Outlining the Challenges Ahead for Agency Holding Companies

The top four holding companies have evolved enormously in the past four decades, from simple (but growth-obsessed) financial owners of agencies to integrated operating companies. At the integrated extremes today are WPP (a "creative transformation company")and Publicis Groupe (a "connected age platform company"), while Omnicom ("an interconnected global network of leading marketing communications companies") and IPG ("we support and invest in our brands") remain solidly agency centric. All of them, though, have invested in holding company headcounts and organization, and each of them face the same strategic problems: commodity pricing for their services, excessive client churn, bloated Scopes of Work, depressed salaries for their people, "overburn" working conditions, talent gaps and growth ambitions that outstrip industry realities. Fiscal year 2022 will put many of them to the test.

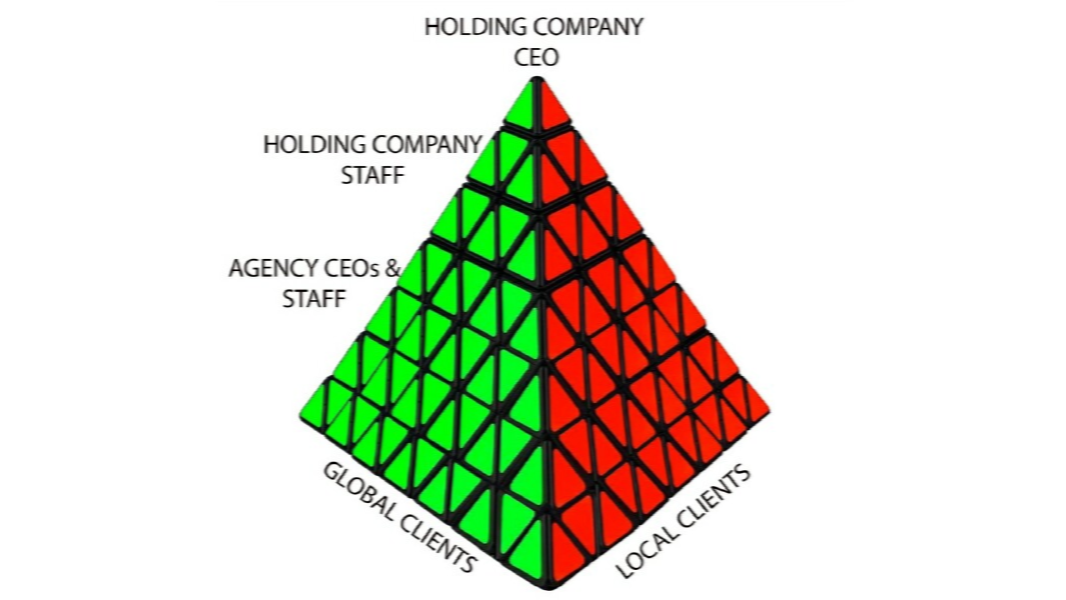

The integration trend was led by WPP and Sir Martin Sorrell twenty years ago. Sorrell observed in the 2003 WPP Annual Report that clients need integrated services, but agencies "work best and contribute more" when their people are "recruited, trained and inspired" by specialist (rather than integrated) agencies. His solution? Service clients with "WPP holding company relationships" staffed by bundles of specialized agency people operating under WPP leadership. He called this concept "horizontality," a word that has since been banned from the WPP lexicon, but the concept is alive and kicking at all four of the major holding companies.

WPP has, by my unscientific analysis of 92 LinkedIn job titles -- 14 agency CEO/executive roles, 41 commercial roles, 16 in HR, 11 in operations, 6 in legal and 4 in finance. The commercial roles have titles like Client Leader, Client Operations, Marketing & Growth, Commercial Operations, Strategic Development & Partnerships and the like. There has been a clear investment in executives whose job is to win and organize integrated holding company services.

Clients quickly learned that they could reduce agency fees substantially by organizing agency reviews around "holding company pitches," pitting one holding company against another for large chunks of media or creative operations. Judged by the depressed level of industry pricing, one would have to conclude that holding company integration either continued or accelerated the trend towards commodity pricing. Big media wins, like WPP's for Coca-Cola and Unilever, and Publicis' for Walmart and Eli Lilly certainly came at a price, but this dimension is rarely discussed by the holding companies or the trade press.

Pricing remains the most fundamental unsolved challenge facing the holding companies and their agencies. Agencies embraced being paid "by the head" rather than "for their work" when media commissions disappeared more than thirty years ago, and agencies have made things worse by failing to document, measure or negotiate their workloads and headcounts for fee purposes. To maintain or grow margins, agencies have downsized and held salaries at very depressed levels.

Holding company financial results for 2021 will be published in the next few months, and despite the strategic weaknesses of the industry, those results will undoubtedly look very attractive -- 2021 revenue rebounded from the COVID-led lows of 2020, and holding company 2021 costs were very low due to office closings, staff reductions and limited travel. These factors are sure to have had a positive effect on holding company margins.

Furthermore, holding companies used share buybacks and dividend increases to engineer the attractiveness of their shares to investors, so 2021 holding company share performance has been strong. WPP, IPG and Publicis achieved share gains of nearly 300% since the March 2020 lows, and Omnicom shares increased by over 150%.

These favorable results will be difficult to replicate in 2022. Inevitably, headcounts, travel and costs will have to rise to meet the increased volume of work associated with more media spend and larger scopes of work.

Holding companies need to review their operations and focus on solving the pricing problems that cause so many difficulties. They should emulate the consulting firms, who achieve premium prices by delivering improved client results. They should organize better training for client leads -- those agency folks who actually run clients -- and teach "best practices" for managing and retaining clients. They should make investments in Scope of Work documentation and measurement.

By contrast, their investments in Holding Company staff and overhead should be halted and either reduced or refocused on transitioning agency missions to "improved results for clients" via agency client lead training, improved pricing and rigorous (and uniform) Scope of Work documentation. There has been too much investment in winning new clients and too little investment in improving the mission and ongoing quality of client-agency relationships.

Click the social buttons to share this content with your friends and colleagues.

The opinions and points of view expressed in this content are exclusively the views of the author and/or subject(s) and do not necessarily represent the views of MediaVillage.com/MyersBizNet, Inc. management or associated writers.