Odds Now Favor Competition in U.S. TV Ratings: Part 2 – Bill Harvey

Why Competition Never Possible Before is Now Likely — A Multi-Part Series. (Read Part One here.)

Nielsen’s TV audience measurement system has proven itself invulnerable to competition for the better part of a century. What has changed today that makes competition more likely?

Fundamentally, Nielsen itself has changed. Where once it stood for all-passive measurement, today it is the most aggressive user of fusion and conforming in place of real data. Fusion is where, for example, Nielsen takes relationships from its national peoplemeter panel and forecasts them onto its local meter/diary panels, then draws all the data including the forecast back into its national peoplemeter panel. Conforming is where, for example, Nielsen Catalina cross-analyzes big data sets and then brings them down to fit the national peoplemeter panel numbers.

In both types of cases, assumptions are being presented as currency. Internal relationships are changed in ways that cannot be estimated and that likely would change decision making. Decisions made based on inaccurate data lose money compared to the more ideal case of having all real data.

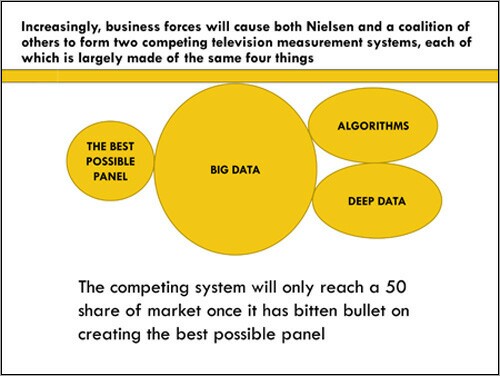

In the diagram below we see a second fundamental difference between the old and the new Nielsen. Formerly, Nielsen TV stood for the best possible panel. They did -- and still do -- everything they can (against the tide of bureaucracy and any budget restriction) to make that panel something to be proud of. With a reputed intab response rate of 42% it is the best in the business. If the whole competition rested on this one element, Nielsen would be in the strongest possible position.

However, its ownership, media technology changes, and other market forces have changed Nielsen from selling that one proposition to competing on the basis of a product that contains three other major elements as well as the national peoplemeter panel: Big Data (such as set-top box and Catalina frequent shopper card data), Algorithms (models for converting assumptions into numbers, fusing, conforming, smoothing, ascribing, projecting, filling-in), and Deep Data, meaning the other 33 Nielsen panels that collect other data.

If you owned a company making good money that had 34 panels, what would you feel while contemplating the idea of changing that system?

You might also decide, as they did, to use Algorithms to splice the 34-panel output into one seemingly single source and omniscient stream. This is where Nielsen is and where it's going.

The reason this new quadratic Nielsen is more susceptible to competition is that the power of the best panel is diluted from 100% to 25% weight in the average person’s mental scale. And the competitors all have access to Big Data, Algorithms and their own Deep Data. Where it would be hard and costly to attempt to catch up with Nielsen based on having a better single panel, it’s far easier to compete with Nielsen when you are tied for three out of four of the basic resources.

This latest transformation of Nielsen increases the likelihood of a counterforce system that will follow the same pattern of using the same four types of data. The counterforce partners (it will likely involve more than one player) are beginning to think about how to create a calibration panel that is even more accurate and all-inclusive than the Nielsen national peoplemeter panel -- and is 100% passive.

No one would have dared to take this step in the recent past because Nielsen was seen as impregnable. But now mistakes are happening more frequently, gaps are not being plugged fast enough, and still the amount of money Nielsen demands continues to increase to levels that surprise even seasoned television executives. Now that Nielsen’s own system is more and more big data and assumptive fusion algorithms that are available to everybody, we are observing meetings being convened of industry leaders to consider what to do about the future of television and video measurement.

In Part III, we will address this question: What are the other changes in the marketplace that move us toward or away from the greater likelihood of competition in U.S. TV ratings?

Bill Harvey is a well-known media researcher and inventor who co-founded TRA, Inc. and is its Strategic Advisor. His nonprofit Human Effectiveness Institute runs his weekly blog on consciousness optimization. Bill can be contacted at bill@billharveyconsulting.com

Strategic Advisor. His nonprofit Human Effectiveness Institute runs his weekly blog on consciousness optimization. Bill can be contacted at bill@billharveyconsulting.com

Read all Bill’s MediaBizBloggers commentaries at In Terms of ROI.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates at @MediaBizBlogger

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaBizBloggers.com management or associated bloggers. MediaBizBloggers is an open thought leadership platform and readers may share their comments and opinions in response to all commentaries.

Image at top courtesy of freedigitalphotos.net.