Odds Now Favor Competition in U.S. TV Ratings: Part 4 – Bill Harvey

Why Competition Never Possible Before is Now Likely — A Multi-Part Series. (Read Part One here, Part Two here and Part Three here.)

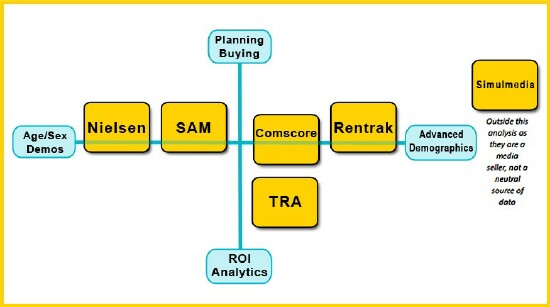

So far in this series we have reviewed how Nielsen over its long lifespan to date has evolved or devolved from being a passive measurement leader to now a combination of passive and self-report (button pushing and survey data), plus fusion; and how others have shown that larger single-source (purchase transactions plus TV/digital ad exposure) samples without fusion are practical (principally TRA/TiVo Research and Simulmedia). In this installment we will review what some other research companies are doing to add to the pressure on Nielsen and on its customers to more seriously consider alternatives to business as usual. CNBC has just become the first major TV network to break away from Nielsen.

In addition to changes in the competition reviewed in the prior installment there is much more that has similar effect in raising the bar of expectations for what Nielsen could be doing:

- In the measurement of purchases, IRI for many years has had nearly half the market, where Nielsen once had it all. This is not news; it is a trend that started in the ‘80s. IRI grew due to innovations (store census, Behaviorscan, analytics) but Nielsen during the diligence process of buying IRI (until the government nixed it) found out so much about IRI that they were able to fight back better until Romesh Wadhwani acquired IRI and doubled its revenues, stunting Nielsen Buy’s growth. (He is also principal at SymphonyAM.)

- In digital audience measurement, comScore now has an estimated 70% of the market, where Nielsen had planned to have it all. IRI and comScore are demonstrations to the marketplace that Nielsen is not all-powerful. comScore and Artie Bulgrin of ESPN seized industry attention with Project Blueprint, a way of putting together TV, digital, mobile plus radio audiences where no assumptions need to be made about how they overlap.

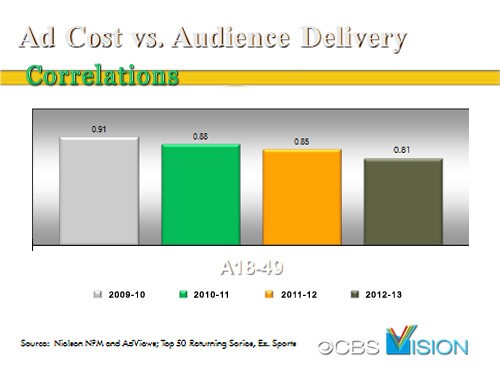

- Although CPMs and sex/age groups continue to be standard operating procedure for making TV buys, the plans preceding those buys have begun to shift to ROI based planning invented by TRA/TiVo Research and now emulated by Nielsen Catalina. (However, Nielsen Catalina uses fusion whereas TRA/TiVo Research is 100% direct match; major advertisers have attested at ARF conferences to their sales increasing as a result of using TRA, whereas we are not aware that this has happened with Nielsen Catalina.) CBS’s David Poltrack has shown that the simplistic Women 18-49 metric, which used to have a very high correlation with the pricing of TV ad units, now each year has less and less of a correlation with price as the new ROI value measurements take hold.

- Steve Walsh, the amazing sales ace of Rentrak (not to mention Chris Wilson and other fine salespeople), has succeeded in bringing many station groups, networks and even CBS and Fox into the Rentrak fold. Some stations and agencies have begun treating Rentrak as currency. Rentrak Chief Research Officer Bruce Goerlich cites “the collapse of effective probability sampling … due to low response rates making the data highly unrepresentative.” Bruce has supplied the following schematic showing how the new services might be viewed as complementary parts of an all-encompassing service.

