accepts no responsibility for the views of MediaBizBloggers authors.