Perception vs. Reality: It's Time to Rethink TV Selling

TV sales execs can make a strong case that TV offers greater reach, superior quality content, more accurate data, and greater audience engagement than digital video, along with longer-term and more embedded historical relationships with advertiser and agency executives. Yet, perceptions of digital video media among advertiser and agency executives are equal to or greater than both broadcast and cable TV networks across eight performance attributes, according to a new MediaVillage industry survey.

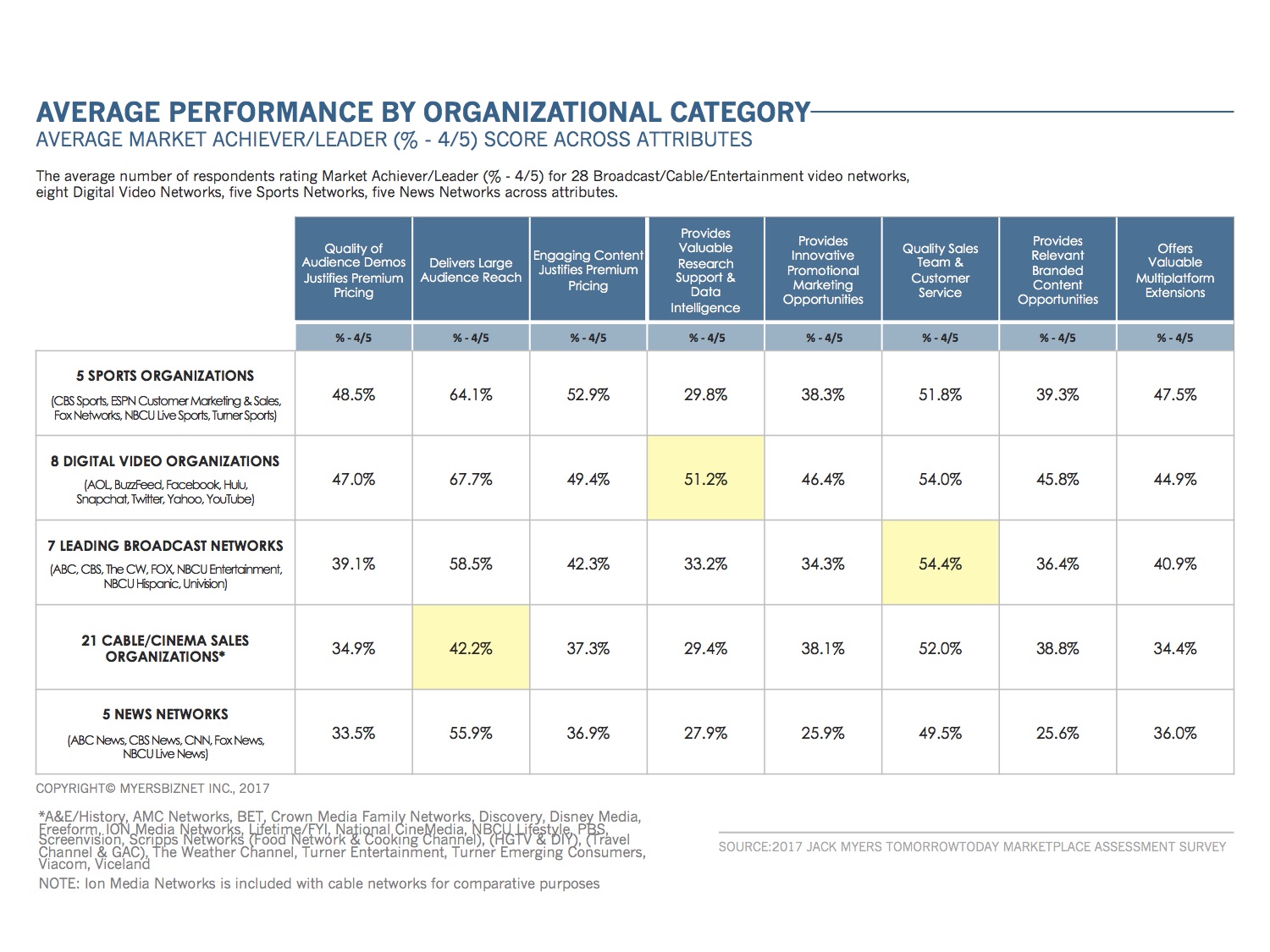

The survey, conducted for MediaVillage by MyersBizNet in October/November, measured perceptions of 515 advertiser and media agency executives toward 46 TV network brands and eight leading digital media companies. Digital media, led by YouTube and Facebook, are more positively perceived overall and rate more favorably across multiple attributes measured in the survey.

- Quality of audience demos justifies premium pricing

- Delivers large audience reach

- Engaging content justifies premium pricing

- Provides valuable research support and data intelligence

- Provides innovative promotional marketing opportunities

- Quality sales teams and customer service

- Provides relevant branded content opportunities

- Offers valuable multi-platform extensions

The chart below reflects the average percentage of respondents who rate TV networks and digital video companies 4/5 on a five-point performance scale (top-two box). Respondents rated each media company (with which they have a relationship) across eight attributes. For Research Support and Data Intelligence, for example, an average 51% of respondents rated the eight digital companies (individually) 4/5, compared to only an average 33% of respondents rating broadcast networks 4/5. Turner, Viacom and NBCU are the leading TV organizations with an average 43% rating the companies 4/5. By comparison, Facebook and YouTube achieve 66% positive ratings, with AOL, Amazon and Twitter all achieving 50% + positive scores.

These are perceptions; the reality is that TV media can make a strong case for the comparative quality of content, reach and multi-platform assets. Advertiser and agency executives, however, push-back that...

...the very definitions of quality, engagement and reach are morphing as the focus shifts from traditional metrics and currencies to customized KPIs based on first-party data and performance-based results. As the importance of long-standing relationships between buyers and sellers diminishes, digital media are using data and analytics to push their value proposition. With analytics groups at agencies heavily weighted toward digital-first young team members, and with more emphasis on customized data, buyer/seller dynamics are transforming.

According to MyersBizNet's recently released long-term economic forecast, digital video advertising will continue to grow exponentially, feeding not only YouTube, Facebook, SnapChat, BuzzFeed, AOL and other digital media, but will also sustain the growth – albeit in the low single-digits -- of television, magazines, and out-of-home. If TV networks and other media that are advancing into digital video and social marketing want to effectively compete, they'll need to conduct a difficult self-examination of their competitive positioning and organizational priorities. It's time to take a long look at how they are managing perceptions, the messages they're communicating, who they are competing with, who they are targeting and how they are reaching them.