- In TV measurement, new forms of TV keep springing up like leaks in a boat, and Nielsen has not been able to cork each hole quickly enough. For example, TV shows watched off of Internet streams by means of TiVo, Apple TV, Roku and about 50 other devices -- called Over the Top or OTT -- has been linked by NBC Universal’s Alan Wurtzel to what appears to be a large scale disappearance of TV audiences. Alan points out that Nielsen has not even announced a plan and timetable to deal with OTT. However, that was before Nielsen’s recent announcement that they will be reporting SVOD -- Streaming Video on Demand -- Nielsen’s perhaps more logical nomenclature for OTT. Apparently they will only be providing each program source with its own numbers, none for the competition. Reading between the lines of their press release it appears that Nielsen has made a deal with Netflix and others where litigation is not to be expected for reporting what had formerly been jealously guarded. This reporting only on one’s own product is apparently something some lawyers worked out and will not satisfy most practitioners. The data shown thus far is sparse and inadequate according to CBS’s David Poltrack.

- CBS and other networks are now reporting their own compilations of their own server data measuring OTT, Rentrak and other VOD data, with Nielsen data. This is a first step in the direction of a more Do-It-Yourself free-for-all to fill the void. (One major studio has reported having to increase spending on non-Nielsen services in order to fill voids in Nielsen’s service and indicates it will shorten the length of its next Nielsen contract.) This development is the one I put my money on for causing the competition -- networks and others using their own server data in combination with Nielsen and any other data to which they have legal access. In the mid-90s with Arbitron, my company Next Century Media did a compilation of server data across many major Internet publishers showing what can be done that way (some of you will remember The Cybermeasururement Index as it was called). The fact that we stopped doing it shows that to maintain such a hegemony-based data service takes capital and determination, in any medium or across all of them; however, the counterforce may emerge as just that sort of being.

- The Coalition for Innovation in Media Measurement (CIMM), representing all the major media companies and agency holding companies plus a number of major advertisers, has been funding developmental efforts by companies such as SymphonyAM.

Are there any forces moving us in the opposite direction, toward a lowered probability of competition in U.S TV ratings? Not that I can see -- but I will publish with credit any that you see.

Note that we do not predict Nielsen will go away! We feel certain, given the topnotch people at Nielsen and their long marketplace history, that Nielsen will adapt and become better, and that there will always be a Nielsen. But at some point soon it will no longer be a one-horse race. The handwriting is on the wall.

In fact, it will take some doing to establish a national panel that is as representative as Nielsen’s, and this will need to be the number one focus of the counterforce.

In the final installment of this series we will look at the players who are most likely to be part of the counterforce that will arise to in all likelihood take away half of the market and cause a sharp reduction in the prices and revenues that Nielsen is able to charge.

My friend Paul Donato of Nielsen said of this series thus far that it is “Ok” except in Part II where I said that fusion is used as part of the Nielsen currency. He said “Currency is buying, Nielsen only uses fusion for planning.” As David Poltrack pointed out to me, technically he is right -- today. Later this year, once Nielsen starts using its announced plan for ascribing peoplemeter data out onto the meter/diary markets and then pulling it back into the national peoplemeter sample, my statement will become correct.

Bill Harvey is a well-known media researcher and inventor who co-founded TRA, Inc. and is its Strategic Advisor. His nonprofit Human Effectiveness Institute runs his weekly blog on consciousness optimization. Bill can be contacted at bill@billharveyconsulting.com

Strategic Advisor. His nonprofit Human Effectiveness Institute runs his weekly blog on consciousness optimization. Bill can be contacted at bill@billharveyconsulting.com

Read all Bill’s MediaBizBloggers commentaries at In Terms of ROI.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates at @MediaBizBlogger

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaBizBloggers.com management or associated bloggers. MediaBizBloggers is an open thought leadership platform and readers may share their comments and opinions in response to all commentaries.

Image at top courtesy of freedigitalphotos.net.