OTT: Netflix, Hulu, and Amazon Audience Differences -- Bill Harvey and Alex Petrilli

In Part 4 of our series we forage into the heavy OTT household to determine what characteristics and viewing preferences categorize a Netflix, Hulu Plus and Amazon Instant subscriber. Based on our January 2014 survey of the TiVo Power||Watch Panel of people who streamed six or more hours a month from one of the three top sites, distinct differences appear.

In terms of household characteristics, Netflix homes index high with household incomes of $200,000+ compared to the overall panel. A distinguishing feature that typically accompanies upper income, Netflix heavy streamers are also inclined to be homeowners. Hulu Plus heavy users, on the other hand, tend to be single with a higher propensity of Hispanic and African-American subscribers. The Amazon Instant profile is also a likely homeowner despite a more modest income and under-indexing when it comes to college attendance.

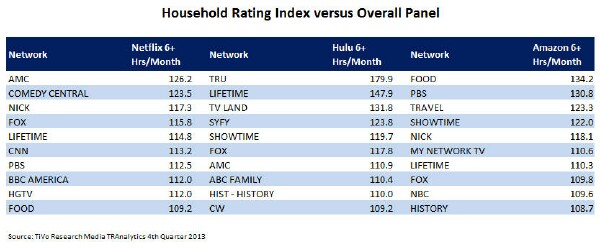

Viewing preferences are equally diverse. A quick look at the top ten indexing networks reveals only two that fall on all three lists, Fox and Lifetime. Here the data reflect set- top box measurements among homes identified by survey as OTT homes of specified types.

More importantly, the top indexing series is a very telling indication of what type of original programming might work for these streaming services. Perhaps, in the case of Amazon, we are too late in releasing this information since Amazon is already committed to new series that do not align well with their heavy viewer’s preferences, but we felt it was our responsibility to report the results.

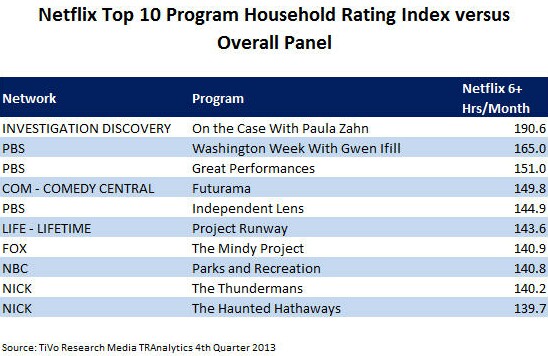

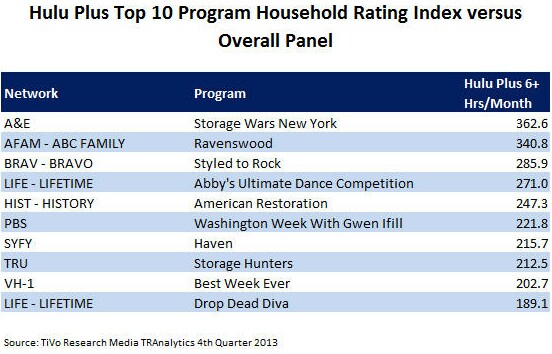

Like the demographics, the linear program viewing revealed by set-top box data also shows that the three leading OTT services are somewhat counter specialized in the types of audiences they mostly serve. One commonality is the popularity among all three types of OTT users of PBS’s series “Washington Week with Gwen Ifill,” with above-average viewing. Among Netflix and Hulu but not Amazon OTT users, a couple of other PBS series wind up in the top ten.

First up is Netflix in all its “House of Cards” and “Orange Is the New Black” glory. Who are we to tell them what to program because by all indications they are doing a fine job. In any event, here are top ten indexing series for the fourth quarter of 2013:

Based on recent reports, some of the upcoming Netflix series on the docket fit well with series that deliver a high index. An adult animated comedy scheduled for summer release, “Bojack Horseman,” appears to be a good fit based on “Futurama’s” index. BBCA’s “Atlantis” (137.8 index) matches well with their recently announced series based on the life of Marco Polo. And from the creators of “The Matrix” theatrical trilogy, the Wachowskis, comes a globe-hopping series called “Sense8,” which aligns nicely with AMC’s “The Walking Dead” (135 index.)

Amazon’s upcoming slate includes a significant commitment to kids’ series, which seems like a solid match based on Nickelodeon ranking fifth in their top indexing network list above. But outside of the renewal for the comedy “Alpha House” the remaining new series from Amazon are dramas (“Transparent”, “Mozart in the Jungle”), a crime drama (“Bosch”) and a sci-fi series from the creator of “The X-Files” (“The After”).

Unfortunately Amazon’s top ten list and extended list of high-indexing programs is loaded with home improvement, cooking and the occasional sitcom. In all fairness, NBC’s “Parenthood” scored an index of 130.8, which should bode well for “Transparent” but beyond that we see little commonality.

The Hulu Plus top indexing programs serve as a good match for their upcoming and returning slate of series.

The most recent launch by Hulu Plus, “Deadbeat,” has a passing resemblance to Lifetime’s “Drop Dead Diva” and sci-fi series “Misfits” should work well based on “Haven” ranking seventh on the list. Another new series that Hulu announced at their recent Upfront presentation (that’s right, Hulu had an Upfront this year) is “The Next Step,” a reality-style drama about a group of dancers at a popular studio. That matches up perfectly with the fourth ranked series from our list, Lifetime’s dance reality series “Abby's Ultimate Dance Competition.”

Clearly these relatively new players are in it for the long haul. OTT is changing the game in new and never before imagined ways, and original series programming is just one facet. You want game changing, look no further than TiVo’s announcement that Netflix will occupy a channel on three TiVo-technology-based cable systems in the United States: Atlantic Broadband, RCN Telecom Services and Grande Communications [ Netflix coming to TiVo on three cable carriers]. The OTT motto can be summed up in the words of “House of Cards” scheming Frank Underwood, “For those of us climbing to the top of the food chain, there can be no mercy. There is but one rule: hunt or be hunted.”

Unlike the Hollywood tradition, these new studios are data driven. They look at consumer records intelligently to draw Big Data powered conclusions, and they use survey research to further enlighten themselves. Time will tell whether this leads to a higher success rate. The network series success rate is single digits if the criterion of success is five years on network enabling syndication aftermarket. One of Bill’s new companies, ScreenSavants (still flying under the radar), is specializing in the use of Big and Small Data to enhance the success rate of new screen content.

As technology companies get rich and pour some of their winnings into content creation, more creatives will get to work instead of starve, and the newcomers helping to drive OTT viewing with new content of their own are destined to change the entire face of entertainment worldwide.

Bill Harvey is a well-known media researcher and inventor who co-founded TRA, Inc. and is its Strategic Advisor. His nonprofit Human Effectiveness Institute runs his weekly blog on consciousness optimization. Bill can be contacted at bill@billharveyconsulting.com

Read all Bill’s MediaBizBloggers commentaries at In Terms of ROI.

Alex Petrilli serves as senior manager of media insights at TiVo. In this role, Alex is responsible for utilizing the vast data resources available at TiVo to convey valuable information about the television industry and viewing trends. Alex has presented TiVo Stop||Watch data at past conferences including TMRE, ARF Research 5.0 and BBM Canada.

Check us out on Facebook at MediaBizBloggers.com

Follow our Twitter updates at @MediaBizBlogger

The opinions and points of view expressed in this commentary are exclusively the views of the author and do not necessarily represent the views of MediaBizBloggers.com management or associated bloggers. MediaBizBloggers is an open thought leadership platform and readers may share their comments and opinions in response to all commentaries.