Nielsen: 18-34 Undergoing Rapid Changes Since 2017

The 18-34 demographic has been important to the advertising business since at least 1922, according to a 2002 article in the Chicago Tribune. The idea of targeting younger people is based on some evidence, but mostly on the belief, that getting a person to favor your brand early and therefore over a longer time span gets you a higher return on your ad spend.

Targeting has moved away from age and gender over the past two decades, partly as a result of TRA getting the ball rolling (most influential 2005-2014), and the ensuing widespread empirical findings that targeting specific kinds of purchasers is more productive of higher ROAS than targeting young people. Yet the lion’s share of television ad spend is still placed based on age and gender guarantees. Advertising workflow habits change very slowly.

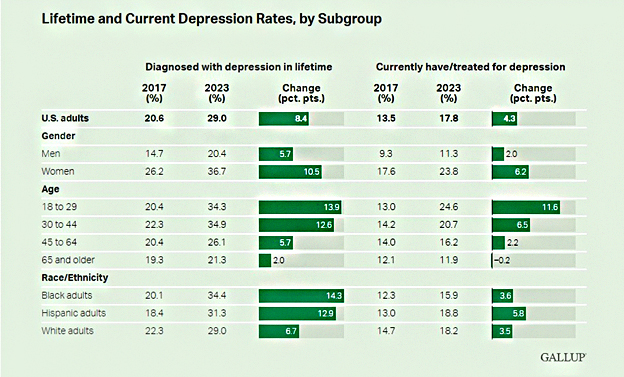

However, other things change faster, such as the habits and mental/emotional states of consumers. Numerous sources have reported that there is a rising crisis of despair, depression, and suicide among 18-34 Americans. For example, Gallup in May 2023 reported that in 2017, 18-29-year-olds in the U.S. were about average in terms of being diagnosed with depression, but by 2023 that level had increased +68% in just six years, to over one in three people in that age group.

In a probably-related finding, in a recent New Yorker article, writer Nathan Heller cites a study by medical software company Epic which found an over-all tripling of A.D.H.D. diagnoses between 2010 and 2022, skewing even higher among younger people.

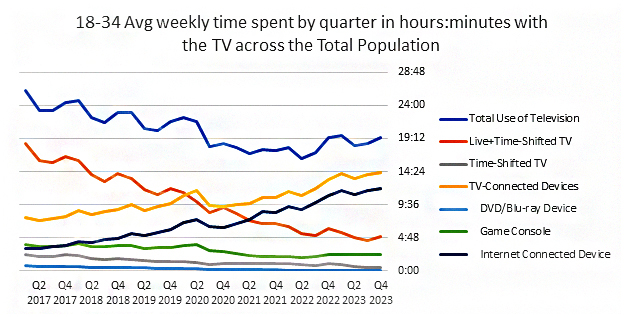

The same age group has also shown the greatest shift in media habits over the same period. Based on Nielsen, between 2017 and today, 18-34 has shifted strongly from watching live and time-shifted linear television, to streaming video. Over 60% of the time spent with TV now is via streaming for 18-34, as compared with 36% for the total population. Even videogame usage went down during this period among 18-34 as the use of streaming rose among this group, both on TV-connected Devices (smart TVs and USB adaptors) and on Internet-connected devices (computers, tablets, and especially smartphones).

This is consistent with the oft-observed phenomenon of shortening attention spans, especially among younger people. Linear and time-shifted TV generally involves attention commitments of a half hour or hour. The use of streaming video by 18-34 probably involves average viewing durations per piece of content which are far shorter than that.

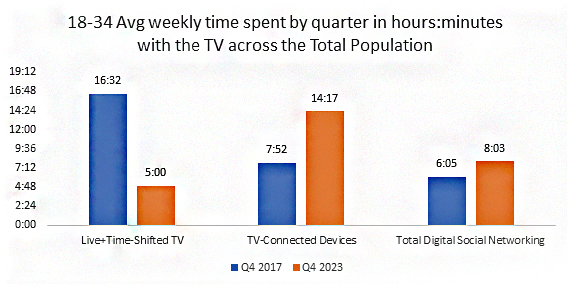

Over the same time period there was also a +32% increase in the use of social media by this group:

This increase in the use of social media could be tied to the depression and A.D.H.D. stats rising.

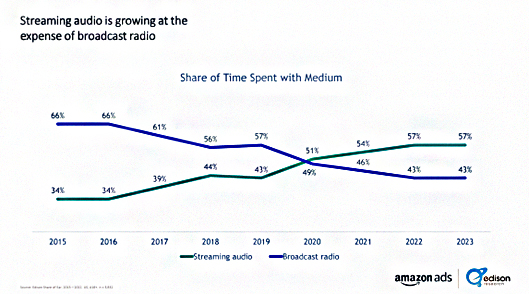

Terrestrial radio has been declining while audio streaming including podcasts have been growing according to this Edison report:

The same Edison report comments that for 18-34, who spend nearly three hours a day with streaming audio/broadcast radio, had increased +18% in their streaming audio usage 2020 to 2023.

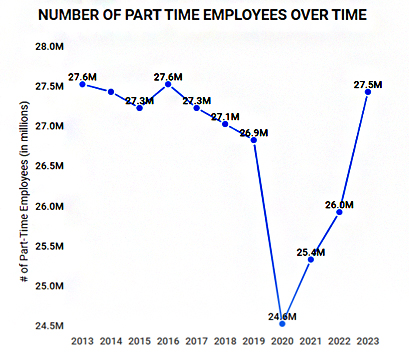

It appears that with these shifts there has been some reduction in overall media usage among 18-34. The absolute number of hours and minutes per week across the media data above from Nielsen (video and social media) and Edison (audio) come up lower in 2023 than in 2017. Where is this time going? Some of it, among the most depressed, might simply be laying around. Some of it might be more positive use of time, such as working, studying, or pursuing lofty ambitions. There has been a great increase in part time employment during this same time period (except during Covid):

It's become even harder to reach this most active age segment than it has always been. Today probably the best way to reach 18-34 is addressable TV, not just streaming but also MVPD addressable TV, not to mention radio, streaming audio including podcasts, influencers, and out-of-home/DOOH.

These younger folks obviously have a lot of things on their mind and ads might not have their optimal effect on people who are so discouraged and distracted. Knowing their state of mind – which is trending down for all age groups – should be taken into strong consideration in the development of advertising campaigns today. Campaigns that are funny might continue to succeed but cannot be assumed to be a panacea. Ads which are uplifting and inspiring are likely to overperform if executed with meticulous balance.

The way the situation has changed in just the last six years or so provides a lot of food for thought about revising ancient belief systems about advertising. This would be a good time to give up on the old idea that younger is better for targeting ads in general. The optimal target for any ad consists of people who are already motivated by the subtly communicated values in the specific ad. Not just product features, but the subconscious human motivations in people’s lives. The motivations in your ad decree who the target should be – you just have to find people who have those as their main motivations – which is what RMT and Semasio do together in the U.S. and Canada, soon to be everywhere.

New content development executives ought to consider programs about depressed young people and how the heroes and heroines lift themselves out of it and make their lives count not only for themselves but for others.

Also, given the possibility that attention span is an underlying factor in these video shifts, content programmers and content marketers ought to consider ways of offering shorter form versions of existing shows, and even developing new series that provide daily serialized stories as short as a few minutes each. This of course was tried by Jeffrey Katzenberg with Quibi 2018-2020 pre-Covid, but maybe it was just ahead of its time. Covid did catalyze a lot of change. In the new era we are in, Quibi or something like it might be worth a second coming.

Posted at MediaVillage through the Thought Leadership self-publishing platform.

Click the social buttons to share this story with colleagues and friends.

The opinions expressed here are the author's views and do not necessarily represent the views of MediaVillage.org/MyersBizNet.